Click Here for Printable Version

As the US Thanksgiving weekend passes markets enter what is normally a reasonably predictable year end pattern. A post-US holiday hangover for the markets until the Futures and Options Expiry day in December and then the usual Santa Claus rally pushes equity markets higher, right up into the New Year.

However, markets had put Covid-19 to the back of their minds, which as we have said before is risky. News of the Omicron variant with some significant changes broke just as the US markets were partially closed on Black Friday.

The trading computers took over and now the markets have forgotten the economic boom, inflation and interest rates and are back on full “Covid-watch”.

The virus news flow will dominate the markets until it is clear just how dangerous (or not) this new variant actually is.

For the Delta variant this took about two weeks or so before the vaccines were proven to work.

It must be noted that there are some commentators that are suggesting that the Omicron variant could be the mutation we have all been waiting for, i.e. the one that transforms Covid-19 from a killer to just another flu.

Clearly, if the latter does come to pass then the dynamics for the global markets will change significantly.

However, if the opposite is true then governments will revert to their prior strategies. For the US and UK, it’s primarily vaccination based, whereas in Europe, with distinct areas with very low inoculation rates we have already seen more draconian measures introduced and China will lock down.

Economically, even if new Mark 2 vaccines take around 3 months to develop, it doesn’t actually change the long term investment picture, it just delays it and could give the Central Banks a little bit longer to work out just how strong the global economy actually is.

It’s all about Demand

There is still a perception in bond markets that the global economy is currently just experiencing a return to pre-Covid levels of production and that the supply issues are just the coughs and splutters of a network that is re-starting after period of enforced slumber.

Inflation will thus return to the low levels of the last 10 years and the global economy will continue along just as before.

This is of course a possibility but is it probable? Under the laws of economics the huge money printing and government spending programmes that Covid precipitated, has to stimulate both growth and inflation and thus if economic theory is right (not always) then surely this is the more probable outcome?

We need to test both possibilities by looking at the data. It is still early days and the virus has not gone away, however, what data we do have is pretty compelling.

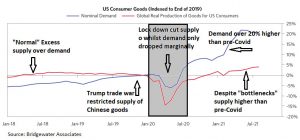

If we look first at demand for US consumer goods and global supply of goods:-

The blue line shows US consumer demand and the red global supply. What this shows is that the US consumer is back spending and in a big way.

Demand for goods is running 20% plus above pre Covid levels and only dipped by c5% during the lock down.

Clearly, some of this will be the spending of US furlough cheques but it is also a clear sign that the pent-up consumer spending is being unleashed.

This appears to be more than a Covid catch up, it appears to be a significant change in behaviour stimulated by the huge wealth creation that occurred under the lock-downs.

Ultimately, there must be a pull back from these high levels as many of the purchases will be a one off e.g. car, computer, etc. But what about the Services sectors many of which are still suffering under restrictions?

The Services (hospitality, airlines, retail etc.) demand remains about 10% below pre-Covid levels.

Clearly, whilst this is improving any new lock-downs will impact on this recovery. But the gap highlights that should the virus go away or global governments finally get their vaccination act together, then there is plenty of growth still to come.

This would underpin whole sections of the global equity indices that are still lagging. It does raise the issue of where the staff are going to come from?

As we have written before all western economies have an inverse population pyramid (more old than young) and many have just retired. Staff shortages will be major impediment to growth

Oil Companies and Carbon Emissions

The giant US oil company Exxon recently announced its results, but it wasn’t the profits that stimulated the ensuing share price move but the announcement that it will exceed its own 2025 carbon emission reduction plans by 20%. Whilst some may wish that the oil companies would just go away, in practice they can’t.

Petrol and diesel are almost waste products from crude oil refining, waxes, greases, gasses, plastics are just some of the many essential products that need crude oil and gas.

Hydrogen, seen by many as the future fuel for trucks, as well as replacing natural gas in homes, can either be made from water (Green hydrogen) or from natural gas (Blue Hydrogen). Blue is of course easier and cheaper, it can also be made with very low emissions through capturing the carbon and storing it underground. What this means for investors is that the big oil companies are not only part of the problem but also part of the solution.

The likes of Shell and ENI are some of the biggest global investors in renewable energy. What the response to the Exxon announcement shows to markets is that it is ok to produce some oil and gas (they are necessary evils) as long as it is done in the right way.

Any company that does so in as “clean” a way as possible will find support, not just from traditional investors but from the rapidly growing Environmental Social and Governance (ESG) equity and bond funds as well.

As ever, it will not be the western oil companies that will be the problem, the likes of Rosneft of Russia, Sinopec of China and Saudi Aramco will need to follow this trend. They are making noises that they will.

Markets

Global equity markets are now in what is normally the strongest part of the year, however, the traditional year-end rally has been put under threat by the arrival of the new Covid-19 variant, Omicron.

As we write it is just not clear whether this new strain is more virulent than the Delta variant or is it just more of the same. Will the current vaccines continue to work or could this actually be the long awaited mutation into just another flu?

Markets for now just don’t know. It took around 14 days for the fears over the then more transmissible Delta variant to subside and in all probability the same could happen now.

Whilst this “discovery period” takes place it is reasonable that markets will start to price-in the worst case scenario.

Should it prove that vaccines will continue to work and it is no more or (hopefully less) deadly, then the Santa Claus rally will come early. Markets will then go back to focusing on profit growth and fretting about inflation, interest rates and the tapering of QE. This is back to being a binary market i.e. it can go one way or the other depending on the news about Omicron.

Intriguingly, the usual starting point for the end of year rally is the December Equity Futures and Options Expiry day, this is where many complex derivative trades are closed down for year and profits or losses booked.

This year it will be on Friday the 17th December, just two days after a crucial Federal Reserve Bank meeting where QE tapering will commence. This should be around the same time we will know the full nature of the Omicron variant, will hospitals be full or hopefully quieter? Let’s hope we all have an early Christmas present and it is the latter.

December 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.