Click Here for Printable Version

January saw the inauguration of Donald Trump as US President and the Dow Jones Index hitting the psychologically important 20,000 level.

As ever markets are mercenary, they only care about the future profits of their constituent companies; they care little about politics or immigration.

So far Trump has focused on non-economic areas for his Presidential decrees, there has been noise about reducing regulation, and two old regulations must be removed before a new one can be implemented etc. but he is yet to get to tax cuts and economic stimulation.

So whilst Trump has been upsetting various groups the markets have continued upwards.

Whilst there may be no feel-good factor amongst the various commentators for Trump, in corporate America optimism appears to be increasing.

The Fourth Quarter 2016 earnings season is now underway and most results are better than at this time last year.

Overall earnings are looking to be about 7% higher, which is good. We do though remain concerned that it will take time for the Trump stimulus to be announced and implemented, in the meantime US homeowners are facing higher mortgage rates and this must have short term consequences for the US and thus the global economy.

The long term outlook, meanwhile, continues to improve.

Warren Buffet v George Soros

The day after Donald Trump’s unexpected win, one of Hillary Clinton’s biggest billionaire supporters had the best day on the stock market of any American tycoon.

A rise in Berkshire Hathaway shares added $1.7 billion to Warren Buffett’s personal investments bringing his total net worth to $68 billion, according to Forbes.

In contrast George Soros, another vociferous Clinton supporter, assumed that the election of Donald Trump would be a disaster, and took up bearish market positions.

He therefore believed the Trump victory would cause markets to collapse. Soros is now nursing a $1bn loss.

He can afford it, what is important is that this is a reflection of their individual investment styles; Buffet buys value stocks and holds them for a very long period of time.

Soros is a trader, taking aggressive stakes on markets and currencies, including famously his bet against the pound at the time of the ERM crisis.

His track record suggests that he has more wins than losses but it is a high risk strategy, you are only as good as your last big trade.

Buffet meanwhile takes the low risk route; he invests rather than speculates, sticks to shares rather than derivatives, rarely trades, and accumulates dividends.

When asked during Berkshire Hathaway’s AGM if a Trump presidency would be a threat to the company, he answered,

“I will predict that if either Donald Trump or Hillary Clinton becomes president, Berkshire will do fine.”

Interestingly, Berkshire Hathaway has bought a further $12billion of stock post the election. Remember Buffet marked the bottom of the market in 2009 by effectively bailing out Goldman Sachs.

Harley Davidson

Harleys are not very practical motorcycles and are purely a discretionary purchase; no-one actually needs a Harley.

They are certainly not cheap but are relatively affordable, you don’t have to be amongst the super-rich to buy a Harley Davidson.

Recent 4th quarter sales were disappointing, falling by 11.9% to 42,414 bikes.

This brought the total number for year sold to 262,221 down 1.6% on 2015.

Moreover US sales were down by 3.9%, international unit sales continued to grow.

This is concerning as it doesn’t reflect the reported US GDP and Consumer Spending statistics, which it normally does.

Now this may be all down to election uncertainty or possibly customers delaying a purchase decision until a new engine is in production?

One quarter is not enough data, but we should be wary that the US consumer is maybe not as healthy as the statistics suggest and this is before the Trump inspired increase in mortgage rates.

End of Cash?

European Central Bank President Mario Draghi recently stated that he is strongly considering phasing out the 500 euro note.

He is not alone, in India the 500 and 1000 rupee note were recently replaced, economists and banks have also called for an end to cash in recent months.

The reasoning is almost always the same; cash is something that only criminals, terrorists, and tax avoiders use.

But as ever this may not be the real reason. QE around the world has consequences; one of them is negative rates.

If you are to be charged for holding spare cash in a deposit account then why not just buy a safe and hold it in physical form?

If everyone did this then the banks would collapse overnight. Cash is only a tiny part of their assets. There is not physically enough cash around the globe to fund even a tiny increase of withdrawals.

Couple this with Central Bank’s stated stance of no more bail outs then it is no wonder that holding cash on deposit is less attractive than it ever has been.

Electric Vehicles and Oil

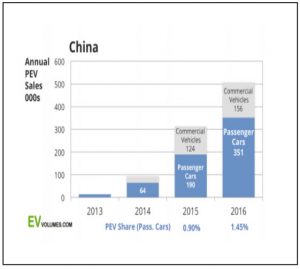

Nevertheless they only represent less than 1.5% of car sales. But at current rates of growth they could be as disruptive to the oil market as Saudi inspired market share war of 2014.

BP says electric vehicles could erase as much as 5 million barrels of oil a day over the next 20 years, while Wood Mackenzie say they could erode as much as 10 percent of global gasoline demand over the same timeframe.

Royal Dutch Shell recently stated that global oil demand could peak in as little as five years.

According to the Carbon Tracker Institute, the cost of electric vehicles is falling faster than forecast and could reach parity with conventional vehicles by 2020.

If this comes to pass then there will be consequences for the oil market and as we have seen over the past few years for the stock markets as well.

Markets

The markets are so far being patient with the new President.

They want all of his economic reforms; they want tax cuts, deregulation and stimulus to be “front and center” of the new administration’s actions.

So far all the attention is on divisive immigration, border and trade issues.

The markets will be patient, but only up to a point, they want immigration to be a sideshow with the economy the main event.

It is very early days but the longer the focus is on these politically tricky issues then the scope for disappointment grows.

For now, Trump has the benefit of the doubt.

Why, because the old world economies are desperate for real growth and a return to “normal.” Profits around the world are picking up, the recovery in oil is helping and there seems to be more optimistic noises coming from Chief

Executives around the world.

It would be a real shame if this opportunity were to be missed. Corporate earnings are growing again and at a healthy 7%.

This is before any tax cuts or stimulus. So fundamentally shares each day are getting cheaper and as growth is accelerating they are becoming better value.

This is important as value is a major support for the markets; it limits the downside as and when the inevitable setback arrives.

Our short term concern remains the increase in market interest rates in the US and the impact this may have before Trump can stimulate the US economy.

Also we have to be wary of the political situation in Europe. The Dutch are saying that if the PVV win the most votes they still won’t be able to form a government.

Most investors have ruled out a swing to the far right across Europe which is dangerous as it would magnify the market shock should it occur.

So we have an improving global economy, global equity markets getting to be better value and a very interesting US economic outlook.

However, the political risk seems to be getting greater each day! But at the same time we mustn’t forget how Warren Buffet made his billions.

February 2017

Click Here for Printable Version