Click Here for Printable Version

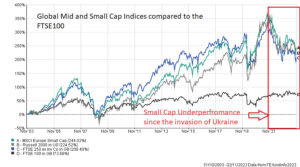

October has yet again proven to be a stormy month both for the weather and for the markets. Stock market crashes famously tend to occur in October and whilst this has been avoided in 2023 equity indices are down c10% from 1st July and long dated US Treasury Bonds are down again by a further 18%.

20 year US Treasury Bonds have now fallen 50% since the Russian invasion of Ukraine.

Investors are in a complex market where macro and microeconomic data is conflicting and there are also multiple geopolitical events from Russia/Ukraine and China/Taiwan concerning markets. There is now a new geopolitical event on the market’s agenda with the events in Israel and Palestine.

Markets are mercenary and have no emotional reaction to these horrible events, their sole concern are the potential economic consequences if the conflict spreads to other areas of the Middle East.

The main economic impact has been seen primarily so far in the US Bond markets and also, as ever, in the trading of crude oil. Joe Biden is on a spending spree and running up the US credit card bill (US Treasury Market).

He now wants Congress to approve $100bn of extra funding for Israel and Ukraine. Markets have started to baulk at the increase in the US debts, hence the selloff in US Treasuries. This move has economic consequences for the whole US economy. Economists estimate the fall in US Treasuries is equivalent to interest rates rising by a further 0.75%. Bad news but also good news, as the Fed may not have to do any further rate increases.

For oil prices it’s all about Iran, will sanctions on their crude oil sales return? Will they block the Straits of Hormuz? If they do how will the Qatari gas get to Europe to replace the embargoed Russian supply?

Middle East Conflict and Geopolitical Shocks

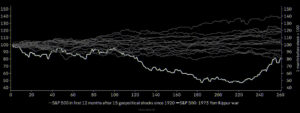

As this chart shows markets aren’t that bothered by geopolitical events, clearly as the conflict in the Ukraine has proven such events can be a catalyst for other market issues, such as inflation, but the conflict itself can carry on and the markets ignore it long after the economic ripples have been dealt with.

The Yom Kippur War of 1973 does, however, still resonate to this day (it was the 50th Anniversary the day after the Hamas attack).

But again it wasn’t the actual fighting that was the problem, it was OPEC shutting off the supply of crude oil, which led to petrol rationing across the US, UK and Europe. As this chart shows this was the one geopolitical event that did severely impact markets. But then, some 260 trading days later, markets were well on their way to recovering their losses.

As we write the conflict in Gaza has not spread and Iran appears to be standing aside and letting it’s proxies fight instead. Many commentators believe that Iran will not get directly involved as it is only just been able to start selling crude oil back into the global markets. This they believe is too valuable to Iran in order to be placed at risk.

Furthermore, Saudi Arabia has plenty of excess oil capacity and can easily fulfil any gaps in the market.

Thus, the market risk lies in a blockade of the Straits of Hormuz not the Israel/Palestine conflict itself.

For now, the main market impact has been in the US Bond market, as the US Treasury needs to issue billions more in bonds to fund support for both Ukraine and now Israel.

US Government Spending

Governments are essentially tax collectors and spenders, what they can’t raise from income, corporation and direct taxes they have to borrow.

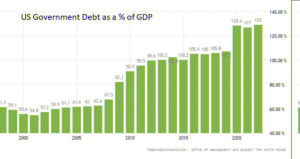

Joe Biden has been on a spending spree. His “Green New Deal”, actually formally titled The Inflation Reduction Act has pushed US Debt to GDP to record levels and will go higher still, even before the extra Israel funding.

The U.S. government has been borrowing a lot of money, $1 trillion last quarter alone and will continue to need much more, which it will have to obtain at higher rates, thanks to the Fed. If the US does fall into recession and the GDP part of the equation drops then this ratio will shoot higher.

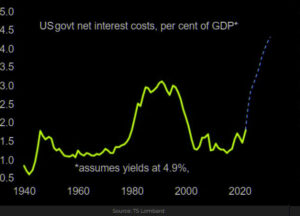

The cost of funding this debt will only get bigger as the second chart shows, with rates at 4.9% the met interest cost of the US Government’s mortgage rises significantly. For markets this means that the political pressure on the US Federal Reserve Bank to cut rates, which will already be high as 2024 is a Presidential Election year, will only get greater.

Markets

Markets seem to be reaching some sort of crescendo. Interest rates appear to have now peaked globally, helped by a panic sell-off in the US Treasury Bond markets. The US should be about to enter recession in the next few months, Europe is now definitely in one.

UK house prices are falling, which isn’t great for the UK economy, but UK consumers seem to have hoarded their Covid savings and now wages are increasing more than inflation.

Globally, we are slowly getting back to “normal” post the 2008 Credit Crunch and Covid. This is though the tricky final few minutes of the game where the match can be won or lost.

Inflation needs stay low, if it doesn’t then the Fed will have to raise rates further with possibly severe ramifications for the global economy.

Geopolitics is back making an impact. The events in Israel seem, as we write, to have been contained and fears of a wider Middle East conflict involving Iran have eased. Most experts believe Iran will remain on the sidelines but clearly there is a possibility that they won’t. In Ukraine, Winter is coming and the war seems to be at a stalemate.

With the US in debt, spending heavily and an election coming, maybe a ceasefire could be considered, with big implications for oil and gas prices. For now, markets remain in this unclear period of will the US and thus the global economy fall into the recession that the markets have been predicting since the Russian invasion of Ukraine.

History and economics tells us that it should and soon, if it does, then interest rates will have definitely peaked and markets will start to price in the first cut. This would be positive for markets.

As we said last month, for long term investors the “ducks continue to line up nicely”. Markets are just waiting for the bad economic news.

November 2023

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.