Click Here for Printable Version

During June the main feature for markets was the US Federal Reserve Bank’s monetary policy meeting. Here, no changes in policy were announced, but it is the nuances within the statements and comments that are scrutinised closely by markets.

Within these nuances it was clear that the US central bank has brought forward the date where they may start increasing interest rates.

This move to 2023 rather than 2024 previously, set the market’s nerves jangling. These nerves focus on inflation and the when the inevitable withdrawal of the market’s current lifeblood (Quantitative Easing) will begin.

Interest rates won’t rise until QE has been significantly reduced. So a 2023 rate increase brings a 2022 QE tapering into the market’s pricing process.

Furthermore there was the comment that they “talked about thinking about…”, so a gentle nudge to the markets that the current $120bn a month quantitative easing bond purchasing programme will start to be wound down, just not yet. Nevertheless, markets reacted sharply, economically sensitive cyclical stocks fell, as the dollar went up in value. Is this the end of the “reflation trade’”, where ‘value’ companies have enjoyed seven months of outperformance, whilst ‘growth’ companies regain their long term position of dominance they have enjoyed for more than a decade?

Ultimately, this will depend on valuations and earnings growth.

For now the markets remain in the dark on just how strong the post covid recovery will be.

United Kingdom post Covid-19

As the mid-July Covid “Freedom Day” beckons, the immediate outlook for the UK economy is likely to be determined by consumers feeling confident enough to return to their prior spending patterns.

The medium and longer-term views are however, more likely to rely on just how effective and efficient the newly profligate HM government spending programmes are, especially given the constraints of national debt at 99% of GDP.

The UK is once again the “poster-child” for the newfound western addiction to Keynesian economic ideology which is expressed as significant government intervention through post-Covid recovery stimulus, infrastructure spending and the extensive “green” programmes to decarbonise society.

Will this lead to a different trajectory for long-term UK growth?

Often politics and the electoral cycle gets in the way of such plans. Unusually, the UK, is for the first time in many years experiencing a period of political stability (based on history, probably won’t last) and we presently, also very unusually, have a government that likes to spend money.

What does the short term outlook for the UK look like?

Covid-19 Freedom Day

Essentially this day is about a return to business for the UK hospitality industry.

The travel sector will perhaps have to wait. The fact that the UK can look to reopen is down to the high percentage of adults vaccinated. The data also suggests that these inoculations are helping to keep Covid hospitalisations and deathrate low and is suggestive of the UK being able to live with Covid-19 as “another flu”.

Clearly, it is very early days and the battle between the vaccines and the virus is still not over.

Mutations remain a real risk and some overseas economies are in a very difficult position.

Nevertheless, in the selfish world of investment the key is that the UK and US economies do seem to be in a good place.

What markets can only guess at is just how strong this recovery will be? Most people misunderstand how the UK economy works. We don’t export much, indeed post the EU/UK trade deal it has become very clear that our guesstimate of UK/EU trade in goods and services (10% of UK GDP compared to Project Fear’s 15%) was way too optimistic.

We knew about the Rotterdam effect i.e. UK exports outside the EU became Dutch exports if the ship stopped at Rotterdam, but we didn’t account for the UK’s seemingly high level of exports to Ireland being mainly EU goods transiting through the UK.

The UK economy instead works mainly through recycling existing wealth and growing it.

Primarily, it is the housing market that dictates the level of GDP growth in the UK. Secondly, it is the currency. Any period of sterling weakness sees money flood into the safe haven UK economy from the politically risky areas of the world such as Russia, China and the Emerging markets.

So whilst the reopening of hospitality will provide a big short term boost and a return to economic normal, it is the housing market that will dictate where the UK economy goes over the next few years.

UK House Prices

The UK media is full of stories of record house prices, low affordability ratios and the distortion impact of the Stamp Duty holiday.

However, if we just look at the long term trends a very different picture appears.

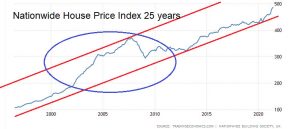

Source: Nationwide

The first chart shows the unadjusted Nationwide House Price index. The circled area is the post-Gulf War II economic growth period that ended with the 2008 Financial Crisis, when the banks discovered their bond assets were worth nothing.

Could we be about to enter a similar period of growth? There is more than enough cash floating around to facilitate this.

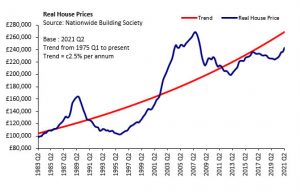

The second chart adjusts the index for inflation and shows that despite the recent growth, UK house prices are still below the long term average growth level. This also does not take into account the generational shift that “Working From Home” has created.

Young families in particular are taking the opportunity to move from overpriced London to undervalued rural areas.

HS2, from being a white elephant now seems to be a key factor in this welcome development. There may well be a hiatus as and when the Stamp Duty holiday comes to an end, also interest rates are too low and will rise, which is a risk to mortgage affordability, Nevertheless, with average prices below trend, a structural shift underway, the outlook, despite some very real risks, looks to be positive.

The Long Term

The longer-term question is what happens beyond the recovery phase, looking out towards 2025.

Will the western world revert to long-term trend growth i.e. 2%-2.5% for the US, 1.5%-2% for the UK and roughly the same for the EU?

This was the pattern for the post-Global Financial Crisis economy, the exception being China.

The Chinese reported the highest growth rate of all the major economies, but it was gradually slowing from highs of over 7% and struggling to maintain 6% (which sceptics believed was a Chinese Communist Party propaganda figure), lately it was also not helped by the impact of Trump’s trade war.

The likelihood is that the newfound western addiction to significant government spending on infrastructure and green programmes may well create a different trajectory for long-term growth.

If it doesn’t, then the high levels of government debt might just create a big problem.

The main risk to this outlook remains, as ever, politics.

France and Germany are facing potentially very bruising elections over the next 12 months. Post-2008 the political fashion was “austerity”, especially in the UK and EU, Now it is clear that didn’t work, so we have flipped over to “spending”.

What we can say though is that for the first time since the 2008/09 Credit Crunch the ducks are lined up nicely for a prolonged period of economic and thus corporate profit growth.

Thus, it suggests a long term return to “normal” inflation and interest rates.

Last time around corporate profits growth wasn’t good enough to cope with QE being scaled back, theoretically it should be this time around.

Markets

Over the rest of the summer the markets will be focussing on just how fast the consumer might return to their prior spending habits.

Much will also depend on the Delta variant and just how effective the vaccines are in preventing hospitalisations and deaths. So far the results seems to be very promising.

But it remains early days. For markets the link between Covid cases and share prices has been broken. The markets continue to believe in the vaccines and thus are ok with the Delta variant, at least for now, but would therefore be vulnerable if the vaccines preventative properties came into question.

The same could be said for any further Covid variants. The markets are also content with the current economic statistics that are coming out.

Again, it is very early days, the furlough and unemployment programmes are still in place and only just starting to be wound down.

These data points could go either way.

Labour shortages are already becoming a common complaint in the UK and if wages rise too quickly then so must interest rates. So as we emerge from Covid restrictions and enter a world of just living with virus the outlook remains positive.

As ever, there are risks, but the economic boom, at least in the UK and US, should theoretically be about to begin.

June 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.