Click Here for Printable Version

November saw global equity markets respond to some very positive news, this was despite the continued development of the pandemic. There were two main catalysts, firstly the US Presidential Election passed (for markets) with what might ultimately be a satisfactory result. Secondly and importantly, we got a series of very positive vaccine announcements. The Federal Drug Administration of the USA had set a bar of 50% efficacy for any possible Covid-19 vaccine to gain emergency approval.

What we seem to have is two candidates from Pfizer and Moderna with rates over 90% and an Astra Zeneca vaccine at 61% at one dose and over 90% with another dose.

For the markets what this does is, hopefully, mark the beginning of the end for the present pandemic.

We always have to remember that share prices are valued on what will be happening to next year’s company profits, this years have already been priced in, so share prices can now be valued based on a world where this virus should be finally under control.

Thus, a Biden Presidency, several possible vaccines, low interest rates, QE and a probable stimulus package all combined together to boost global share prices.

Vaccines

The global economy was tipped into recession by the virus pandemic.

Some countries have been more successful than others at controlling the spread and restricting second waves.

Many governments in Europe, as well as the UK, have handed control of the economy to the health departments, with for many, no immediate sign of when this control will return to Treasury offices.

This is why vaccines are so significant, they put a potential end date for the virus into the market’s pricing process.

There are a total of 16 known candidates in development, 12 in the West, 3 in China and 1 in Russia.

The Chinese and Russian candidates are already in limited use, one from Pfizer has just got UK authorisation, others will follow. The markets have responded to this drip feed of positive news, though the Astra Zeneca candidate has received some negative opinions.

This is unfortunate as at present this is the most practical candidate.

It is cheaper to make and easier to transport and store. Governments are just starting to realise the enormous complexities of moving billions of vaccine doses around the world, especially with so few planes flying!

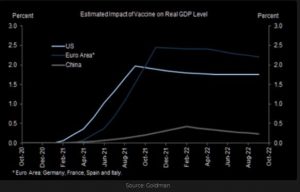

This chart from economists at Goldman Sachs shows the impact the vaccine could have on global GDP growth.

On its own a vaccine(s) could add 2% to US growth next year and more for the heavily virus impacted European economies.

In China the impact is less, but then the initial impact of Covid-19 was more rigorously controlled and thus the vaccine benefit is much smaller.

In the UK stock market we have seen share prices of the most heavily impacted companies such as Carnival Cruises, TUI and the airlines bounce strongly, however, for the decimated retail industry these vaccines in the UK at least might be arriving just a bit too late?

Arcadia/Debenhams

The news of the collapse of Top shop owner Arcadia and also that of Debenhams shouldn’t have been a surprise.

Both companies had failed to invest in their ecommerce proposition and their brands and had very weak balance sheets. Businesses and retail in particular, are in constant evolution with fashion trends coming and going and both companies propositions were out of fashion.

The pandemic has clearly had an impact but it didn’t destroy these businesses it merely accelerated the inevitable. Environmental reasons are restricting cars (and thus consumers) from cities and high streets whilst rising rents and business rates are inflating costs.

Retailers are therefore being forced to move to out of town “sheds” and onto the internet. Any retailer that has failed to spot this trend will struggle. Luxury, sportswear, fast delivery and returns and competitive pricing are the key to fashion retail success in the current environment.

The pandemic has meant that seven years of trend change has occurred in seven months, when it does pass consumers are unlikely to significantly change their new habits.

High value goods and speciality retail will need some sort of outlet that acts as a “destination” but low value, volume retail will leave the city centre possibly for good.

Department store buildings such as Debenhams might become hosts for a range of small specialist independent retailers?

Where this leaves the likes of John Lewis and Marks & Spencer is hard to say.

Their food retail operations are doing well but both have been slow to properly embrace online services.

Retail is important, it employs some 900,000 people in the UK with some reports suggesting around 25% of these jobs (mainly low paid) are at risk. Estimates are there has been a £10billion total hit to revenue this year.

The industry is at an inflection point, the lock downs have now accelerated a process that was already underway.

History tells us that disruption does forge new growth and it will be fascinating to see how the industry evolves over the next few years.

In the very short term many companies are going to have to be very nimble over the truncated Christmas trading period if they are not going to join Arcadia and Debenhams.

Thanksgiving

An immediate concern for markets is an uptick in new virus infections in the United States.

This was already rising before the traditional Thanksgiving holiday and with few restrictions in place at the State level and the present incumbent of the White House unlikely to force a national lock down, the US is risking a significant increase in new Covid-19 infections.

We should know by the middle of month just how bad this will be. If it is not that bad, it may inspire the UK leadership to relax the current tiers in time for Christmas?

US Presidency

Whilst we will not definitely know that Joe Biden will be the next President of the United States of America until the Electoral College meets and votes this month, the markets (and virtually everyone else) are working on the basis that he will be.

Whilst the markets have assumed that Joe Biden will be more predictable than Donald Trump there is a fear that he might seek to accommodate the vociferous left-wing of the Democratic Party.

However, analysis of voting patterns does seem to suggest that this section of the party did cost some Senators and Congressmen their seats.

The consequences of this can be seen in Biden’s Cabinet appointees which so far have been from the more traditional Democratic wing, whether this continues remains to be seen.

For markets this has particular implications for Tech and Bank regulation. Of particular note though has been the appointment of former Chair of the Federal Reserve Bank, Janet Yellen as Treasury Secretary (US Chancellor of Exchequer) a move that was widely applauded by the markets.

She was a very successful Fed Chair and is a supporter of Fiscal Stimulus.

This is a hugely confidence inspiring move. However, early indications from the Biden camp on trade do not point to an immediate change in stance on China, also the EU’s imposition of new tariffs on US goods looks to be particularly poorly timed.

Markets

There is a normal pattern to stock market action in December, once Thanksgiving has passed, prices tend to pull back ahead of year end Options and Futures Expiry.

This year Expiry occurs on Friday the 18th December. Once this is out of the way, transaction volumes tend to drop off as the holiday season starts and the Santa Claus rally into the year end begins.

Given the magnitude of the post Presidential Election and vaccine based rally, prices are likely to be vulnerable in the short term.

Trump is still in power until January and he could, if he so wishes, apply new trade sanctions.

We also need to keep an eye on the vaccine news, especially the cheaper and easier to transport Astra Zeneca candidate. If the new clinical trials are successful then markets may well react positively.

For the UK markets and the pound we are still awaiting the agreement of a UK/EU Trade deal.

As we write we are at the first significant deadline, but not necessarily the last.

Indeed it could be argued it may suit both sides for the UK to move onto World Trade Organisation terms from the 1st January and then negotiate with each issue on a piecemeal basis.

Our view all along has been that leaving the EU for the UK economy isn’t that good but then again is not that bad either.

Most would expect the pound to be weak if the trade talks fail for now and that tends to be good for the FTSE100.

December 2020

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.