Click Here for Printable Version

From the market’s perspective one of the most difficult and complex years since the Credit Crunch is now drawing to a close. We are starting to see some improvement in at least two of the three big issues facing equity and bond investors. The US Federal Reserve Bank is now signalling that it will reduce the magnitude of future interest rates hikes.

Markets now see them peaking at between 4.5% to 5.0%, so no more than another 1.0% from here. This news sent the US dollar into reverse and indices globally have started to pick up. Markets can now see an end to this dramatic and record breaking monetary tightening.

At the same time the newly reappointed leadership in China was forced to respond to widespread public unrest following the imposition of new lockdowns.

This “reopening” of China could restore disrupted component supply lines and reduce western inflationary pressures. Unfortunately, the war in Ukraine is ongoing and still has the potential to disrupt the European power markets.

Winter is arriving across Europe and the drawdown of gas reserves will be closely monitored. In the UK Rishi Sunak’s premiership faced its first major market test with his Chancellor’s “sensible Budget”. This was very much a return to the austerity style of Cameron and Osbourne, good for the Gilt market and thus interest rates, but not much else.

There was no attempt to stimulate growth just a “kick the can down the road” of future revenue increases. Jeremy Hunt joined the Bank of England in forecasting a recession for the UK.

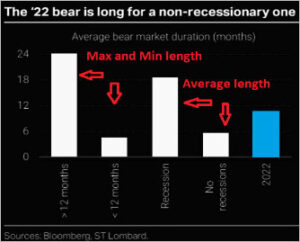

Markets have been forecasting a global recession all year.

What is confusing, both in the UK and globally is that recessions are normally caused by rising interest rates leading to a collapse in company profits thus redundancies, rising unemployment, defaults on loans and mortgages and thus “froth” is squeezed out of an economy, inflation comes down and the cycle starts again.

But what happens if companies choose to ride out the slowdown, not wanting to loose precious staff, as they are already running as lean as they can post Covid?

Can there be a proper recession without rising unemployment? Markets also still worry about possible unintended consequences from the dramatic tightening of US Monetary Policy but so far, bar some declines in property prices there remains no evidence that a recession is imminent in the US, that doesn’t mean it won’t come. For now it remains a guessing game.

Recessions and Bear Markets

Housing

On both sides of the Atlantic the most concerning signs are falls in house price indices. The two key factors that dictate UK economic activity are the pound and the housing market. It must be noted that the UK is just coming out of a post Covid boom in house prices and a generational shift from London with “work from home”.

A cooling is necessary and must be expected, but crucially no commentator is forecasting a significant collapse and thus a rise in mortgage delinquencies.

The Bank of England needs to bring inflation down and its main weapon to achieve this is interest rates. The consequence of using this tool is that house price affordability falls. That is as long as wages don’t at least keep up with mortgage payments, so the key factor is in fact not mortgage rates, but the difference between actual monthly mortgage costs and wages/disposable income.

Work-from-home does seem to increase disposable income and is thus cushioning some of the impact of higher energy, mortgage costs etc. The other factor in play is the widespread use of fixed rate mortgages, which is very different to previous house price crashes.

In the UK, roughly a third of homes are owned outright, another third are on at least a two year fixed rate mortgage and the balance on either variable/tracker/nearly at the end of a fix. So for the majority of consumers there won’t be a mortgage squeeze.

But it won’t take much of reduction in activity for house sales to be completed at below asking price and thus the various house price indices to fall. 10% below asking price seems a normal reasonable discount and thus an index fall of around this level, in practice, means very little.

The changes in Capital Gains Tax allowance and rate is also disrupting the property market, with allegedly tenant eviction notices already rising sharply as investors seek to sell before the new changes kick in.

The risk overall is that there is not a big enough squeeze to bring inflation down and thus the Bank of England has to go higher and for longer with increased interest rates.

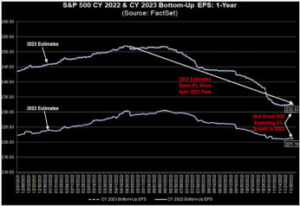

US Corporate Earnings

China

China seems to be slowly and carefully reopening from Covid lockdown, this potentially is good news.

However, it is just part of what is proving to be a difficult period for China and it’s movement from a centrally planned agrarian economy to a capitalist industrial one. Politically, for the first time since it emerged from Mao’s Communism, it is taking a step back.

President Xi has been appointed for a third term of office, whereas the rules say two is the maximum.

He has also purged the Politburo of the pro-capitalist members and filled it with his supporters. He initially reiterated the Covid Zero policy, but seems now to have backtracked following widespread protests in China. This easing of restrictions comes just as new China Covid cases are hitting all-time highs, given the lack of immunisations this is risky.

Western hopes of a deflationary flood of new components from China are dependent on this new strategy working.

Markets

As 2022 draws to a close, markets have recently taken heart from indications that inflation has or is about to peak.

Meanwhile, central banks are indicating that they are close to stopping monetary policy tightening and now China is starting to reopen.

Oil prices remain subdued and Europe has plenty of gas. All positives, yet for now, inflation remains front and centre of market concerns.

If it doesn’t come down as quickly as indicated, then these positives will be delayed. There does remain the nagging fear of unintended consequences from this record breaking tightening cycle.

However, markets do “climb walls of fear and worry” and we are a long way through this market decline. Many commentators would be happier if there were to be one last “lurch down” in equity prices, then again, markets rarely give traders what they want.

China remains important for markets, this reopening could be very significant for the global economy, though if it falters it is also hard to see without mass adoption of western vaccines where China goes next?

President Xi may also not like his newly enhanced authority challenged. The war in Ukraine is grinding on and unless there is a prolonged freeze across Europe gas and oil markets seem to be stable.

Indeed, gas prices are holding at current lower levels, thus limiting the ultimate cost of Sunak/Hunt’s energy subsidies. As we enter the year end period traditionally the Santa rally arrives for share prices, this usually starts on the Monday after Options and Futures Expiry, which is on Friday the 16th December, just after the Fed meeting where it is expected they will raise rates by 0.5%.

Lets hope Chairman Powell doesn’t ruin Christmas for the markets!

December 2022

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.