Click Here for Printable Version

Despite appearances to the contrary Boris Johnson has so far been very successful, he has got what he wanted. He has a revised and slightly better deal with the EU, he has purged his Parliamentary party of “Remainers” and now has achieved his main aim, a General Election.

But as we have said all along this has brought us to the single biggest risk of the whole Brexit saga, a possible Jeremy Corbyn premiership.

Meanwhile the global equity markets continue to ignore Brexit, for them it is all about the China/USA trade war.

They go up when there are positive developments and go down when Trump gets aggressive. With an Impeachment process underway and the Presidential Election getting closer, comments from both sides suggest that a deal could now be imminent.

The US and Global economy needs it.

Looking at US manufacturing in isolation this sector is heading into, if not already in, recession. Germany is firmly in recession as is strife torn Hong Kong.

One positive is that interest rates are coming down and QE is back, but the markets want and need a trade deal, they have been very patient.

In the meantime an even more important than usual US earnings season is underway.

US Company Profitability

We are 75% through a crucial earning seasons, before it started expectations had been lowered and we also knew that expectations for 2020 onwards were also ridiculously high.

There was a risk of disappointment and hefty downgrades. So far, with the majority of the high profile names having reported, the season has been okay.

Operating Profits which exclude write downs etc. are actually up on the last quarter, however, are down by just over 3% from 12 months ago.

Not good but not disastrous either.

Generally speaking manufacturing in the US is struggling from the trade war but the US consumer has started to spend again. This is enough to outweigh the negatives of the trade war.

At the sector level Energy (Oil companies such as Exxon, Chevron) saw a big decline as oil prices pulled back whilst Healthcare (Pfizer. Merck etc.) showed good profit growth.

The markets remain optimistic that a deal can be done and thus US corporate profitability will accelerate from here

US Quantitative Easing (QE)

Souce: Federal Reserve Bank of St, Louis

This chart effectively shows the balance sheet of the US Federal Reserve Bank. We highlighted in a previous newsletter the dramatic liquidity shortage in the US inter-bank markets as the largest US banks hoarded cash.

Chairman Powell stated that the Fed stands ready to provide funding for the overnight markets.

In practice this means that US QE has been restarted through a “back door”.

This is significant as with the small reduction in US interest rates the Fed has returned to an accommodative monetary stance, at a time when the economy, according to historic stats, is still growing nicely.

What do they know or have they just poured gasoline onto a smoking fire?

General Election 2019

In 2017 Theresa May gambled on a snap election aiming to increase her majority.

She did it based upon a hugely successful Local Council election where the Tories trounced Labour. Her gamble failed, partly because her advisers had given her a very poor and weak manifesto whilst Labour offered treats from the “magic money tree”.

But more importantly Brexit had a major impact, she lost traditional Tory seats in Remain focused London and the South East whilst picking up traditional Labour working class seats in the North to Brexit supporters.

So whilst it is still very early days in this campaign we have to wonder whether this pattern will repeat itself or has something changed?

What has changed is a resurgent Liberal Party with an unequivocal No Brexit manifesto.

Labour with its eye on the working class seats of the North has to have its “maybe in, maybe out” strategy. Given the potential hit to their personal wealth from a Corbyn government it is possible that these new South East Labour seats might now go to the Liberals?

That is going to make the election arithmetic very difficult indeed.

Scotland is another area which makes forecasting very difficult, 2017 was relatively poor for the SNP and the Conservatives did well, but that was under Ruth Davidson who has now gone. Many assume that this election is Boris’s to lose, but it wasn’t Labour that granted Boris his election wish, it was the Liberals and the SNP.

Perhaps it was because they scent seats and thus power and influence?

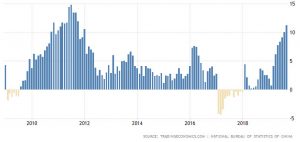

Chinese Food Inflation

Surging pork prices have pushed China’s food inflation to a near six-year high.

It is easy to forget that Chinese consumers remainvery poor by western standards (though rapidly improving) and food costs are the dominant element of consumer spending.

This is impacting the effort to stimulate growth, but could also be an incentive to buy more agricultural goods from the U.S.? The main factor was surging pork prices, up 69% from the prior year.

Outbreaks of African swine fever, a virus that is fatal to pigs has severely hurt output in China, the world’s largest pork producer and consumer. What makes this important for markets is that China now needs US agricultural products more than ever and thus makes a US trade deal more probable.

“Super” Mario

The dull world of Central Banking saw one “superstar” leave and another take office.

Mario Draghi has retired as head of the European Central Bank and French national Christine Lagarde has taken office.

Hers was a political appointment as European leaders sought not to have an austerity minded German in the role.

Lagarde’s CV is impeccable but unusual. She is not an economist, has not worked for Goldman Sachs (normally a prerequisite for a Central Banker) but successfully led the International Monetary Fund for many years.

She is a political animal and that is exactly what Europe is going to need in a post Brexit world (assuming the UK actually does leave at some point).

The ECB has already gone “all-in” with restarting QE and negative interest rates, it has little else it can do. Europe needs fiscal stimulus and a restructuring of the whole banking system, probably by a Banking Union.

As head of the ECB she will have to use all her political skills to achieve this, it has often been promised but never delivered.

Markets

November brings Thanksgiving in the USA, Black Friday shopping now virtually everywhere and the uniquely Chinese, Singles Day on November the 11th.

What this means is that in one month the spending power of global consumer will be tested.

But for recession watchers the focus remains on a possible US/China trade deal.

The “mood music” from both sides seems to imply that a “Phase 1” deal is close. Rumours suggest that Huawei will be allowed to buy US components again and China, as we have seen above, will commit to buying US Agricultural goods.

The US mid-west states are struggling and farmers are crucial swing voters in the USA. Commentators are split on whether US tariffs will be rolled back or reduced and the suggestion is that the big issue of intellectual property theft might be pushed into a “Phase 2” deal.

For the global equity markets hopes are high, but then again we have been here before and Trump is not predictable, especially now with the Impeachment process underway. So we do need to be watchful that this does not all go horribly wrong.

Fundamentally, at present the equity markets seem to be in a better place than the bond markets were predicting.

Earnings aren’t good, are way behind where they should be at this stage of the cycle, but are not collapsing.

Valuations are stretched but not immensely so and Central Banks are supportive. Interest rates around the world are coming down and QE is being restarted, this brings out a Pavlovian buying response from equity traders.

So as we enter positive seasonality for equity markets all seems fine, but this is predicated on a trade deal.

This is now a true binary market, if a good deal is signed, the uptrend should continue, bond yields will have to rise and so would interest rates.

No trade deal and Central Banks will have to keep riding to the market’s rescue and in the case of the ECB with nearly empty guns!

November 2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.