Click Here for Printable Version

Last month the Federal Reserve Bank (the US central bank) indicated that as long as inflation continues its current downward trajectory, then it is prepared to halt the record breaking increase in interest rates.

The problem since then is that inflation and other economic data have been very mixed. US Core PCE Inflation (the number the Fed uses) crept up to 4.7% from 4.6%, not what was wanted.

Helpfully, for the markets, US unemployment did go up, but at the same time the US economy is still generating very high numbers of new jobs.

A delve deeper into the employment stats shows that record number of jobs are being created in Heavy and Civil Engineering Construction as Joe Biden’s “Green New Deal” money starts to get spent.

Good news for the US economy, not so good for the markets.

A casual observer would look at the equity indices and believe that all is fine, however, the latest mania has arrived, Artificial Intelligence. This has boosted the big technology stocks back to “Tech Bubble” valuations, but the rest of the markets including bonds, non-tech equities, commodities, property even gold have been weak.

But, then again this is what normally happens towards the end of an interest rate increasing cycle.

It is currently far more complicated than usual, but we are getting closer to the end of this difficult period. The AI mania is masking the beginning of the Summer doldrums for markets. Big questions remain about the direction of inflation and whether the Fed goes further? They haven’t officially paused yet and may not do so, the Cleveland Federal Reserve Bank issues a Nowcast which shows the actual US Inflation rate as of now. This is indicating an annualised rate of 4.56%. With US Interest rates at 5.25% is that enough of a squeeze to bring inflation down, especially if the Green New Deal is boosting the economy at the same time?

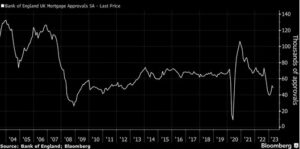

UK Mortgage Approvals

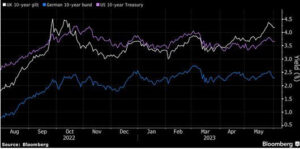

Market Interest Rates

The most recent UK inflation number touched 8.7% and crucially was worse than the market expected.

This caused Gilt prices to fall again (now down 15% over the past 12 months) which in turn caused many already nervous mortgage providers to pull fixed rate products from the market.

As this first chart shows UK mortgage approvals have fallen to very low levels.

In fact they are not far off the lows touched during the Credit Crunch of 2008/09. The Bank of England started raising interest rates from the pandemic low of 0.1% at the end of 2021, now 18 months later, expectations are they will stop at 5.5%, roughly in-line with the US interest rate.

The impact that such moves have was reflected in the Nationwide House Price Index which peaked last August.

We have also had the Gilt crisis which was sparked by the Liz Truss/Kwasi Kwarteng Budget.

As the second chart shows, market interest rates, as represented by the three main global sovereign 10 year bonds, have shot up, with Gilts showing the biggest percentage increase.

The penny has dropped, investors realised that central banks were serious about raising rates and that inflation wasn’t just going to fade away. The sheer speed of that Gilt spike effectively shut the UK housing market for a brief period as worried lenders pulled mortgage deals.

Remember, the interest rate on a mortgage deal depends more on market expectations for borrowing costs than it does on the Base Rate.

Unsurprisingly, the mortgage market freeze meant that the number of mortgage approvals collapsed. The number hit rock bottom in January, then began to recover, with a solid bounce in March. The recent poor UK inflation has though caused this bounce to come to a (hopefully) temporary end.

UK Inflation

In April, UK inflation (as measured by the Consumer Price Index) was an annual rate of 8.7%. This was a big fall from March’s 10.1% but was still a lot higher than expected and resulted in the markets revising their expectations for UK interest rates.

This inevitably led to usual UK media doom-mongering. However, as investment bank, Panmure Gordon states, of the 12 biggest categories in the UK CPI calculation “the one that has been doing the most damage in terms of UK price changes diverging from the US and the Eurozone, is the housing, water, electricity and fuel part”.

