September has proved to be a fascinating month for markets. There have been subtle changes in the forces that drive share prices and global political sentiment.

Quantitative Easing (QE) by the Central Banks of the USA, UK, Europe and Japan has lowered bond yields and boosted equity prices.

During September it became clear that the US Federal Reserve will more than likely raise US interest rates at its December meeting and the Japanese Central Bank intriguingly is markng a change in QE through the introduction of what is now known as the “Kuroda Curve”.

Politically the world might be changing as well. The Brexit referendum has proved to be a wakeup call to politicians around the world.

The mantra of globalisation, open borders and austerity is being rejected by voters who are no better off than they were before the 2008 Credit Crunch. Voters will accept “jam tomorrow” policies for only so long.

Politicians fearing the loss of their jobs are now moving to a vote winning formula of immigration control and crucially for markets, fiscal spending (increased government spending). We have written many times that economic growth requires a triumvirate of central banks, banks and government working in harmony to stimulate economic activity and we have not this.

Politically, austerity is coming an end in the UK and depending on the outcome of elections may well do so in the US, France and Germany. The tricky bit is to get the high street banks’ lending again without significantly raising interest rates and thus crushing home owners who have become reliant on low interest rates, and this is the idea behind the Kuroda Curve.

The End of Quantitative Easing?

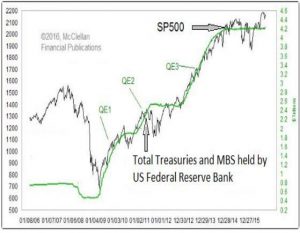

This was supposed to be a short term exercise to keep the global financial system going. The Fed tried three times to end QE but the underlying economy simply wasn’t strong enough to survive.

As the chart shows, thestock market follows the amount of bonds bought by the Fed.

As it is being gradually withdrawn in the US, this has increased volatility but so far the economy is just about holding up.

QE can only do so much, central bankers are flagging to governments around the world,“it’s over to you, start spending, stop austerity, and we are nearly out of ammo.”

The Kuroda Curve

Japan has led the way with “extraordinary” monetary policies.

A strong currency and aging population has killed Japanese growth. Yet the biggest QE program of them all has failed to lift inflation. The next step for Japan is to get the banks’ lending again.

The problem a bank has is that it borrows money from retail customers (savings), for short periods, pays them a modest rate of interest and lends this money at a higher rate of interest for a longer time frame.

Normally long term borrowing rates are significantly higher than short term savings rates.

This is known as the Yield Curve,borrowing for ten years should have a higher rate of interest than for one month. In a growing economy this gap is normally pretty wide and allows the banks to make money.

It used to be that the differential had to be as much as 3% for a bank to make a profit. With current global interest rates at about nothing banks simply aren’t bothering to lend money and hence growth is stagnant.

What Governor Kuroda of the Bank of Japan has done is announced two interest rates, a negative Base Rate but also that the 10 year rate should be 0%.

This has had the effect of pushing the 40 year interest rate to 0.6%. Doesn’t sound like much but it is a very important message for markets.

It says that the period of lower for longer might just be coming to an end. For overvalued bonds not good news, for expensive equities it will be fine as long as it has the desired effect, i.e. greater economic growth and thus higher profits.

This move by Japan could prove to be a subtle, but very important one.

The Pound

Firstly, Article 50 will be triggered by March. Secondly, the starting point (as of course it would be) is that Britain will go for a “Hard Brexit” i.e. a complete break form the EU with separate trade deals being negotiated.

Remember, this is a poker game; no one wants to declare their hand too early.

It has, however, had the impact of weakening the pound against the euro. This is good news for UK corporate profits, hence the FTSE rally.

As ever, whilst the headlines are dramatic, a look at the long term picture shows that sterling is simply giving back its strength since 2009. What also came out of the conference, in a speech by Liam Fox, is the intriguing statement that Britain will be a leader in global free trade.

This was one possible outcome of Brexit we highlighted in the June Newsletter; it was also the one that offered the greatest long term growth potential.

Deutsche Bank

Germany’s biggest and one of the world’s most important banks has a market value of just $15bn.

Competitors such as JP Morgan Chase and HSBC are valued at $240bn and $120bn, which highlights just how small this once dominant, but still very important European bank has become.

The US Department of Justice has been levying fines across the banking sector for various reasons (essentially because they can).

Deutsche has dragged its feet in reaching a settlement which may not, in hindsight, have been particularly wise.

Rumours persist that the US is looking to levy an enormous fine of $14bn on the bank.

Deutsche already needs more capital but a one off fine of this magnitude would give it severe problems.

Clearly, Germany would not want to see its national champion go under but the kind of state support it can offer is limited by EU rules, which coincidentally were written by the Bundesbank.

Any preferential treatment would also see the Italian Banks asking for the same.

For now Deutsche Bank remains solvent but its immediate fate lies in the hands of the Americans.

No one wants another “Lehman moment” especially when there is an election going on in America!

Markets

October is traditionally the worst month of the year for markets.

Traders like to pull prices back in order to build positions ahead of the usual year end run.

We also get the third quarter corporate results season. US interest rates didn’t go up in September, despite all the noise from various regional Fed Governors.

The message was pretty clear though, they will go up in December, unless of course Trump wins.

To an outsider “the Donald” seems to be trying very hard to lose, but his opinion poll ratings remain robust.

Post Brexit it has become clear to politicians across the globe that the voting public has lost patience with austerity and QE; they have delivered no material gain for middle income earners.

Political rhetoric is therefore changing and this has implications for markets. QE will be reined in, government spending, fiscal stimulus and deregulation will become the main strategies.

In the long run this should all be inflationary and thus accelerate the return to normality.

In September we may just have seen the beginnings of such a change in stance.

Theresa May in the UK is certainly now pushing in this direction as are the Japanese. The Americans are looking to raise rates and whether the US government starts spending depends on the outcome of what so far is a fascinating and, troubling election.

But the key in the US is not the Presidency but who gets control of the houses of Congress.

In the meantime, the markets have had a great run, and now need a good earnings season to keep going.

The OPEC inspired rally in crude prices will help. Remember, good corporate profits lead to a cheaper market, Deutsche Bank will though dominate the news flow for now. September 2016

Click Here for Printable Version