Click Here for Printable Version

There was always the risk that Trump would “walk away” from a trade deal with China, one that we have been highlighting for many months.

The markets still believe that ultimately a deal will be done, especially as the US Presidential election is due, but some doubts are starting to creep in. The longer Trump stays away from the table then these doubts will grow in magnitude.

The other problem the markets have is that US and thus global recession indicators continue to flash danger signals.

These two issues are in essence just one, the US economy is slowing due to the introduction of tariffs.

Chinese suppliers have simply added the extra cost to their wholesale prices and this has been passed directly onto US consumers by the retailers.

They have no choice, China has a monopoly of supply for high volume,low price consumer goods. Consumers are responding by simply not buying.

Trump gloats about the billions of dollars being raised,however, tariff receipts are indeed high but much lower than expected, indicating that the US consumer has gone back on strike.

There is a G20 summit due at the end of June and Presidents Xi and Trump are still expected to meet, markets may well test Trump’s resolve ahead of this event.

Trump’s Trade Tariffs

Rationally an agreed trade deal should be the expected outcome, but both parties need a reason to blink.

So far neither has any need to do so, but it will come.

Trump has the moral high ground and China needs the US more than the US needs China. However, Xi is not elected in the western sense, Trump is and is now facing an imminent Presidential campaign. However, the actual vote will not take place until November next year, which means that in theory this game of “chicken” could go on for many months yet, unless of course Trump or Xi experiences domestic economic pressure.

Trump claims that tariffs are a “beautiful thing” however in economic terms they are simply a tax on the consumer. Suppliers don’t pay the tax, the importer does and passes it onto the retailer.

Walmart as an example has simply added the duty onto the ticket price.

But consumers aren’t stupid,why would they pay a higher price when it is probably temporary?

So they have responded by not buying,some reports suggest that sales of duty impacted consumer goods are down by 50%. Oxford Economics have modeled all the various impacts of tariffs and in this chart suggest that in percentage terms the impact is small, with 0.3% off Global Growth.

This research is a double edged sword,Trump and his team might see that the impact is suggested to be small and will keep the pressure on. However, some indicators suggest that this research might be too optimistic?

We have reported for some time that the US Yield Curve (the difference between 2 year fixed rate of interest and the 10 year one) is very close to inverting, this is historically very accurate at predicting a US recession within the next 2 years.

Most other economic indicators are suggesting a slowdown but not as yet a recession.

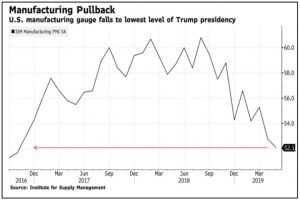

This month the US ISM manufacturing gauge dropped to 52.1. Below 50 suggests recession, so we are not there yet, but are getting close.

Currently,the 2 year Treasury Bond yields 1.8% whilst the 10 year is at 2.1%. Again,not quite there yet, but it wouldn’t take much to move the 10 year rate lower. Markets are now pricing in a Federal Reserve Bank cut in interest rates as early as July. This would make the current rate increase cycle one of the shortest on record. Maybe tariffs aren’t quite so beautiful after all?

UK Elections

In the UK,politics continues to dominate the headlines with the resignation of Theresa May.

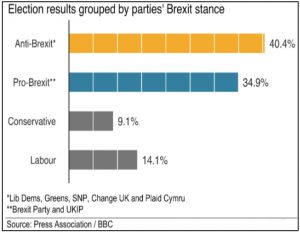

The implications of the Local Council and European Parliamentary election are hard to decipher.

We have to be careful of over analysing any underlying message from these votes, as Theresa May found to her cost after calling a snap General Election following a strong Local Council performance.

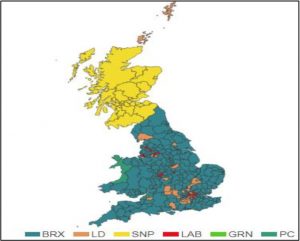

If we look at the map of the UK on a Euro constituency basis, being Pro-Brexit would appear to be a General Election winner.

Corbyn knows this which is why he is fighting against a second referendum as party policy.

If another referendum were to take place then it is still unclear what the result would be.

Both sides claimed victory after the recent votes, but without any clear statistical justification,as some Labour and Conservative voters are Pro Brexit and some Anti.

Much depends on who wins the Conservative leadership vote. One scenario is for a new Pro-Brexit leader presenting a No Deal manifesto and calling a snap election in the hope of getting enough Parliamentary seats to push a No Deal exit through.

For the Remainers the best hope, at present,would seem to be to keep pushing for a second referendum, a “softer” Tory leader might well use this as an option.

European Leadership

There are presidential appointments due in Europe as well, whilst the replacement for Juncker will get the most attention it is the success or of “super” Mario Draghi as President of the European Central Bank that will have the greatest significance for global markets.

There are French and German candidates for both positions and the current etiquette is that no country can hold more than one of the five European Presidencies (Commission, Council, ECB, Parliament, Eurogroup).

Thus, if say Barnier gets the vote ahead of Weber for the Commission Presidency it increases the likelihood of Bundesbank Chief Jens Weidman taking over the role at the ECB.

The markets won’t like that, he is “old school” and will focus on inflation and will not be naturally inclined to support markets or indeed banks.

Markets

Markets are hostage to Trump and his trade wars. They are clearly, despite his protestations,having an impact on consumers and thus US corporate earnings.

The markets are still though assuming that this will be temporary, but what if it isn’t? Then we will have to believe that a recession will come early. Logically,with the Presidential Election due,a deal will ultimately be done and markets will hope that the scheduled meeting between Presidents Xi and Trump at the G20 summit at the end of this month will prove to be the trigger for meaningful progress.

But if nothing comes out of this meeting markets will be disappointed and will have to re-price. The markets also know that Trump does measure his success via a healthy and rising stock market. It is possible that “players”could seek to influence events by forcing prices down. All eyes will be on the G20 meeting in Osaka, Japan on the 28thand 29thof this month.

June2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.