Thus, by far the biggest contributor to UK inflation is energy bills. “Since January 2020, this has risen by 114%, compared to 60% for the Eurozone and just 32% for the US.

Another surprising statistic from comparisons of food price inflation between countries is there is no significant gap between the UK and the rest in terms of how rapidly food and beverage prices have risen”. Crucially, UK Energy prices are due to fall by 17% in July, as the new energy cap comes into force.

With possibly another drop due in October. However, this good inflation news and thus also positive for mortgages, won’t come until the August CPI data release. So the big picture is that we are still in the messy stage of waiting for the data to get better and reflect the increasingly difficult economic conditions. It is coming, just as the markets are predicting, just not yet.

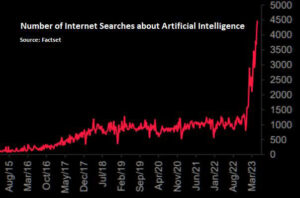

Artificial Intelligence (A.I.)

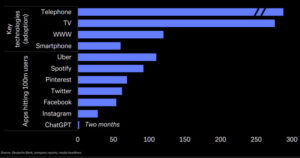

It took Facebook over 4 years to reach 100m users, ChatGPT has done it in two months.

Internet searches about A.I. have exploded as well. This all occurred following the release of the latest Chat GPT software from private company OpenAI. This software was so much better than expected it has sparked an “arms race” between the main search engine providers Microsoft and Alphabet (Google) with the likes of Meta (Facebook) and Apple declaring their AI credentials as well. Hardware providers such as Nvidia are able to sell AI specific servers at 10 fold the price they were pre ChatGPT.

Stock markets love a good mania, the advantage is that during such events normal valuations are impossible to place on the companies involved, so traders can simply “jump on board” and enjoy what is often a very volatile ride.

History tells us though, that the first companies involved are rarely the long term winners e.g. Acorn, Lotus 123, AOL, Compuserve, Nokia, Motorola, Palm, Myspace, Friends Reunited and so on.

The difference this time is that A.I. is word based not numbers and that means that it can do many of the service based tasks that replaced traditional factory labour.

Where this will end is pure conjecture, but as history again tells us, it won’t be the direction that is first thought! Remember BBC’s Tomorrows World predicting the end of paper in an office?

Markets

The rise of A.I. has masked general bond and equity weakness that has followed the lack of progress on inflation.

Inflation is coming down as economic activity is declining, just not as fast as hoped. Germany is in recession, it thus normally follows the rest of the EU and the UK follows suit. The interest rate pain should be working by now, there is a risk that the Central Banks don’t have enough patience.

But then again, the politicians don’t want to see all of the benefits of their massive “Green Stimulus programmes” counterbalanced by a severe recession.

This is the delicate and always tricky final stage of the market cycle, where traders and investors are not at all clear on the immediate outlook and there is little consensus.

Some feel another leg down is required to reflect persistently higher inflation, whilst others feel that the work has been done. What we can say is that interest rates are back to “normal”, the inflationary catalysts of the war in Ukraine, sanctions on Russian oil and gas, the China lockdown creating component shortages, all have either passed or are likely to.

Even the Saudis cutting production cannot get oil off its lows, where is the future inflation coming from?

As the UK CPI numbers show, a lot is technical and the numbers are all due to drop.

In the meantime, we are seeing damage done in US banking and there is the unfolding collapse of US Commercial Real Estate.

In the UK, mortgage providers are on strike. It all sounds bad, but, we mustn’t forget the markets have predicted this and priced accordingly. It is always dangerous to try and finesse the last few months of a drawdown cycle.

Is it just possible that A.I. has caused it to pass already? Nobody knows, it is all guesswork, but the Portfolio Roadmap suggests that roughly around now, markets should have fully discounted all the bad news and will at some stage start to progress back higher again.

There remain many individual markets and sectors still down 20% or so, on their pre-Ukraine war levels.

June 2023

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.