Click Here for Printable Version

January 2024 has passed with the “Goldilocks” scenario still firmly in place. Inflation remains at or close to target for the US, UK and Europe. Despite the “medicine” (interest rates) being excessively strong, recession in the US and UK, is currently being avoided.

The downside from this positive scenario is that it means that the Fed can afford to wait before cutting interest rates, just to be sure inflation has been beaten.

Jay Powell has told the markets there will be no more interest rate increases and probably three cuts this year, but, if the current data pattern continues, these cuts won’t come any time soon.

Economists remained confused, their carefully crafted models with decades of data, keep telling them that a recession is imminent and something is about to break.

Crucially, based on past history there is still time yet for them to be proved right.

Another two banks, one in the US and another in Japan, have been crippled by US Commercial Real Estate loan losses, there will be more. In the US the Presidential Election process has begun its long and complicated journey. Also, in January we had the final quarterly earnings results season for 2023.

It is at this point in the cycle where we can start to calculate the true value of equities, rather than pricing off interest rates and bond yields, markets can return to calculating value based on company profits.

It is these numbers, as interest rates begin to fall, that will drive future portfolio returns.

Corporate Earnings Growth

Investment returns are driven by three factors, inflation, which in turn dictates the level of interest rates and earnings growth that is helped by low interest rates. If interest rates are below a company’s return on capital then decent profits are the result.

If, however, profits decline (such as in a recession) then shares become expensive and have to fall and vice versa when they are cheap.

The perfect scenario for markets is inflation around 2.5%, interest rates about 3.25% and thus earnings growth then tends to be above average at well over 10%.

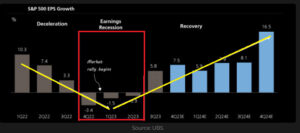

As the first chart, from Bank of America shows, prior to the Credit Crunch of 2008/09 earnings growth was typically around 15% in non-recessionary times, post 2008/09 growth was low and struggled to get to and stay at 7%. This was a period of deflation and very low interest rates as banks refused to lend and governments embarked on “austerity”.

In theory therefore with inflation currently at the target of c2.5%, once interest rates come back down to say 3.5% we will be in the same set of economic circumstances as the pre 2008/09 period.

Companies should therefore re-enter the higher level of earnings growth.

Interestingly, the second chart, from UBS, shows that whilst the US economy has avoided a formal recession, corporate earnings were actually in one, starting in the 4th quarter of 2022.

It is perhaps no coincidence that indices picked up once these corporate earnings started to recover. This is markets working exactly as they should. This chart also shows earnings recovering nicely this year.

However, these numbers are currently dominated by the big 7 tech companies, the forecasts take little account of the other 493 companies in the S&P 500. It is these companies that will be the primary beneficiaries of this return to economic “normal”.

This is also where valuations are cheap and thus the risk lower. We continue to see this as a generational investment opportunity whilst the market’s attention is focused on a few glamourous, Artificial Intelligence focused, but very expensive companies.

Presidential Election

The long and complex process to elect the next President of the United States of America has begun. What the markets know so far is that it appears, for now, to be a run-off between Joe Biden and Donald Trump.

Trump has dominated the Republican candidacy results with only Nikki Haley remaining as a contender. Whilst Trump’s support amongst Republican voters is strong there are some surveys of swing voters that suggest, if he is convicted in the myriad of Court cases then they would be unlikely to vote for him.

The markets have though started to price in the probability of a second Trump term. The perceived benefits would seem to be an intense pressure on the US Federal Reserve Bank to cut interest rates plus a reduction in global geopolitical tension.

But making predictions at this stage of the process is high risk. Nevertheless, as the year progresses markets will start to focus more and more on the race.

The Fed traditionally doesn’t make policy changes during the latter stages of the process. If it is going to cut three times this year then they need to begin doing it before well before October, therefore not that much time to get it done.

US Commercial Real Estate

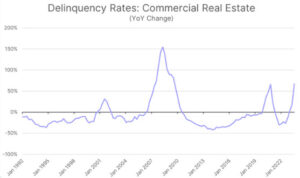

(Source: Reef Insights)

A landmark office in Washington DC, the Xerox building, has just been sold for $25m, it was last purchased in 2011 for $145m.

This shows the scale of the rapidly unraveling crisis in US Commercial Real Estate. As this chart from Reef Insights shows US delinquency rates are indeed rising but still remain way below the levels of the Credit Crunch in 2008/09.

This suggests that the worst is yet to come. New York Community Bank Corp shares collapsed after it set aside $552m to cover real estate losses. Japan’s Aozora Bank did the same. There will be more, as cheap fixed rate loans expire, many investors will hand the keys back to the banks. The big question is, will these be of a scale that the Fed finally has the excuse it is looking for to cut interest rates?

Markets

Each of our 4 broad scenarios for the global bond and equity markets remain valid.

- The Goldilocks i.e. Inflation keeps falling and yet recession is avoided

- Economics is right i.e. the US and UK will join Europe in recession during early 2024

- The Fed has done too much i.e. a major financial crisis arrives as banks see a wave of defaults

- Inflation returns i.e. inflation isn’t beaten and comes back with a vengeance

What markets do know, is that the inflation statistics are all consistent with core inflation returning to healthy, normal levels of c2.5%, so 4. seems to be the least probable.

There will undoubtedly be scares, however, the inflation trend remains firmly down.

As we highlighted above, for corporate earnings this is very good news, as it would be consistent with pre 2008/09 levels of earnings growth i.e. much higher than markets have got used to.

Furthermore, interest rates are simply too high.

They have to be in a range of 0.5% to 1.0% above inflation, so they should be around 3.0% to 3.5%.

The markets think so too, but with 10 year bond yields, in both the UK and US at 4%, they have not fully priced in this potential cut. Markets remain in a “wait and see” mode as the pattern of data hasn’t, so far, changed enough to stimulate the Fed into immediate action. This means that the recent rally in Bonds and Mid/Small Capitalisation equities has stalled.

But it is a question of when rather than if interest rates will be cut. US politics will also play a part, Trump likes to criticise the Fed, they in turn want to be seen to be apolitical, this means they have a very narrow window to cut rates before the vote, especially as the Fed doesn’t meet in May or August, there are only 5 potential cut dates.

If the 2nd, or 3rd point (listed above) come to pass, then the cuts will be sooner and deeper than is currently priced in.

Thus, in the very short term the economic data releases remain the key, markets are looking for a slowing economy, so far, both the US and UK economies remain remarkably healthy. February 2024

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.