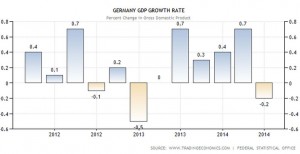

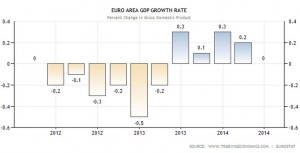

As the third quarter of 2014 finishes it has been a lacklustre one. The pessimists have been encouraged by the news out of Europe and Japan as these economically becalmed regions are showing few signs of recovery.

Indicators such as the falling oil price are suggesting that as US QE comes to an end then so will the recovery. However, the bedrock for markets is corporate profit growth, as long as global multinationals deliver earnings growth above inflation then the equity markets will continue to make progress.

September delivered few hard facts that indicate corporate profits are coming under pressure. There have been few profits warnings, and yet again it is just the fear that this may happen that is driving markets. This is, however, just noise, markets do fluctuate, and investors have perhaps become complacent? We have over the past few years experienced abnormal markets; September simply reminds us that normal service is being resumed!

Europe

Last month we highlighted an impending ECB meeting, hopes were high that this time “Super” Mario Draghi, rather than just telling the market that he would do “whatever it takes” to save Europe would actually do something. The markets want full QE, the Germans, who control the purse strings, don’t. They argue that structural reforms across Europe are the solution.

When we see Air France pilots striking to protect their mandatory 55 retirement age, as well as an average salary of £200,000, we can’t help but think

that they are right. Draghi did announce another new scheme, but again not full QE; instead it is a form of direct funding of European banks.

Called the TLTRO this is around $1.3 trillion in zero cost, four-year funding, on the condition that the banks expand their business loan books. But if we use evidence from Spain, it probably won’t work.

The initial round of TLTRO takedowns came in at only $100 billion compared to the $200 billion widely expected. It seems that Spanish banks, like their counterparts elsewhere in Europe, are finding virtually no demand among small and medium businesses for new loans. Many businesses are wary of the offers from banks; there is a lack of trust.

The reticence in Spain suggests demand for credit may be as much of a problem as the supply.

The monthly demand for new one year loans up to euro1m, the type of credit typically used by small and medium-sized companies, is still down by 66% from the pre Credit Crunch peak, according to Bank of Spain data. So if Europeans are too scared to borrow money and banks too scared to lend then the European economy will remain in suspended animation until someone comes up with a plan that is better than just throwing money at the problem.

The US Dollar

One of the startling features of the markets over the past two months has been the strength of the US Dollar. Its strength against the Pound can be explained by the Scottish referendum, but there have also been huge moves against the Yen and the Euro.

What is this big move telling us?

Firstly, hot money when it is not sure what to do returns back the Dollar. Regardless of whether you are a Russian Oligarch, a Chinese tech billionaire or Middle Eastern Oil sheik your default reserve currency is the US Dollar.

So the hot money has taken its chips off the global roulette table and put their money back in the piggy bank. In all probability this may be down to a perfect storm of US QE finally tapering out, Abenomics not appearing to be working in Japan and Europe continuing to slide into deflation. But what we do know is that this money doesn’t stay static for long.

Any sign of improvement in the level of growth in the US and some positive news from Europe will see it flow out and be put to work again. This money moves quickly and aggressively and is the main driver behind the day to day volatility that we as long term investors have to ride out.

Any sign of the Dollar weakening, often accompanied by a rise in Gold will be an early sign that the current equity market malaise is coming to an end.

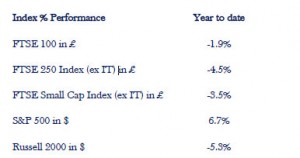

Mid and Small Sized Companies

These are volatile investments and currently the degree of underperformance is within historic boundaries. It is always a concern when the growth companies start to struggle, especially as we are very late into the cycle, but profit growth trumps all.

Crucially, there is no sign of the current healthy levels of corporate profit growth starting to deteriorate.

PIMCO and Bill Gross

In the dull and dry world of investment there are few genuine superstars, the equity world has Warren Buffet, hedge funds George Soros and for bonds it is Bill Gross. He founded Pacific Investment Management and built it into a manager of over $2trillion of bond investments.

His flagship Total Return fund is valued at over $200billion, staggering numbers, and thus very significant in terms of the bond markets. Pimco sold out to the German insurer Allianz and there have been rumours for some time about management difficulties. Gross has now left PIMCO and joined Janus, an independent US fund company which has only a small exposure to bonds.

This means he will have all the freedom he desires. For the bond markets the question is what happens to the clients, will they follow Gross to Janus, stick with Pimco or move somewhere else entirely and more importantly what will happen to the holdings.

If clients move will Pimco be forced to dump assets into a difficult and overvalued market, or will the bigger clients transfer the assets “in specie” and thus not touch the markets. Bonds are not dealt electronically like shares and as the Fed steps away as a natural buyer (due to the end of QE) could this be the “Black Swan” event that triggers a bond market revaluation? As ever, no-one really knows, only time will tell.

Markets

US QE is actually QE3; the US Federal Reserve Bank has had three attempts at getting the economy back to “normal” levels of growth. At around 2.5% US growth is fine but still below where it should be at this point in the cycle.

After 5 and half years since the market bottomed we should normally be experiencing a booming US economy, growing at say 4% p.a. with house prices and wages also growing at levels which would trigger the Fed to start raising interest rates.

The first two bouts of QE didn’t work and when they ended US growth slipped back towards recession.

Institutional investors are simple folks, they work on the basis that what happened last time will happen again, and markets are telling us that when QE3 ends in October the US and thus the global economy will slow, perhaps even back into recession. Until these investors see hard evidence to the contrary they will act nervously and will expect a US slowdown. But the next US Presidential election is November 2016. With both Houses of Congress incapable of passing economy stimulating budgets without a huge argument, Obama has to rely on the Fed.

If the Democrats want to win then the US economy needs to accelerate from here.

For now though we are entering a new US corporate results season, and what happens here will dictate how October goes.

The deflationists have an opportunity to bring the markets back down. All the geopolitical risks that are around, to which we can add the student protest in Hong Kong, and with European heading back towards recession, means that they should be pushing on an open door. But as we keep saying corporate earnings trumps all. Good numbers and a few takeover bids will see the trend reassert itself regardless of whether Putin takes advantage of the deteriorating weather to turn the gas off. October is often the most difficult month for markets; this one looks set to continue the pattern.

September 2014

Click Here for Printable Version