Click Here for Printable Version

There are lots of issues facing the global economy at present but there is only one that really matters, that is the trade war between China and the USA. Hopes were high that after the rapprochement at the G20,talks would restart and progress rapidly, as logic suggests that both sides are hurting.

However, President Trump isn’t a logical politician, he is unpredictable and markets don’t like that.

Markets still fundamentally believe that Trump wants a deal and China more importantly needs a deal.

It’s just what will the damage be to both economies and thus the global one if the process of reaching a deal becomes further bogged down?

Trump recently introduced a new tariff of 10% on a wider range of products including laptops and mobile phones, most other China tariffs are at 25%, hence this may not be the end of story.

In turn,China devalued its currency to below the psychologically important 7 yuan to the dollar.

Where do we go from here? Nobody really knows,are the Chinese waiting for a Democratic President?

That would be a gamble on their part, the Democratic candidates are not setting the world on fire so far.

Much will depend on the Chinese economy, Trump needs a deal but has time yet before the election, though the clock is ticking. For other parts of the global economy, especially Europe any trade deal may already be too late to save it from recession.

With European interest negative fiscal stimulus is needed, but, with the exception of Germany,no major European economy has any spare cash to stimulate economies that were already stuck in neutral but are now misfiring as well.

The exception is the UK where, with a virtually balanced Budget, new Prime Minister Boris Johnson has come bounding onto the stage and is promising goodies for anyone who will listen.

Sounds like a General Election is coming?

Boris

As widely anticipated Boris Johnson was voted by Conservative Party members to be Prime Minister.

He has quickly built a very pro-Brexit team of Cabinet Ministers and advisers.

This is a seismic shift in the UKs approach to negotiating a Brexit with the European Union. Theresa May avoided at all times the threat of a No Deal exit and instead relied upon the EU treating the UK reasonably in negotiations. To be fair to her, the EU largely did, however,she possibly inadvertently turned into a cul-de-sac with the Irish Backstop.

This is/was a fail safe mechanism for the Irish border if a trade deal could not have been negotiated.

In hindsight, if the trade deal had been negotiated in parallel or had been widely mapped out and made known to Parliament she might well have still been in power. However, all this is now irrelevant, with not just a Pro Brexit Cabinet but a pro No Deal one the stakes have been raised.

Whether this is all bluff is hard to say.

Markets have raised the probability of a No Deal Brexit from 15% to 20%, which is still very low.

The end of Project Fear

We have always stated the General Election risk and thus a very damaging Labour Government is high and this would be economically far worse than any hard No Deal Brexit would be.

Why? The overwhelming majority of UK plc’s European business is in service industries, customs barriers and trade tariffs therefore represent few barriers to trade.

Regulations can be easily sidestepped through opening brass-plaque offices within the EU,it is manufacturing that would suffer most.

But manufacturing exports to the EU are only 7% of UK GDP and as we have reported before that figure is probably overstated.

Currency weakness has already made UK business more competitive by more than the cost of any possible tariffs. Let’s be clear,with the global economy facing an imminent recession the timing of a hard Brexit would not be good,but just logically and mathematically not as bad as has been widely predicted.

All the scary economic forecasts quoted in the media do not take into account any post Brexit tax cuts and tariff removal.

It now seems from comments from Boris’s chief advisor Dominic Cummings that this is now becoming official policy i.e. a No Deal Brexit will not be as bad as has been previously made out.

Parliament

The new Prime Minister still, however, has the same old Parliamentary problem, there is no majority for anything, let alone a No Deal Brexit.

Cummings has allegedly briefed Civil Servants that he believes that it is now too late to stop a No Deal Brexit.

If Boris loses a No Confidence vote then he argues the Parliamentary calendar could place a General Election after the 31st October deadline and thus the UK would crash out by default.

To prevent it would require a coalition of disparate parties, including some Conservatives to be able to form an alternative government, very difficult,but not impossible.

It is also technically possible, to have an election before the 31st October.

The 24thof October has been suggested, this would be after the EU summit on the 17thwhich would be the final opportunity for any EU concessions to be tabled. Polls and the results of the recent EU Parliament and Local elections would suggest a 100 plus seat majority (as long as the Brexit Party stands aside)for a No Deal stance.

But we also have to factor in legal challenges in the Courts,as both Gina Miller and John Major have indicated they will challenge any attempt to circumvent Parliament.

It looks like we are going to have an interesting September and October, with Parliamentary and Constitutional crises a strong possibility.

The new Chancellor of the Exchequer, Sajid Javid (an ex-Bond trader and thus very City of London friendly) is also likely to deliver on Boris’s promises.

The pound is already starting to take all of this on board,thus delivering a windfall profit for many FTSE constituents.

US Corporate Earnings

But what really matters is US corporate earnings, if they are going down then so must share prices. The cycle is very mature, a recession is due, Trump’s trade war should be having an impact by now.

We are mid-way in the latest US company results season and this is therefore a good time for a fact check.

On the face of it with 70% of companies reporting a 2.1% increase in S&P500 earnings over the past twelve months seems ok. However, at this stage of the investment cycle we would normally expect growth of around 10%. Moreover, if we dig underneath the big number and look at the industry sectors,all is not quite so good.The majority of industries including the main consumer ones reported falling profits.

Real Estate is always volatile but without the Healthcare sector reporting such a big percentage growth number then the whole index would have been flat to down over the previous year. There is only one reason for this, the trade war.

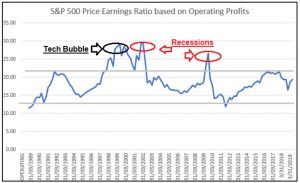

The good news is that the market isn’t expensive.

Over 20 times earnings per share (currently 19.3x) and the valuation risk becomes elevated. But it isn’t also screamingly cheap, below 15 markets become a safe buy. But we must remember this valuation is a function of the profitability of US companies, if profits deteriorate from here(in a recession they will do so very rapidly) then the valuation will quickly move to be expensive.

Whether that happens shortly depends on whether or not a trade deal is signed.If so,then earnings will accelerate and valuations move to become cheap. The markets immediate direction therefore remains in Trump and Xi’s hands!

Markets

In August 2016 China devalued the yuan, this led to a short but painful period of readjustment for global markets.

Will history repeat itself? The last time the markets bounced rapidly, traders will therefore be very wary of being caught on the wrong side of any market bounce.

All it would take is a Trump tweet and the markets could be roiled in either direction.

August is normally a low trading volume month when news flow slows, we have therefore to be careful of extrapolating August events into a trend.

It’s still all about the trade war, if it drags on then the Federal Reserve will have, against its better wishes, to keep cutting US interest rates. But the FOMC members go on holiday in August, nothing will happen on the US interest rate front until September the 18th. So what is there to drive markets, China and trade, that’s all. In the UK Parliament goes on holiday as well. Our guess is that Boris will keep the good news flowing for as long as possible and also ratchet up the No Deal pressure on the EU ahead of the October 17thsummit. Oddly, the UK economy looks to be the only one in the “old world”where any genuine fiscal stimulus will actually happen, despite being much needed globally, especially in Europe!

August 2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.