Click Here for Printable Version

Traditionally May is a difficult month for markets as traders bank gains ahead of the summer holidays, this time round it proved to be a relatively quiet month, unless of course you were holding Bitcoin.

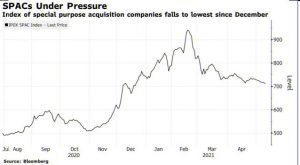

What was interesting is “normal” investment assets i.e. equities, moved up nicely over the month when the highly speculative cryptocurrencies and Special Purpose Acquisition Companies (SPACs) crashed heavily. These are just two of the ultra-high risk areas of the global markets that have seen “hot money” (in the search of quick profits) flow rapidly into.

As ever, the markets do like to punish excess speculation and so it has happened again. In the meantime the conventional investment assets continue to benefit from the combination of money printing and record government spending. Nevertheless, the virus has not gone away, the vaccines will only mitigate the severity of it and those countries that are lagging in the vaccine roll-out are seeing a rise in cases, particularly in the Far East.

The markets though seem happy to look through these new waves as unlike last March, there remains an exit route and lock downs have generally proved to be not as economically damaging as first thought, at least for most industries.

We must though accept that there remains the risk of another virus related shock. Year to date, in local currencies the MSCI World Index is up by 10.8%, but when this is translated into sterling it is only up by 6.4%. This shows just how strong the pound has been following the success of the vaccination programme.

Strong sterling is normally bad news for the FTSE100 but, helped by mining shares, it is up 8.7% over the year and Gilts, given the inflation risk, are down by 6.3%.

Inflation

For years markets have wanted inflation, now in theory they should be getting it.

Questions are though, when, and by how much? The answer to the first question is that it is happening now. Primarily, this is due to supply disruptions pushing up manufacturing costs, which do seem to be being passed onto consumers. The belief is that these raised costs are due to pandemic related bottlenecks and transport disruptions and thus will be temporary.

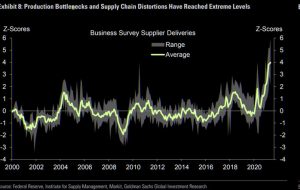

The chart below from Goldman Sachs is complicated but does show that global supply bottlenecks have reached an extreme level and are thus likely to dissipate. Nevertheless, the markets have to price-in the possibility that they won’t, thus they have pushed their expected inflation rate (the Breakeven chart from the St Louis Federal Reserve Bank) to 15 year highs.

So the risk of higher inflation is priced in, but not, should it start to run away beyond 2.5%.

Production Bottlenecks (Goldman Sachs)

Expected US Inflation Rate (St Louis Federal Reserve Bank)

The Far East and the Pandemic

The countries of the Far East survived the first wave of Covid-19 pretty well.

No doubt the relatively recent experience of SARs meant they had good plans in place. Also it meant that their populations were used to and willing participants in wearing face masks and taking part in track and trace procedures.

This initial success now appears to have led to some complacency and a lack of impetus to be vaccinated.

Japan has only vaccinated just over 2% of its population despite having an aged population.

South Korea, Taiwan and Singapore are not doing much better and now new cases are starting to pick up.

This year’s Olympics might be in doubt and already very stretched supply chains may again be disrupted.

The markets, however, know that picking the next vaccine success story is a useful way of gaining short term outperformance. They now seem to be less affected by the Covid-19 bad news and focus instead on vaccine good news. This geographic area and Japan’s equity performance in particular, may well depend just how many jabs they can administer over the next few months?

Special Purpose Acquisition Companies (SPACs)

Equivalence

London listed SPACs were one new proposal that emerged from Rishi Sunak’s recent Budget.

The City of London and especially the wealth management industry is anticipating further structural changes to be announced. At present these are delayed by the ongoing equivalence talks between the UK and the EU. The fact that Financial Services were excluded from the Trade Deal was at the time surprising for some, but not the City.

London dominates Europe in financial services and bar a few symbolic shifts in share trading to a Dutch domicile (the instructions still come from London) not that much has actually changed. Project Fear’s flood of bankers to Frankfurt has in reality, so far, just been a trickle.

London financial services cover a huge range of activities including insurance, derivatives trading, investment banking, private equity and wealth/hedge/pension/mutual fund management. It is the latter where change is most likely.

Presently the UK has granted permission for EU domiciled funds to be marketed to UK retail investors (these rules mainly impact retail customers not professionals) but the EU is dragging its feet in return.

They fear that London will revert from “Rules Based Regulation” to its traditional “Principle Based” one and thus gain a huge competitive advantage.

The EU also wants the symbolically important Euro Swaps market to move to an EU domicile. The City may well be prepared to do this. It has had more reincarnations than Dr Who and has always been about profit rather than turnover.

Trade execution is now in reality a back office function that is computer based and few investment managers care where the legal domicile of the trade takes place. Execution may have huge scale in the value of the transactions but has tiny profit margins.

It is the capital gain on the trade that counts and that will stay in London. The new City will be more about investment management than trade execution and to that end a new fund structure the Long Term Asset Fund is presently being consulted on by the UK regulator the FCA.

Markets

The “sell in May go away and don’t come back ‘til St Leger Day” hasn’t worked so far for mainstream investments but has done in the speculative “frothy” areas of the markets, which is good.

In the USA the economy is rapidly reopening as the vaccine programme reaches its crescendo. It’s “walk up and be jabbed” approach, rather than wait to be invited, has worked even better than the UK. Europe is catching up, but the rest of the world remains way behind.

This means that for now, Covid-19 and it’s variants have not gone away. What this does economically is create a tiered recovery, which is actually a good thing.

This will help prolong the cycle and keep inflation, hopefully, under control. We are still waiting for the Biden infrastructure plan to be agreed in the US, as well as some sort of tax increases. In the UK the promised June 21st “freedom day” seemingly might be delayed but economically most employees are now back at work. Hopefully, by the end of the month markets can mark an end to the UK economic damage from the virus. May 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.