Click Here for Printable Version

As the first quarter of 2021 passes and the US and UK lockdowns begin to ease, markets have experienced a period of what can be best described as “churning”. Investors moved out of the pandemic winners such as the technology shares and into interest rate sensitive stocks such as banks and mining. Have they moved too soon?

The vaccine programmes should lower the mortality rates but won’t stop the virus until all have been “jabbed”.

As social movement increases then markets should expect infection rates to rise. The fact that a whole range of vaccines have been developed within 9 months and across the UK and USA the most vulnerable have been inoculated is a staggering achievement.

The next few months will see whether we have just won a battle or the war? This rotation from one industry to others has however led to one spectacular financial loss. This might just be the greatest single loss of personal wealth for an individual in history?

Given all that is going on with the pandemic at present, one very rich man losing all of his money must be put into perspective, however, there are important lessons to be learnt and messages for the markets to digest. Though the most significant news event of March was the announcement of the Joe Biden’s US economic infrastructure plan.

Biden’s Infrastructure Plan

Ever since the Credit Crunch of 2008/09 economists and central bankers have been demanding fiscal stimulus, despite massive bond buying and money printing programmes western economies were stuck in neutral and barely delivered growth above inflation.

The pandemic has blown away western political reticence about spending, debt and taxes. Country leaders are now racing to spend the most and in the greenest way possible. US President Biden has proposed a giant $2trillion plan that seeks to invest heavily in electric vehicles, green infrastructure and also health care.

This is a proposal at present and one that will no doubt have to be watered down to pass both Houses of Congress.

How will it be paid for? Looks as if companies will have to bear the brunt of the cost. The plan raises the onshore US Corporation tax rate to 28% and the offshore to 21%. Rishi Sunak has done something similar with UK business taxation.

It is early days in the plan for markets, it is though welcome and cements the fact that there is a new industrial revolution underway, but it does come with inflationary risks.

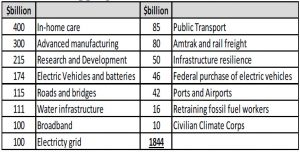

Possible “Shopping List” Source: US Government

As this table of some of the main proposed programmes shows there is a heavy emphasis on utilities, broadband and electric vehicles.

The global economy is already facing a semiconductor shortage and pricing action by Chinese nickel producer Dafang suggests that there may not be a smooth road ahead? China has moved first to secure rare earth and other key minerals, the USA is also reliant on Taiwan where most western semiconductors are sourced.

It is easy to write a stimulus plan, it may though be harder to implement and crucially make a success?

Archegos Capital Management

Bill Hwang was a former hedge fund manager who set up Archegos Capital Management as a Family Office.

This is where an investment management company works for a single individual or family and just manages their wealth and does not promote its services to outside investors.

Clearly, to do this the sums involved have to be very large, but crucially as there is no marketing to the general public such offices fall outside the scope of the regulators.

Whilst the majority of such offices are very conservative in the protection of their founders wealth this particular fund embarked on a very risky investment strategy that went wrong and will cause its brokers, including Goldman Sachs, Credit Suisse, Nomura and others to book billions of dollars of losses.

Information is scarce but it appears that rather than just cautiously investing his wealth, Bill Hwang undertook some highly speculative trades and did so using derivatives. This was a huge gamble that initially paid off but rather than banking the gains he seemed to increase the

risk.

Most balanced portfolios have hundreds of underlying holdings, this one had less than ten.

Furthermore, by using derivatives he was able to build an investment position possibly up ten times the size of his capital.

This is fine as long as the prices keep going up. If you place a deposit of 10% of the trade’s value and it goes up by 10% you have doubled your money. But if it goes down by 10% you have lost it all, if it goes down by say 15% then you owe the broker the extra 5% and also they will require another 10% of the reduced value to keep the position open.

This is the “margin call”. Archegos didn’t have the cash to pay the “margin call” and thus the brokers had to close the positions down, take the loss and try and claim it back from Bill Hwang, assuming he had enough wealth left to pay it.

Current estimates are that the realised losses will add up to $10 billion but no one really knows just yet!

This had the potential to rock the markets, but it seems so far the banks involved can afford to take the hit.

It does raise serious questions though. Where were the risk controls? The fact that Archegos had a spread of brokerage accounts meant that each broker might not have understood the full picture?

These types of trade, known as Prime Brokerage are very profitable for the banks, as they take a cut of the trade and charge interest on the open position.

It is important to note that nothing here was technically illegal, just extremely risky.

Are there lessons to be learnt? The Democratic administration is keen to reign in Wall St excess and no doubt this event will set regulatory alarm bells ringing.

How many others are using the Family Office structure in this way? For ordinary investors it is a salutatory lesson that shares prices go down as well as up and risk management is paramount.

Speculators/gamblers focus on the potential profits, investors focus on the risk. Diversity and no leverage under any circumstance are the key to steady accumulation of wealth through the investment markets.

Corporate Earnings S&P 500

Source: Dow Jones S&P

With two of the three main market drivers turning negative (inflation and interest rates) indices are relying on corporate profit growth to push share prices higher.

Many are saying the equity markets are expensive. The key valuation ratio the P/E (which is calculated by dividing the index price by the average corporate earnings) at 22.58 is historically at the top end of the valuation range.

But on its own this figure is meaningless. We need to put it into context, particularly where we are in the cycle and also the level of growth.

Markets place a higher value on high levels of profit growth. In 2019 at the end of the last cycle and pre-pandemic, the S&P 500 was on 20.56 times earnings with pedestrian growth of 3.6%. In 1992, where the second Gulf War had delayed the recovery the valuation was 24.9 times, in 2010 at the beginning of the last cycle, the valuation was also high at 19.2 times. So there is a clear message here, the first year out of recession can often appear to be an expensive one.

If we then factor in estimated growth of a staggering 40% (the long run average is about 7%) followed by 15% in 2022, which many think is too pessimistic, then valuations far from being expensive look to be just fine.

Markets

As time moves on and lockdowns start to ease optimism in the recovery is starting to rise.

There will always remain the fear of Covid mutations but markets cannot price those in until they occur. Interest rates and inflation are returning to “normal” levels and as such we are now entering a potentially difficult period for global bond and equity markets.

Hopefully, pent up consumer demand will help profits to grow at record levels and thus bring valuations down.

As the new industrial revolution takes off, helped by government spending, the outlook for the cycle remains very good.

As always, there are risks, it is clear Russia and China will test the new US President. The US may have woken up too late that it has become dependent on China and the Far East. There are going to be difficult conversations if the current supply shortages in semiconductors and rare earths continue.

With bond yields continuing to rise markets will have to rely on earnings, here we should start to get a better picture of exactly how good they may be as the April results season gets underway.

March 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.