Click Here for Printable Version

Any hopes that Trump’s trade war with China is “reversible” and mostly rhetorical, are quietly fading away.

Add this onto the stalled NAFTA talks with Mexico and Canada plus the building trade conflict with the EU then the global business supply chain seems to be facing increased costs and disruption.

Markets had considered that Trump’s trade war statements were at best a poker game negotiating tool, as nobody could conceive the US President actually implementing measures that could threaten the US economy and stock market. However, over June the market’s view has started to change, as it has slowly dawned on traders that Trump is not (or might not be) bluffing.

Markets often swing from Greed to Fear and there are signs that such a swing is now underway.

The problem we have is that one minute Trump was about to go to war with North Korea and the next minute he is holding peace talks.

He could easily turn on a sixpence and markets will jump back into Greed mode. Trump is unpredictable and that gives the markets a problem, especially if players try to use them in order to exert influence.

So far the first move seems to have been from the Chinese, they have let the yuan fall in value by around 7%, which is an immediate 7% tariff of all US goods and crucially services.

China

Since Trump announced tariffs on Chinese imports to the USA the currency has magically fallen in value against the dollar, and without any of the usual “influences” that the Peoples Bank of China likes to use.

This suggests that this move is deliberate.

As one commentator has stated the Chinese have “weaponised” their currency.

China exports more physical goods to the US than it imports but many US service companies, lawyers, accountants, investment bankers all do well out of China.

By weakening the currency, their services have just become a lot more expensive and thus uncompetitive.

Increased cost to business is the key fear of this trade war, but so far the markets don’t seem to be worried and may yet not do so.

Unless that is, the profits of the constituent companies start being downgraded. As soon as that actually happens, rather than the fear that it might do, then the cycle may turn and do so early.

Trump won’t like that and that is the counterpoint, we may have to accept that markets will have to go down in order for Trump to change his mind and do deals. The trouble we have is that surely the Chinese know that, as such they could target key companies e.g. Apple’s iphones could easily be banned from China on national security grounds etc.

It is this denial of market access to key companies (just as Trump has done with Chinese mobile manufacturer ZTE, and China with Micron) that is a real risk to the investment world.

So far China seems to be losing in the first round of this trade war, in June when the S&P 500 was up by 0.5% the China CSI 300 (not open to foreigners) fell by 7.7% and US listed Alibaba was down by 6.3%.

The Chinese are famed for taking a long term view but Trump is gambling that the Chinese leadership will not want a serious economic slowdown at this point and will do the “right thing” by reducing tariffs and crucially taking steps to redress perceived US intellectual property transgressions.

The Chinese on the other hand will want to see the political impact that their tariffs (and the EU’s) have on the US mid-term election.

China and the EU have targeted key US states with tariffs on key products and companies such as our old friend Harley Davidson.

But that gives the markets a real problem; the Gubernationals are quite a way off, not until the 6th November.

Global Trade

The crux of all the various trade disputes with Canada, Mexico, China and the EU is that Trump is actually right.

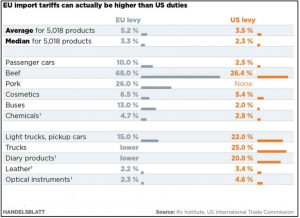

All these countries levy larger import tariffs on US made goods than the US charges them.

It isn’t fair and from an economic perspective theoretically wrong.

It may have been fair when these tariffs were set in the 1970s when comparatively the US was economically so much more powerful.

Whether this is the right way to go about resolving the various issues is arguable. But as an example this table shows the duties levied by the EU are higher than the USA, with cars in particular a sore point.

That is what the World Trade Organisation was set up to do, but like other supranational organisations such as the UN and IMF, it seems to have been left behind by “globalisation”.

It may well be that this is what Trump is aiming for, using aggressive negotiating tactics to bypass the WTO and achieve in months what usually takes years or even decades.

If he pulls it off then markets will be extremely happy. But we have to ask what his probability of success is?

That is very hard for the markets to assess, hence uncertainty and increased volatility.

As an aside Theresa Mays’ Brexit problems over whether to stay in the Customs Union and the Irish border issue could be solved if the UK declared its intention to become entirely Duty Free!

Europe

At its heart the Europe Union is an exercise in financial convenience. Germany’s exports benefit from the euro being cheaper than a deutschemark, whilst the rest of the Eurozone benefits by being able to borrow at what are effectively German interest rates.

What this means is that German economic success is the key to European economic success.

Angela Merkel is under enormous political pressure but it is the future of Germany’s car industry that could be the true threat to Europe.

Trump taxing European made models of German companies is one threat; Brexit, as Britain is the biggest export market for the German car industry (bigger than both China and the USA) and the 5th Industrial Revolution are others.

The big German car companies are perceived to be behind China and the USA in the development of new technologies.

German companies might well have to move production closer to the customer to survive; furthermore, the rest of Europe will have to get their finances in order.

Brexit and Politics

As we have written at length before, whether it is a Hard or Soft Brexit is an economic non-event, Soft no change, Hard about 1% p.a. hit to GDP, but depending on the ensuing policy response, an acceleration of long term growth.

It is politics where the problem is.

As we write, Theresa May has a Cabinet agreement for the UK’s first Brexit proposal to the EU, it won’t be the last; the actual deal will be done at the very last minute.

The real question is who will be negotiating it, will it be May or Boris? There remains the very real risk that Theresa May will be forced out and that brings the risk of a Corbyn or even Corbyn/Sturgeon government.

Markets

Fundamentally the global economy continues to do well, however, Trump’s myriads of trade disputes have the potential to scare markets and bring global growth to a halt. So far we have had a number of disruptive shots fired and are yet to enter a full fight.

The markets assume that this remains a poker game and deals will eventually be done.

These deals normally take years to negotiate but Trump is not known for his patience and it is this that brings uncertainty.

We should expect markets to be moved by the trade dispute news flow, both good and bad.

In the UK we need to watch out for any political developments that might precipitate a General Election.

Across Europe, the new Italian government continues to disrupt whilst Angela Merkel’s long and impressive political career seems to be drawing to a close?

For markets the third quarter is usually the weakest one of the year, but starts with US 2nd Quarter corporate results season and this should be a spectacularly good one.

This will be very important as whilst the negative news flow seems to get greater each day, the results season reminds us that we invest in companies not politics.

June 2018

Click Here for Printable Version