Click Here for Printable Version

2022 has proven to be a difficult year so far. Russia invading the Ukraine surprised the markets and precipitated a commodity shock.

Together with post-Covid labour shortages this has pushed up inflation globally which has reached 40 year highs. Markets are ultimately driven by the direction and rate of change of interest rates, inflation and corporate earnings.

Of these, only corporate earnings is currently supportive of share prices.

Even here, risk remains elevated, fears of a global recession are building, though economists place only a 50% probability of this occurring within the next 12 months. Inflation remains the main negative factor and the US Federal Reserve Bank is responding in a particularly hawkish manner.

Expectations are that US interest rates will peak at 3.5%, three months ago these were 1.5%. High commodity prices and restricted supply arising from the sanctions on Russia remain the biggest input to the higher inflation numbers, though labour shortages remain a significant element as well.

The “Fed” therefore remains central to equity market direction. They have already succeeded in returning market expectations for interest rates and inflation to “normal” i.e. 2.5-3.0%. There are concerns that they may overshoot and push the US and thus the global economy into recession.

There are positives though, If there is a global recession, it is likely to be short. There is a Presidential election coming, Joe Biden will want a recession over very quickly and a boom in place by Christmas 2023.

Nevertheless, markets remain in a difficult period but crucially have been for 6 months, a normal bear market for a normal recession (rather than a credit crunch) is between 9 and

12 months. The S&P did touch down 25%, (still just a Correction not a Crash), indeed, some commentators are questioning have we fallen enough given all the negative news-flow?

It is important however, to remember that markets work 12 to 18 months ahead of the economy and the aforementioned US election is coming. Furthermore, Covid (another major negative) seems to be passing in China.

Crucially, commodity prices, including oil, are starting to roll over, these have been a major driver of inflation.

So whilst it is early days, we are starting to see turning points ahead in many of the negative factors facing the global economy.

The UK Economic Conundrum

We mainly focus on the outlook for the US economy as it is US inflation, interest rates and company profits that directly influence global and UK stock and bond market direction.

However, given the current deluge of negative news flow about the UK economy it is perhaps appropriate at this time to reflect on the outlook for the UK.

The Bank of England has just raised Base Rates to 1.75% (US rates are 2.5%), forecast a mild recession in Q4 and warned of a difficult 2023 for the UK economy.

Whilst these forecasts are in line with many economists, we do need to be careful about becoming too pessimistic. There are just too many variables in play for anyone to make a truly accurate forecast.

Importantly, roughly half of the reduction in UK Personal Disposable Income is directly down to the government. The increase in National Insurance and the freezing of Personal Income Tax allowances, just at the wrong time, was poor execution by the Treasury.

Furthermore, the very modest (by international comparisons) cut in Fuel Duty and equally modest help for heating bills, were again not that helpful.

However, we will shortly have a new Prime Minister. Whoever wins will have an eye on an early General Election. So whilst the fiscal pressure is unnecessarily high at present, there is a high probability that it will be eased and very shortly.

Can we afford it?

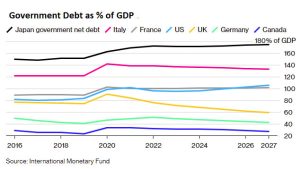

The simple answer is yes we can. UK debt as a percentage of GDP is way below that of France or the USA.

What is more, of all the G7 countries, the UK is the only one that has seen its percentage debt reduce post Covid. Getting the debt down in monetary terms never happens, not even Margaret Thatcher achieved it.

This is why the fiscal decisions taken by the former Chancellor (with the benefit of hindsight) were so odd. At the time they seemed sensible but when Russia invaded, the world changed and so should have UK fiscal policy.

Austerity was a failure post 2010 and the same mistake is, so far, happening again.

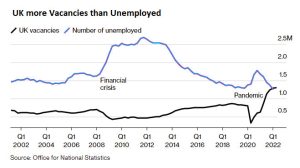

The tricky element to forecasting a UK recession at the moment is the robust health of the post Covid and post Brexit UK employment market. Both of these Black Swan events combined to significantly reduce the number of people available for work.

Most UK recessions see unemployment rise sharply, mortgages become unaffordable and thus house prices fall.

For the UK it is house prices that are the major factor in economic growth. But post Covid and Brexit there are fewer people chasing more jobs.

Pay that had been held down for years by cheaper overseas agency labour is finally starting to catch up. The reality is most employers are going to have to pay more for their staff.

Whilst this is inflationary, it also acts as a significant buffer against too much economic damage on consumers. The Bank of England has been very clear that the current high inflation rate is primarily due to high wholesale gas prices.

Of the Bank’s 13% forecast inflation rate for Q4 over half arises directly from the European Wholesale Gas prices feeding through to the Energy Price Cap. There is also a further quarter from the indirect impact from these higher energy prices.

What we cannot get away from though is that even now UK interest rates are too low and remain on a path to returning to “normal” i.e. 2.5%-3.0%, just as they have in the USA. The Bank of England is essentially using the gas/inflation crisis as an opportunity to escape the artificially low interest rate environment of the past 13 years.

House Prices

For the UK economy the big question is what will be the impact on house prices?

The Bank of England has stated that they do not see much stress in the mortgage market unless rates move over 5%.

Credit Card debt in the UK post Covid is at record lows and consumers are savvy, the lock down periods showed that monthly spending for many is flexible. Footfall figures already indicate a move from Sainsburys / Tesco to Aldi / Lidl.

Given that redundancies are likely to be very low the fear of losing a job should not be a factor.

Furthermore, the boost from the Stamp Duty holiday and “work from home” created a large one-off shift away from London.

Many, if not all, of these new mortgages will be on fixed rates and it could be argued those that were likely to move, did so during this period.

There may well be a natural slowdown in the UK property market, but unless interest rates and thus unemployment go to extreme levels (possible but not probable) most commentators see the UK housing market being underpinned at these levels.

If there is to be a recession, it may be a very different one than any that we have seen before.

Inflation is the key and we need to remember it is a very odd statistic, it is the rate of change in prices between two moving dates.

Gas prices are the basis of 75% of current UK inflation. Even a modest downward move will change the inflation statistic dramatically. For the UK much will depend on what decisions the new Prime Minister makes.

Markets

Markets have shown signs of life, this was driven by a fall below $100 pb in the price of oil, which meant that expectations for US interest rates have pulled back. The US Federal Reserve Bank has so far pushed official interest rates rapidly to 2.5%, the markets are expecting more modest increases from now on and then a reduction starting in H2 2023, just in time to engineer a boom ahead of the US Presidential election.

The risk is the inflation numbers don’t come down fast enough and thus the Fed is duty

bound to go further.

Oil is still the key for the markets. For traders the missing part of the Bull market equation is dollar weakness. Most remain a little sceptical of this bounce as the dollar hasn’t fallen, particularly against the yen. If it does then these same traders will be chasing the equity markets higher. For Europe and the UK it’s all about gas prices and that in turn depends on the war in Ukraine, where Russia is making very slow progress.

European Natural Gas prices have doubled since the end of June, indeed 12 months ago they were e26 per megawatt they are now at e198.

Good news for Russia, not for consumers.

It is unlikely that this problem is going away soon, though a new PM in the UK could do more to mitigate the impact on consumers.

Much will depend on the progress of the war. Russian oil is still finding its way onto the global market and sanctions have eased very slightly.

The move in oil prices below $100pb does benefit the US in particular. Global markets remain focused on the US inflation data and the Fed’s reaction. The news here is improving, let’s hope it continues to do so.

August 2022

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.