Click Here for Printable Version

The normally stormy month of October has passed relatively calmly, at least for the global equity markets. For the bond markets it was a much more difficult month, with Gilts falling by 4%. As ever, underlying the raw numbers there was lots going on.

Markets started to believe that the US and UK central banks are serious about reducing the flood of money into the global economy.

Also they think the pandemic has mainly passed (hopefully) and the global economy is returning to “normal”.

Demand for goods is reaching levels matching and some areas exceeding pre lock-down levels. This was not a normal recession, as we have said many times before, most recessions destroy wealth, houses and investment portfolios go down in value, this time the opposite was true and wages were subsidised by the government.

With Christmas and Thanksgiving coming, global retailers are desperate for stock and those economies that have fully reopened are booming.

This was confirmed in the US profit reporting season as company after company reported better than expected profits. Given this background, interest rates are just too low, they have to rise and QE needs to be dialled back.

Crucially, it needs to be done in a way that doesn’t spook the markets, which is what happened in 1987, or kill the growth, which is what they have been waiting for since 2009.

In the UK, Rishi Sunak announced a Budget that for a Conservative Chancellor was quite staggering.

UK Budget Taxes

Under Conservative governments the annual Budget statement is normally very predictable i.e. “small government” taking as little as possible out of the economy.

That usually means cuts in government spending, including benefits, to enable taxes to be reduced, this in theory stimulates growth, raises tax revenue and the government’s overdraft is thus reduced towards zero.

This time around Rishi Sunak sounded more like Labour’s Gordon Brown than a Conservative Chancellor.

In practice, he has raised revenue from Corporate Tax, National Insurance and Income Tax and spent it mainly on the NHS and benefits (Universal Credit).

This is risky as it takes hard cash out of the economy and gives it to areas that traditional absorb the cash rather than invest it and benefit from the multiplier effect.

There is a big difference between just spending tax money and investing it in projects that create jobs and stimulate growth. There is a danger that this Budget might end up doing more of the former and not enough of the latter.

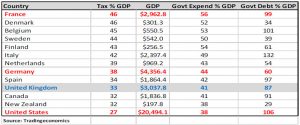

Much has been made in the media that the UK tax take as a percentage of GDP will rise by 2026 to a post WW11 high, as will Government Expenditure. The following table puts the present situation into context, please note, most, if not all of these countries, the USA included, will see a similar increase in taxes and government spending, so we would not expect the UK relative position to change significantly by 2026.

Clearly, the European economies do spend more and this is with health services (e.g. in France and Germany) that are only partly state funded. The Scandinavian economies, often used as shining examples of health and social care, do tax more and spend more.

So even with the current increases, the UK still taxes less than Europe and given that taxpayers in the USA have to pay for private healthcare insurance the UK’s numbers are actually, relatively speaking, not too bad.

UK Budget Housing Market

Clearly, there was some investment included in the overall spending, it is just that the markets would have been happier if the investment exceeded the expenditure.

Gilts fell in value as a result and UK inflation expectations rose. The consequences of such a strategy, if not executed perfectly, is that consumer spending gets crushed under the weight of taxation, inflation rises and thus so do interest rates.

As ever it is house prices and mortgage availability that will be the key determinants of future UK growth, the former have been growing nicely helped by banks that are happy to lend again.

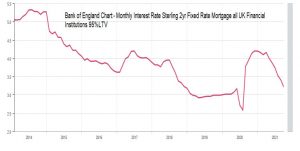

Crucially, mortgage rates do remain very low by historic standards.

Anecdotally, following the Budget, mortgage rates are starting to creep up but from a low level.

As this first chart shows the average 2 year Fixed Rate mortgage, 95% LTV, pre-Budget was around 3.25%, still remarkably cheap. As the second table shows house prices continue to move in the right direction.

The high rate of home moving triggered by the lockdowns and stamp duty holiday should naturally abate.

If we assume that most of these buyers took out a fixed rate mortgage deal, then at the very soonest it will be another 2 years or so before any increases in interest rates could have a significant impact on the housing market.

The Metaverse

Facebook the owner of WhatsApp, Instagram as well the dominant social media platform itself, has decided to change its name to Meta.

This marks a move away from the main Facebook app which is mired in political criticism at present. But what exactly is the Metaverse? Hard to explain but instead of looking at a picture of an item of clothing and wondering what you would look like wearing it, by entering into a Virtual Reality world (the Metaverse) you could try it on without leaving the comfort of your home.

Furthermore, rather than guessing which of the myriad of different versions of “medium” size would be accurate it would fit your uploaded dimensions.

You could in theory try on every item in the store(s) many times over before clicking to buy and having it delivered, maybe even the same day. A Zoom-style meeting could take place in a virtual boardroom and so on.

It all sounds a bit “Star Trek” but huge investment is being made into the Metaverse by all the big technology companies in both the USA and China.

It’s not that long ago that the internet was just a good idea.

Markets

Having survived October without too much damage, the global equity markets are now entering the usual Thanksgiving/Black Friday/Christmas period of seasonal strength.

But we are also entering a very complex area for markets. Of the three key market drivers Interest Rates, Inflation and Earnings it is only the latter that is likely to be going in the right direction.

The other two must rise and the markets do accept they need to “normalise”. The next few years should finally allow the global economy to put the disruption of the 2008/09 Credit Crunch “to bed”.

Markets will in the meantime fret about a possible Central Bank policy mistake just as the ECB did in 2008 and again in 2011. This may well explain the just announced, initial slow pace of tapering from the US Federal Reserve Bank and perhaps also the Bank of England rather awkwardly deciding to delay it’s well flagged increase in base rates.

What economists don’t know is whether this current inflation is just due to the reopening creaks and groans of the global supply system or whether it is something more permanent.

Maybe, there is also concern over the new Covid flare-up in China, they probably will lock-down again, thus disrupting supply chains further.

So whilst the new cycle is just getting going, it is unlikely to be a smooth one, there are just so many dislocations in the global economy and exceptional financial packages that will have to be removed.

However, given the sheer scale of the wall of cash in the hands of governments, companies, banks and consumers that will ultimately be spent, this is the best chance, for over ten years, for the western economies to return to normal operation i.e. without central bank support. November 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.