Click Here for Printable Version

As the first Quarter of 2024 passes, the “investment clock” has moved out of the negative period.

It is important to note that markets go up more often than they go down, that is the basis of the global investment industry.

Clearly there are periods, which often feel lengthy, when returns are negative. Historically, this is usually when interest rates go up. Again based on history such periods last on average 18 months with a range between 12 and 24 months.

This time around the first US interest rate increase was in March 2022 and the Fed indicated they have stopped raising rates in October 2023 i.e. 19 months, just about perfect.

Since then we have seen a mixed recovery in both bond and equity prices. Normally, a negative market period is predictive of a recession and indeed in the UK, Europe and Japan there has been a technical recession, but not formally in the USA.

However, corporate earnings did fall by 15%, just as they would in a recession and crucially US House Prices have fallen by 20%, not dissimilar to the 23% collapse in the Credit Crunch of 2008/09. This is not what you want as an incumbent US President going into a difficult election. So as markets move through the “Bear” period into the new “Bull” we enter the “Wall of Worry” phase.

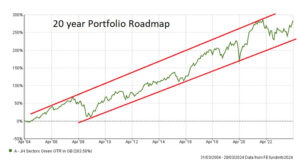

Bad news sells and commentators, economists and market analysts will be in denial for some time. Inflation statistics have not quite fallen back to target yet and the Fed seems to be in no rush to start cutting rates. But they may have to in June if they wish to be seen as apolitical ahead of November’s Presidential election. However, time (the most important factor in investment returns) marches on and the Portfolio Roadmap has returned to growth.

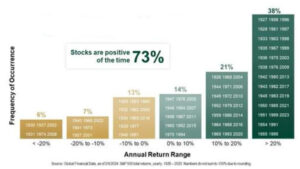

Annual US Equity Return since 1925

Source:Tradingeconomics.com

Portfolio Roadmap: Unit Trust Sector Averages

Balanced Investment Strategy using Unit Trust Sector Averages

This first table takes the average annual return from the US S&P 500 over the past 99 years.

What this shows is that returns are positive 73% of the time and very high annual returns (20% plus) occur 38% of the time.

In practice for investors these high returns come when they are least expected and those that seek to “time the market” often miss the best periods.

For the negative periods the message is they don’t happen often, 27% of the time and rarely last more than 24 months. Patience is thus important. Putting these two facts together lies behind our advice process, get invested, stay invested and keep enough cash reserves so you are not a forced seller just at the wrong time.

Was it different this time? Once again, it seems not.

Green Shoots? US Leading Indicators

Green Shoots? Shipping Activity

Now that recession has arrived in the UK and we have had a recession-like collapse in corporate earnings and house prices in the US markets can begin to look through and price in the recovery.

This is where the returns within a Bull market are the highest.

Are there green shoots out there?

In the US, The Conference Board’s Leading Indicators index has turned up. The second chart shows shipping activity, this is often an early indicator of improving global business climate, this is picking up nicely. Clearly, it is early days but in terms of timing and from what these indicators are saying, the prospects appear to be good.

The Rest

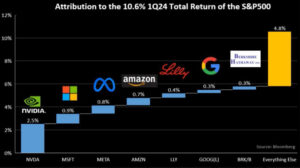

Another intriguing aspect of the 2024 first quarter was the change in relative performance from the big technology stocks. In 2023 the “Magnificent 7” of Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla drove all of the returns from the S&P 500, the others i.e. 493 companies were effectively unchanged on the year.

So far in 2024 the pattern has changed, “the rest” delivered the highest overall contribution with Warren Buffet’s investment vehicle Berkshire Hathway, which is full of old non-technology stocks, in second place. Indeed, Artificial Intelligence leader Nvidia, cost performance over the quarter.

The Mid and Small sized stocks are also just starting to show signs of life as well.

Elections

2024 is a year of elections globally and these will impact on market sentiment, the actions of Central Banks and often vote-winning giveaways can inadvertently stimulate inflation.

The US Federal Reserve Bank will be the most focussed of all the Central Banks as they will not want to be seen to be working either for or against either US Party.

Historically, they effectively close down in October just before the November vote.

We have stated before that their window for action is very tight. US Interest rates are essentially 2% too high if inflation is running at around 2.5% to 3.0%. If they don’t act soon it might be perceived badly politically.

The problem the Fed has is that the current inflation and jobs data points are slightly too high to justify big cuts just now.

Normally, they would just sit and wait for the data to come to them, but American politics may not let them.

Markets

Number 1 of our 4 broad scenarios remains the key market driver at present:-

- The Goldilocks i.e. Inflation keeps falling and yet recession is avoided

- Economics is right i.e. the US will join the UK and Europe in recession during 2024

- The Fed has done too much i.e. a major financial crisis arrives as banks see a wave of defaults

- Inflation returns i.e. inflation isn’t beaten and comes back with a vengeance

Economic data announcements remain the key to market direction in the very short term, here, the recent data has been mixed.

Some jobs data points to rapidly rising US jobs lay-offs, in the UK the number of job vacancies has seen a record drop, yet official numbers still show unemployment at historically low levels. Essentially, what we have are various data points that could satisfy each of the above market scenarios.

Crucially, Fed Chairman Powell appears unconcerned and seems to keep confirming that the first interest rate cut will come in June. In the meantime we have the first Quarter 2024 corporate earnings season beginning later this month.

The numbers should be good and this should be across a wide range of industries and not just technology.

This is the point in the cycle where mid and small sized equities should spring to life and resume their historic position as the main drivers of a “Bull” market.

Overall for markets at some point the baton will be passed from Interest Rates and Inflation to Corporate Earnings Growth as the key determinant for market returns.

Not quite there yet, but getting there. Valuations excluding “Big Tech” remain cheap, especially at this point of the cycle, after this earnings seasons good growth they might become even cheaper still?

April 2024

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.