Global stock markets with the exception of China appear to be asleep. They are stuck in tight trading ranges waiting for a clear picture to emerge from a confusing set of indicators. Growth should be booming around the world, it isn’t.

Inflation should be picking up, it is actually falling. Corporate profits should be ticking along nicely and therefore so should dividends and share prices. They are not; hence markets are stuck in neutral.

What is the US Economy telling us?

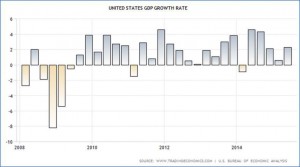

The US is the key driver of the global economy for now and thus the profits of the multinational global business that make up our portfolios. The GDP growth rate for the USA remains a concern. It is showing growth, but the growth rate is flat when it should be accelerating.

It is also inconsistent. The issue seems to be that whilst the US economy is generating jobs, they are low paid and this is not being fed through to consumer spending. We do have to be careful though with such statistics, economies are not linear they are organic patterns of human behavior that are notoriously difficult to predict.

Once the habit of frugality is broken the consumer can and will embark on a spending spree.

Just because the numbers look poor now we can’t automatically extrapolate them into a trend.

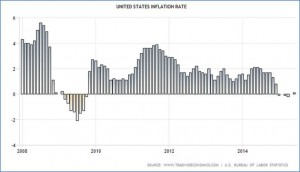

Furthermore, an expansionary economy should be also generating inflation. The fact that the US is flirting with deflation is not the sign of a healthy economy.

Again, we need to be careful with over analysing the inflation rate as oil prices and food prices have been falling.

We are getting closer to the anniversary of the oil price collapse and soon the twelve month comparator will drop out.

This will mean that the inflation number will mathematically start to rise. For food we are also entering an El Nino weather period which historically has led to food price inflation.

What are corporate earnings telling us?

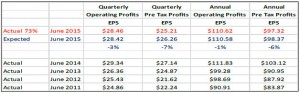

The ultimate driver for markets is company profits and thus the market valuation. US earnings declined during the 1st quarter results season.

A combination of a collapsing oil price hitting a big percentage of the corporate world’s profits and a strong dollar meant that earnings disappointed. Hopes were that this was temporary and the second quarter would see a recovery.

With 73% of the results in, such hopes seem to have been dashed, as the following table from Standard and Poors shows.

This is a major headwind for the cycle.

So far markets seem to be looking through these figures, but there have been downgrades, most notably from Goldman Sachs.

They are now forecasting yearend combined S&P earnings at $114 per share; this would still show growth over 2014 but by only 1.5%. In March the forecast was $118.

The belief remains that this should be transitory. This is because the US GDP numbers continue to deliver respectable(ish) levels of growth.

If oil can recover and the dollar weakens, then these declining forecasts can rapidly recover.

Market Valuation

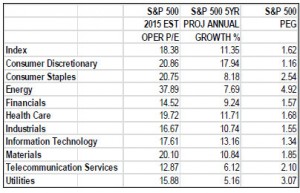

(Source Standard & Poors)

However, whilst it is very poor practice to rationalise an indicator, if we adjust the Energy (oil) number from 38 to say 20 then the overall P/E drops to a far more reasonable 17.

Where we do need to be careful is that the market can only command a high P/E if it is growing at a high rate, which clearly it isn’t at the moment.

By dividing the P/E by the eps growth rate we get the PEG calculation. A good PEG is 1.0 to 1.5; 2.0 and above is expensive.

The current 1 year unadjusted PEG is 12!

BMW

Car sales for the core BMW brand in China fell 5.5 percent in May, their first decline in over a decade in the world’s biggest car market, this is perhaps a more reliable indicator than Chinese government forecasts?

The last time the company had a decline in its BMW brand in China was in January 2005. What is perhaps more encouraging is that across the rest of the world BMW’s core brand sales rose 4 percent in May to 159,000 vehicles, helped by strong demand in the Americas and an ongoing recovery in the European car market. Sales of combined BMW, Mini and Rolls-Royce vehicles rose 5.9 percent to 188,000 vehicles, making it the best May ever for the carmaker, despite China.

In the United States, 4.3 percent more BMW and Mini cars were delivered to customers, while in Europe deliveries rose an encouraging 8.4 percent. So when we dig underneath the headlines things may not be so bad after all?

China

The new headwind for markets is China. This massive economy is growing from a very low level, the GDP per head of population is $3,866 in the UK it is $40,968! The growth potential of this market remains, along with India, the major long term investment theme. The Communist Party’s implied “deal” with the Chinese population is that there will be no democracy but don’t worry we will make you wealthier each year.

Their target is to grow at 7% per annum; the reality is that it is more likely that China is currently growing at 4%. Still very healthy but not what the markets want.

In the very short term the Chinese leadership is brushing the collapse of the casino-like Chinese “A” share market under the carpet, but these losses must be having an impact on Chinese consumer spending as we have seen from BMW and also Apple.

Some commentators are suggesting that this could be the inflection point when the Party finally relaxes its control and lets the market dictate the direction of the huge Chinese economy.

Markets

The summer is slowly drawing to a close; all eyes remain on the dollar and the oil price to see if there could be an early improvement in corporate earnings. Unfortunately, with China in the background and the US consumer on strike, markets may have to wait a while for a resolution of the current impasse. Europe is the only bright spot for now.

Let’s hope they don’t lose patience.

July 2015

Click Here for Printable Version