Last month we talked about the concept of the “Black Swan” and the impact this can have on markets. Well we have now had a whole flock of swans flying over us. The terrible earthquake and ensuing tsunami in Japan, plus the alarming spectre of multiple nuclear meltdowns sending a cloud of radiation across the engine room of global growth in the Far East. This was followed by military action in Libya. Global markets were initially spooked by these events, but as the worst fears receded their mercenary instincts took over again. They calculated that the impact on growth would be limited and perhaps there was a silver lining to these clouds as Japan’s reconstruction would add another leg to what appears to be a solid period of recovery.

We still have issues. Bahrain looks to be a mess and the Saudi day of rage was “calmed” with 10,000 riot police and soldiers. This a dangerous strategy as the problem has not gone away and is trouble stored up for later. China is also now fully aware of the democratic pressures; their solution is to try and make people richer in the hope that they will be so satisfied that they won’t want to rock the boat and the Party Congress made noises to this effect. Overall the democratic revolution appears to have slowed down, but it has not gone away. Col Gaddafi has shown despots the way to deal with protests and Tunisia; Egypt et al need to show the rest of the non-democratic world that it was all really worth the effort.

Japan

Japan has produced below average growth for over a decade now despite waves of Quantative Easing which has left the country even more indebted than the UK. Their problem is one of demographics, not enough young people to keep the economy growing and too many old people that do not need to spend. With a net reduction in consumers Japan simply cannot grow. A great manufacturing economy with great manufacturing companies but eventually those companies will expand manufacturing in the cheapest place they can find such as the UK or China and closer to the global consumer, not at home, a lesson perhaps for Germany?

A stagnant consumer economy is a problem that we now have in the UK and to a lesser extent in the USA as well. The next leg up in the recovery needs the consumer to start spending again. We have talked in previous newsletters that this is dependent on house prices and unemployment coming down. We have just had a Budget for Growth, what help did George Osborne bring the consumer? Not a lot, other than a marginal reduction in fuel prices.

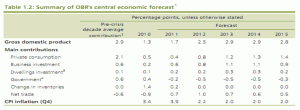

UK Budget

But crucially consumer spending will still be below average until after 2015. The Coalition is very much relying on business investment to bail us out, but with the banks refusing to lend this is a risky strategy. Meanwhile with the rest of the World predicted to be growing at between 4.4% and 4.8%, even after the world’ 3rd largest economy Japan has been devastated; we are just getting left further and further behind. Remember though that this is a deliberate policy to get rid of the debt and downsize Government once and for all.

The Budget had a few headline grabbers but brought nothing to change our view of UK stagnation. Inflation is a problem and ultimately the MPC will be forced to raise rates. The longer they wait though the better the inflation numbers will look. Best hope is that the US holds out with “rates lower for longer” but with US unemployment now below the magic 9.0% level and looking like it may go lower that protection may not be around for much longer. US house sales are still at worrying levels which may help the Fed to keep rates low.

The Coalition is, however, trying the old Thatcher trick of getting the foreigners to pay for the recovery through inward investment. The Corporation Tax cut will help particularly as Ireland is sticking to its guns (despite European pressure) with a very low rate. A shrewd move by the Chancellor and is perhaps the best thing to come out of a very dull Budget.

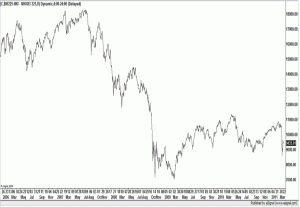

Markets

Markets have been under pressure from this flock of Black Swans, there are still plenty of headwinds (Europe is due another debt crisis any day now) but because growth is continuing and companies are making bigger profits up go share prices. Nothing fundamentally has changed so on goes the Bull market. China, Saudi Arabia are the biggest Swans of all, for the trend to change something significant would have to happen to either of those critical countries. As always we will monitor the situation on client’s behalf and act accordingly if needed.

March 2011