Click Here for Printable Version

As the mid-point of 2021 passes markets appear to be very strong. Year to date the FTSE100 is up by 11% with the MSCI World in sterling terms up by 12%, whilst Gilts are down in value by 6%.

Just glancing at these numbers you would think these are consistent with a strongly growing post-Covid global economy and interest rates that have to return to “normal”. But these numbers hide huge underlying swings in investor expectations. We have to remember markets are driven not by actual data but by investor “expectations”.

Markets are not mathematical, they are actually a numerical representation of human behaviour.

This is why they are so difficult to forecast and despite billions of expenditure on computer programmes and artificial intelligence, machines still cannot beat the markets.

The original market thesis for this year was that the vaccines would work and by the final quarter the global economies would return to “normal”.

Huge global government stimulus programmes plus QE, together with unspent consumer spending firepower would finally propel the western economies back to their pre 2008/09 Credit Crunch growth and inflation levels.

However, just lately the markets have started to challenge this view. Yes the inflation numbers are rising as predicted, yes corporate earnings growth is at 20 year highs, the vaccines do seem to be working and if the UK is the guinea pig it might just be possible that we get to the desired “herd immunity” sooner rather than later.

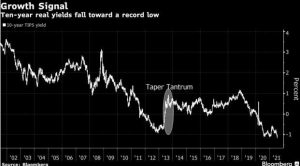

Yet, US bond yields far from moving higher, as economic theory demands, have actually fallen, possibly indicating growth is slowing. The equity markets think otherwise.

Both cannot be right, or can they?

Market Interest Rates

The rate of interest on a mortgage or a loan is not actually set by the either the Bank of England or the Federal Reserve Bank.

These rates are set by how much the banks have to pay to borrow the money they then lend to you. The old days of taking money from current and deposit accounts and lending it as a mortgage has long gone.

To borrow instant access money from account holders and then lend over twenty five years to mortgagees is deemed to be too risky, especially post the 2008/09 Credit Crunch.

Instead banks now lend a multiple of their assets which are primarily made up of government bonds.

Central Banks like this, as they can exert some measure of control over bank lending. Most mortgages are not held until the end of their term, many are repaid within around ten years as homeowners either move or re-mortgage to get better rate or release equity.

This means that the critical rate for bank funding is the ten year government bond. What is odd is that given the positive outlook this rate should be moving higher.

However, in the US it has counter intuitively moved lower from 1.6% to 1.3%. This is when the expected future US inflation rate has hardly moved, that is still around 2.3% which brings the real yield i.e. inflation adjusted back to a record low.

The same is also true in the UK. The question is why. Various answers have been put forward.

1.This low real yield might be suggestive that the bond market thinks that Covid-19 will not go away and that lockdowns are the new “normal”.

This may be possible, but at present the data post vaccine suggests that it is not probable.

2. The Fed is going to make a mistake, they are naturally looking to raise rates and are looking for any excuse to do so.

Therefore the bond markets think they might move too fast and too soon and will have to back-pedal. Again this is possible but not probable, the Fed keeps stating that they intend to run the US economy “hot”.

Fed Chairman Powell’s term of office ends in February 2022, as a Trump appointee he probably will be replaced, he may thus not want to move policy at all and leave the problem to the next person.

3. There is forced buying underway. Clearly, the Fed is still in the market buying $80billion of bonds per month, this is creating a shortage of bonds for the natural buyers.

These include the pension funds that have to rebalance each quarter and of course the aforementioned banks. If you can borrow from the government to increase your capital base at 1.3% and lend it 2.5% then it is not bad business.

How long this will last when QE tapers and with the Biden admin having to fund its spending plans is hard to say, but logic and economic theory suggests rates will not be down here for long.

Can both the bond and equity markets be right?

Yes they can, it is just a question of timeframe.

Equity markets are looking through the present to a post QE world of high profit growth, whereas, bond investors are just doing what they have been doing since 2008/09 i.e. pricing in current data and won’t change until the Fed tells them otherwise.

Present US economic data is not good enough to suggest that tapering QE can be justified in the very short term. So the bond markets are “right” for now, but then so is the equity market, but for next year and beyond.

Bonds appear to be waiting for the unemployment and furlough cheques to end, then they can assess just how strong the forthcoming boom will be.

Staycation

Research from the Resolution Foundation has suggested that up to £30billion could be injected into the economy by UK holidaymakers staying at home rather than travelling abroad. However, it should be noted that this would also be at the expense of the airline and airport industries and it would not be spread evenly across the UK. Cities such as London and Edinburgh are big losers as the foreign tourists can’t travel to the UK.

The big winners are the South West of England, Wales and East Anglia. More research this time from estate agents Hamptons suggests that up to 60,000 Londoners have bought properties in the shires.

This is a huge and clearly long term commitment. This suggests that “work from home” is likely to be here to stay.

Tencent and the China Technology Crackdown

The Chinese government sent shockwaves through their equity markets with a series of crackdowns.

First, was Didi (a Chinese Uber). This company had recently floated in the US and was subjected to new regulation over how it stores customer data. The shares consequently halved in value, less than a month after being floated.

Immediately afterwards, China clamped down on education companies.

This move had been flagged for some time, a communist country that relies on private education was always going to be a difficult concept for these companies to navigate.

The above chart shows tech giant Tencent. Their shares have suffered after regulators suspended its WeChat app to comply with new data rules. There is clear pattern of intervention coming from the

Chinese leadership.

This has brought valuations down to bargain levels, though as yet, investors are not seemingly prepared to stomach the extra political risk.

Markets

Whilst the indices continue to make progress, markets are experiencing a number of hidden dislocations.

The US Treasury Bond yield is important. As it falls traders have moved from the recovery and value stocks back into tech, should the rate rise then this trade will reverse.

Likewise, with Chinese tech companies dominant in the Emerging market indices the political stresses are impacting on returns from these areas.

There has been no rapprochement between the US and China, many of Trump’s trade tariffs and restrictions are still in place.

It may well be that US/China relations may have to get worse before they can get better.

China was the first major economy to recover from the pandemic and all these various government interventions are impacting growth. China can often lead the way in global markets, so whilst these changes have not hurt western markets we do need to be aware that they might.

With regards to the pandemic, it seems to be very clear from countries with high Pfizer/Astra Zeneca vaccination rates that the inoculation does not stop the spread of the virus, but does significantly reduce its severity and thankfully mortality.

For the markets this is probably not as yet fully priced in, as post vaccination delta variant infection rates are only just picking up in the US.

Will the President hold his nerve and follow the Israeli/Singapore/UK experience where the desired herd immunity might be close?

Low vaccination rates seem to be state specific so new lock downs are not as yet expected.

Nevertheless, markets might move on the higher infection rates. So in the usually quiet summer months there is a lot going on.

In the short term markets will be focussed on the Delta variant, China and most of all US Treasury Bond yields, just what are they telling us?

August 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.