Click Here for Printable Version

Virtually 18 months to the day from the Russian invasion of Ukraine, which fuelled global inflation, there was a possibly pivotal economic development. Inflation statistics, both in the USA and UK, showed a marked decline in the rate of price increases. This is what the markets have been waiting for.

Remember, the three key drivers of share prices are inflation, interest rates and corporate profits.

Rising inflation means that interest rates also must rise to choke off excess growth which in turn reduces company profits.

Falling profits means shares are expensive and have to reprice at a lower level before they can resume their previous uptrend.

The past 18 months have seen exactly this pattern play out. 18 months, as we have stated many times before, is the average length of a markets drawdown (decline). It would thus appear that, virtually on cue, these drivers are starting to turn more positive for markets. The most difficult aspect for market behaviour to grasp, even for many professionals is that this is

coming just as the economic environment is deteriorating.

Wall St and Main St operate on different timescales, share prices are valued not on current corporate profits but future ones.

As long as inflation and interest rates are falling the markets will ignore declining profits for at least 18 months into the future.

Markets have been predicting this economic slowdown since the invasion i.e. 18 months ago, now they are being proved right.

Bank lending is down, house prices are falling, bankruptcies are up and this makes the markets content. Perhaps the most significant economic event of the past few weeks, at least for the UK, was price cuts from Tesco.

Inflation-Food

The two main drivers of headline inflation, particularly in the UK, have been domestic energy and food prices. The Governor of the Bank of England highlighted recently the impact of post Ukrainian invasion fixed price food supply contracts that were struck at very high prices.

These contracts are now expiring and food inflation is thus slowing.

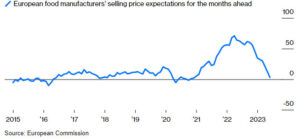

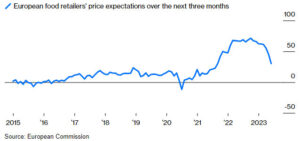

The following charts from the European Commission show sharply declining European food manufacturers and food retailers price expectations for the next 3 months. This is very relevant to the UK as Aldi and Lidl are now UK price leaders and UK processed food supply is still fully integrated into the European network.

What these charts are showing is that pricing is returning to “normal” and the war impact is disappearing out of the pricing equation.

We have already had the 15% energy price cap fall, which will help August’s UK inflation numbers and now we have a background of food prices falling as well.

Autumn usually sees the start of supermarket price wars as they seek to clear stock ahead of the crucial Christmas trading period. This is why Tesco’s news is so significant. Asda and Morrisons are both heavily indebted and owned by private equity investors, this could be a very tempting opportunity for both Tesco and Sainsbury to take market share.

What we can say is that two of the big pressures on UK inflation, energy and food, are rapidly going away.

Interest Rates

Global interest rates are all inter-linked and take their lead from the USA.

The dramatic rise in US interest rates from virtually nothing to 5.5% in record breaking time is at the root of this very messy and volatile 18 month period of market behaviour. What is very significant is that markets think are now at the top, or within 0.25% of the top, of this monetary tightening cycle.

US inflation is back to “normal” levels and there are increasing bankruptcies, corporate defaults and US house prices are falling, all tell-tale signs of an economy in recession or about to be.

What this means is that the US Central Bank, “the Fed”, can at least consider stopping raising interest rates. They seem to have timed it just about right, as what is likely to be the most bruising US Presidential elections of recent times is now underway.

President Biden wants a healthy US economy by nomination day in February, this in effect means by late November this year i.e. Thanksgiving. The Fed is now officially “data dependent” i.e. as long as inflation stays low then it is on hold.

Crucially, if the US economy does nosedive it will cut and do so rapidly.

If we translate this into market direction then we have three general scenarios depending on the direction of interest rates:

- If interest rates are rising and at a fast pace, bonds and equity markets always fall

- As soon as interest rates seem to have peaked, equity and bond markets will start to anticipate future cuts and will begin moving higher, albeit in a very volatile manner

- When interest rate cuts start, then markets enter a sustained, low volatility, steady growth period for both bonds and equities

We do seem, both in the US and the UK, to be moving to point b).. Inflation is the key, as long as it keeps coming down the Central Banks will start to relax.

Furthermore, if the US economy does moves into a full blown recession, then interest rates will fall, as the Central Banks will assume that the recession will do the price control for them.

So whilst the data on either front is not wholly conclusive as yet, it is pointing in that direction.

Corporate Earnings

(source JP Morgan)

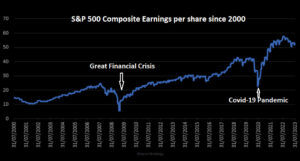

The third of the big three drivers of global stock markets is corporate earnings.

We are mid-way through the second quarter results season and S&P 500 earnings are set to drop roughly 7% over the past 12 months (source: FactSet).

If correct that would be the largest decline since the pandemic and the third consecutive quarter of declining profits.

Estimates for Q3 and Q4 have dropped from 5% and 10% growth at the start of the year to 0.2% and 7.5% respectively.

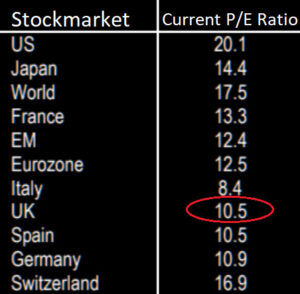

There is a recession out there, it is just not showing in the official stats. It is also crucial to note the huge distortion arising from the big technology companies. This is reflected in the higher US valuation.

What is very unusual is that valuations normally tend to be very high during recessions, as share prices fall less than company profits. This time many markets, especially outside the USA, are incredibly cheap by historic standards (under 15 is cheap).

Maybe markets feel profits are about to collapse further? However, this is a win-win situation, if they do, then interest rates are coming down and share prices will automatically go up regardless of valuation; if they don’t, then shares are cheap and will eventually reprice upwards.

Markets

The markets are approaching an inflection point. It is a truth of investing that you never know when a turning point will occur; it can only be accurately identified with the benefit of hindsight.

What we can say, is that, based on the regularly repeated historical patterns of the last 130 years, we are now in the zone where the three primary market drivers are likely to turn more positive for markets.

So far, there is a shift from being negative to neutral in the case of interest rates and corporate profits and crucially to positive in the case of inflation.

Market activity is typically sluggish in August and September. This is when governments and trading desks are closed for the holidays and as a result, they can be volatile times.

Much depends on the economic data, the inflation numbers must continue to improve while other economic news must be generally negative. If this is the case, the balance of probabilities will continue to point to a near-term turning point.

Inflation is the key, it needs to stay low, all the indicators, for now, point towards it doing so.

August 2023

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.