Click Here for Printable Version

February has been a month of waiting, markets are waiting for the widely predicted US recession, they are waiting for the US Federal Reserve Bank to start cutting rates and they still waiting for the Chinese economic “bazooka” to kick-start the world’s second largest economy back to high growth.

In the meantime bond markets have gone to sleep as have interest rate sensitive sectors such as the small and mid-capitalisation shares.

Traders instead have continued to focus on the “Magnificent 7” i.e. the big US tech companies. But here there are changes as well, Apple is struggling with a lack of demand from China for iPhones, Google’s latest A.I. browser launch was a disaster, Tesla shares are also struggling as electric vehicles falter and China’s BYD highlights the weaknesses in its product line up.

The valuation gap between Big Tech and the rest is now at extreme levels, this will reverse, it’s just a question of when. The Magnificent 7 is now 4, Nvidia, Microsoft, Meta and Amazon, all being driven by Artificial Intelligence. However, valuations matter in the long term and whilst the building of the infrastructure for AI is creating a goldrush it does bring back memories of Y2K.

Once all the cloud data centres have been upgraded and expanded what happens then? In the UK we have possibly just had the last Budget before a General Election, this brings the economic record of the UK into focus.

Once again the mainstream media likes to highlight all the negatives but is this reasonable?

GDP Growth in UK, France and Germany

Inflation in UK, France and Germany chart

Source: Tradingeconomics.com

The point of these charts is that GDP Growth post Covid, and Inflation post the invasion of Ukraine, in the UK, France and Germany are pretty much identical.

There is some volatility in the individual data points but the pattern and the trends are the same.

In the period after the Ukraine war growth collapsed, inflation shot up, but since May last year inflation has returned to normal. There are occasional “spikes”, particularly as Energy Price Caps are introduced or removed, but broadly speaking where one goes so do the other two.

The mainstream media likes to “kick” the UK’s economic performance but it is no worse or indeed no better than our major competitors. The US leads economically, as it always does, however, to single out the UK as being particularly poor/good is not supported by the economic facts.

Debt to GDP

Source: Tradingeconomics.com

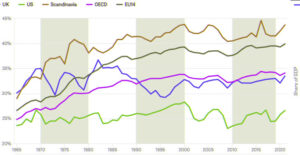

Tax Take

Source: OECD

The same mainstream media highlights that the UK is massively in debt and that taxes are at record highs. Both facts are true, however, as above, this must be placed in the international context.

UK Debt to GDP is below many of our competitors, including USA and France, indeed it is not that much higher than parsimonious Germany.

So whilst as a country we have a big mortgage, it is not as bad as our major competitors. Tax levels are where we do diverge. UK taxes are low compared to the rest of Europe and very low compared to Scandinavia.

Many complain that our public services are poor compared to others on the Continent, but the reality is they do pay more for them. The UK historically tries to be close to the US in taxation but then also close to Europe in Public Services. This is a very difficult balancing act. It must also be noted that the UK numbers include funding for the NHS, whereas across Europe health services are in the main funded by insurance.

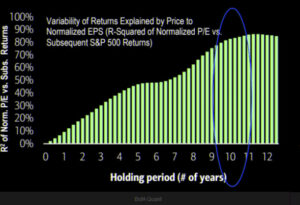

Valuation Matters

Source: Bank of America and Goldman Sachs

As stated in previous newsletters markets are driven by inflation, interest rates and company profit growth.

In the short term it is the direct relationship between inflation and interest rates that go up and down in tandem that counts.

However, over the long term it is individual company profit growth and the value associated with it, that drives portfolio returns. The faster profits grow, the cheaper shares become, the higher the returns.

As this first chart shows, after 10 years, 90% of the return from a portfolio can be explained by valuation. So given that fact, what is the current valuation of shares?

As ever, using the USA (UK is even cheaper) as the benchmark, if we exclude the big technology companies then the rest of the market is valued in the middle of the range, which is good. This is also just at the point where we should expect profit growth to accelerate to above average as interest rates start to fall.

“Big Tech” is expensive, “The Rest” are cheap.

Just like in 1999/2000 (Y2K), as the chart shows, technology shares can become even more expensive, however, as we saw in the years following Y2K, when all the software and hardware upgrades had been completed, tech valuations collapsed back to the mean.

Markets

Each of our 4 broad scenarios for the global bond and equity markets remain intact for now.

- The Goldilocks i.e. Inflation keeps falling and yet recession is avoided

- Economics is right i.e. the US will join the UK and Europe in recession during early 2024

- The Fed has done too much i.e. a major financial crisis arrives as banks see a wave of defaults

- Inflation returns i.e. inflation isn’t beaten and comes back with a vengeance

In the very short term Number 4 has come back into play.

The most recent US (and UK) inflation statistics were higher than ideal. This restricts, for now, the Fed’s room for manoeuvre.

An interest rate cut in March was always optimistic if the above Goldilocks scenario remains in place. After March there are only 4 scheduled FOMC interest rate setting dates before the US Presidential Election, for a projected 3 interest rate cuts.

If the US economy does nosedive then the Fed will have to do bigger reductions than the presumed 0.25% per meeting.

But there is still no sign of the widely forecast US recession arriving. In the UK however, economics was right and we have just joined Europe and Japan in a formal recession, doesn’t feel like it though, as unemployment remains low.

So for now markets remain in a “wait and see” mode. Interest rates are too high, they have to come down, just no-one really knows when.

Valuations excluding “Big Tech” are cheap, especially at this point of the cycle, but no-one wants to buy anything other than A.I. related companies. This will change, markets will revert to the mean, as they always do.

March 2024

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.