Click Here for Printable Version

As the first half of 2017 passes markets have stalled. The FTSE is down over the month by nearly 3% and the World Index by just under 1%.

Is “sell in May” working this year? There are plenty of reasons around for markets to pull back but we mustn’t forget another well-known market adage “bull markets climb walls of fear and worry”.

They do so because markets are not priced on what is happening now but on what might happen in 12 to 18 months’ time. It would be easy to look at Trump’s political problems and May’s disastrous General Election results and assume markets will fall.

The reality is that for the stock markets politics is transient, profits are usually not. For corporate earnings we need to concentrate on the consumer and the oil price.

In both cases there are, for now, some worries.

But for the crucial and long under pressure banking sector we are finally starting to get some good news.

US giant JPMorgan has announced plans to return a staggering $27 billion in excess cash to shareholders over the next twelve months, after the Fed signed off on the plan as a part of its annual stress test.

The capital return plan is the largest by any US bank this year, Citigroup, who aims to return almost $19 billion over the same period is the next largest.

This effectively completes the rehabilitation of the US Banking sector since the financial crisis of 2008/09.

The US regulators have stress-tested the banks’ balance sheets and found they have too much capital for their needs.

Rather than rashly lend it out as before, the regulator is happy for them to return this excess cash to shareholders.

This is important as Banks are a key sector within the major indices.

For example in S&P 500 index Banks and Financials make up 15% of the calculation.

Indeed, with a “normal” Yield Curve gradually appearing, allowing the banks to lend at higher interest rates than they pay depositors, we might just be seeing Banks take over from Technology as the major driver for equity markets.

We also mustn’t underestimate the impact that so much returned capital will have on the US economy.

Seasonality and Volatility

Each market has its own volatility index but, as ever, the most widely watched is the volatility of the US S&P500 i.e. the VIX.

Since the Trump election, markets have enjoyed a strong run and the VIX value has been very low.

This highlights the consistency of the buying and the confidence of the buyers as well. “Old hands”suggest that it also means that these buyers are becoming complacent and thus the magnitude of any future shock could be made far worse.

This chart shows the seasonality of the VIX.

Over the past 20 years on average the VIX has risen sharply from July to October. This reflects “sell in May” as governments shut down for the summer.

It is a graphical representation that we are entering negative seasonality.

Theresa May and the General Election

With hindsight the snap election was a mistake, we now have a much weakened Conservative Party and a Prime Minister whose credibility has been shattered.

However, Labour still lost and lost badly, they only did marginally better than when Gordon Brown was evicted from Downing Street.

We need to dig underneath the result to find the hidden messages that the media are not inclined to look for.

If we use the analysis of Strathclyde University’s Prof John Curtice, who correctly predicted the result, the Conservatives did indeed pick up the hoped for UKIP vote, but only in those seats where UKIP was strong.

Indeed, more broadly, the Conservatives did best in those constituencies where the vote toleave was strongest in last year’s referendum.

However, the other half of England and Wales swung strongly to Labour.

Where UKIP was weakest two years ago, and where the leave vote was lowest, there was a heavy seven-point swing to Labour, including not least in London.

In appealing to the Brexiteers, May forgot that she needed to carry with her the nearly half of the country that voted Remain, especially in London. The core of the Remain vote comprised young, university educated voters and these younger voters swung strongly behind Labour.

But it still wasn’t enough to achieve anywhere near close to a majority, Labour needed to win back its old working class heartlands, it didn’t. What this means is that the country is still divided on Brexit/Remain lines, hence the Tory move from Hard to Soft Brexit, (which is more market friendly) not that they have much choice!

Amazon / Whole Foods

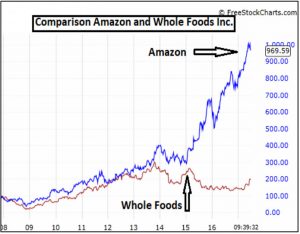

The latest move in this direction comes with the proposed purchase of the major upmarket US supermarket chain Whole Foods by Amazon.

Amazon core business is home delivery and it sees food and “instant” delivery as the next major step in its meteoritic rise.

Whole Foods brings the product range and the stores (as distribution bases) to take internet retailing to dominance over the High Street.

In the US shopping malls are already starting to close and even the mighty Walmart is struggling to grow.

We are yet to see a similar move in the UK though the move down in supermarket shares around the world highlighted what a serious threat Amazon could be.

This amongst driverless vehicles and artificial intelligence will have significant long term implications for employment and wages.

Sintra Tantrum

During June a select gathering of Central Bankers met up at the Portuguese resort of Sintra.

Before this meeting markets expected that in the European Union and the UK interest rates would remain low for the foreseeable future. After the meeting the market now believes that QE will come to an end sooner rather than later and interest rates will rise from here.

This is a massive shift in market perception; across Europe and in the UK bonds fell in value and yields consequently rose to reflect the new “hawkish outlook”.

Mark Carney’s stance was particularly surprising, okay UK inflation is rising but that is almost entirely due to the Brexit currency weakness.

Wage growth remains weak, house price inflation is slowing and the UK’s Brexit negotiating position has got weaker since the election.

Surely the Bank of England should be readying more QE not less?

It may well be that the Central Bankers are using the old trick of talking the markets to the level they want?

ECB Chief Mario Draghi is a past master of saying he will do “whatever it takes” but in practice simply does nothing. Nevertheless, this a very significant change in the tone surrounding interest rates which has negative implications for bonds around the world.

Markets

As we said last month June normally sees the start of the summer market doldrums, and for the first time since the Presidential Election we have started to see some equity markets pull back.

There still a lot going on particularly with Trump and the longed for US Budget tax cuts.

We remain concerned that the global economy is not quite as strong as it should be and the opportunity presented by Trump’s proposals is in real danger of being missed.

The markets believe that what we are seeing in the US is a delay not a cancellation.

But Trump is appearing to lose political friends daily and at some point the markets will have to consider that nothing may actually happen.

We hope that if that point does arrive underlying growth is good enough to cope with the disappointment.

So far the evidence is mixed.

This is why this allegedly uncoordinated new Central Bank policy of talking up interest rates is so disconcerting.

Nevertheless, there is still a lot to be positive about.

We have the return to health of the banking sector; Europe returning growth with new French President Macron saying sensible stuff. If we then add in a more realistic tone from both the UK and EU over Brexit plus China showing stability then there are plenty of positives.

These will all help secure long term growth. In the short term though, we have the usual summer headwinds to navigate.

June 2017

Click Here for Printable Version