During June the main US stock indices hit new highs but here in the UK the FTSE actually fell 1.5% over the month as did the Mid Cap and Small Cap indices. This divergence is unusual as mature global markets are normally interlinked.

Some commentators have pointed to the belief that the UK will be the first of the major economies to raise interest rates. Therefore Sterling has been strong thus making the UK relatively expensive to other markets. This view was reinforced by Bank of England Governor Mark Carney’s comments at the Mansion House Speech, where he stated that, “there’s already great speculation about the exact timing of the first rate hike and this decision is becoming more balanced.” The press have linked this statement to the booming London housing market, but yet again the press do appear to have it wrong.

House Prices

Firstly, where is the boom? The first chart shows the Halifax House Price index, whilst it is picking up and is definitely in recovery mode it is, on a national basis, a long way below its 2008 highs.

By a strict economic definition the UK housing market is not in a boom.

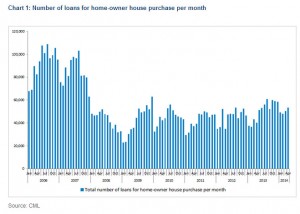

The second chart from the Council of Mortgage Lenders shows the number of new mortgages issued is still stuck in neutral.

Though, it has picked up a bit with the seasonal lows higher than the previous year’s equivalent. According to HMRC, seasonally adjusted property transactions have been more than 100,000 for five months in a row – the strongest performance in six years, but still way behind 2007 levels.

However, approvals for mortgages not yet drawn down have eased back since the start of the year, according to the Bank of England, May’s seasonally adjusted figure of nearly 62,000 was some 7% lower than in March and the lowest since mid-2013.

Again, there is no sign of a boom. Indeed since the 26th April new affordability rules have been forced upon mortgage lenders, this has meant that many potential buyers will no longer qualify for the mortgages they want.

Anecdotally nearly 30% of pre April mortgage offers have been withdrawn before a transaction completes as these new rules are implemented; those that qualified pre-April now find they are unable to get the same sized mortgage. Rather than facing a boom we might actually be facing a mini housing crisis?

Rightmove, the online estate agent, also reports a surge in houses coming on to the market just as the ability of buyers to pay has been made significantly more difficult. Long term this is no bad thing, banks’ lending to those who couldn’t afford to repay was ultimately the root cause of the 2008 Credit Crunch.

How is it that London prices still keep increasing?

Well the reality is that not all London prices are rising, in May prices in Westminster rose by 3.5% but Haringey fell by 4.8%. Of London’s 32 boroughs only 6 saw prices rise by more than 1%. So what is driving the headlines? Where there is a boom is in “Buy-to-Let” investment, specifically just in London and from overseas investors.

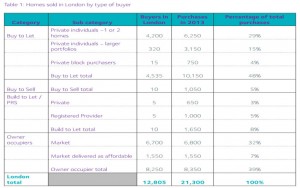

The British Property Federation (BPF) who represents house builders, estate agents and institutional purchasers produced a report looking at who bought the 21,300 new build homes in London last year and why.

After talking to developers and examining information on sales in 2013, it finds that a staggering 61% of new homes in London were bought by investors. This is only new homes, but remember that the government Help-to-Buy scheme was in 2013 only for new homes and there is a structural shortage of property in the UK.

Also as new homes these statistics will not include the mega- million properties that are now fashionable for Russian oligarchs and Chinese/Indian super rich. These statistics are for new build flats and houses built throughout London that should be for “normal” owner occupiers.

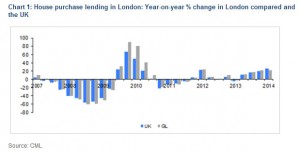

The following chart shows London mortgage borrowing compared to the national trend, for the past few years it has been virtually the same. This suggests that overseas cash buyers are indeed driving the market.

The table, from the BPF, shows that in 2013 only 32% of London purchases were for owner occupiers with a further 7% shared housing, the balance was from investors.

Similarly, estate agent Knight Frank found in early 2013 that 49% of luxury central London property was bought by overseas investors, as well as 20% of new builds in inner London and 7% in outer London.

Asian residents dominate the buying, but investors from Europe, the Middle East, Russia and even North America are investing cash in London. Why is this important, well because if the Bank of England raises rates the rest of the country and poorer London Boroughs would suffer and yet the cash driven investor properties would remain unaffected.

Interest Rates

So why would interest rates rise? Central Banks fear inflation both too much and too little. Inflation can be “imported” through rising prices such as oil or food; through excessive lending by banks (the money supply); through asset bubbles such as property booms but also by employment reaching “full employment” levels and thus workers demanding greater wage increases.

Currently the UK economy is generating lots of jobs and there is a big debate at what level we will reach “full employment”. There are skill shortages in the UK economy especially in computer coding/technology, please note “full employment” does not mean zero unemployment as there will always be those without the right skills for the current economy and in the wrong location. Also the Bank of England is looking closely at the nature of the jobs created, zero hours contracts, the gang master system and part time temporary contracts are unlikely to feed through into greater wage inflation.

But the statistics do show that that employment growth is one area that might cause inflationary problems in the near future.

Markets

June has been a relatively quiet month for corporate news, geopolitical events such Iraq and Ukraine have dominated the headlines as have central bankers Mark Carney and Mario Draghi.

“Super-Mario” finally announced Europe’s version of QE which can’t be called QE as the Germans don’t want to admit that is what it is! Europe is suffering from deflation; this package is certainly late only time will tell if it is too late. July though sees the second US corporate results season of the year and one where we should see genuine corporate earnings growth at “normal” levels.

If not, then the deflationists will be back out in force. Bond prices are still telling us that global deflation remains a real possibility despite Mark Carney suggesting that interest rates will rise sooner than later.

The performance of Bonds has been a major surprise for the investment management industry this year, but with the return from cash being zero, 2% yields have proved to be better than nothing! Despite the performance of equity markets there remains a real concern that growth will remain sub-par for some time yet.

Some commentators have pointed to US interest rates post the Great Crash of 1929; they remained at close to zero until 1944, when war production created inflation. Our view is that whilst this is a possibility we prefer to follow the high probability route, that growth is slowly returning to normal and that the cycle remains intact, until evidence clearly points otherwise. For July, the US results season will be the key.

June 2014

Click Here for Printable Version