Year to date markets continue to make progress, this is despite a promising start to the year which was snuffed out by Europe and China’s self-induced slowdown. July however, finished on a positive note as “Super” Mario Draghi, the Head of the ECB, said that they will do “anything necessary to preserve the Euro”. This was shortly followed by Hollande and Merkel saying the same thing. For the first time in 3 years maybe the penny has finally dropped? It is all about confidence and saying the right things. Inspire the markets that you have a plan and that it will all be alright in the end, then the markets will always give you the benefit of the doubt. Here’s hoping!

During July, Bonds were up 1.5%, mature market equities rose by 2.2% and as is typical in rising markets the Far East/ Emerging Markets grew the most, rising by 3.2%. One of the big fears at the beginning of July was for the forthcoming US results season, would the crisis in Europe translate into actual sales falling below expectations for US companies and if not would the Chief Executives sound a note of caution with their guidance for the current quarter? The reality was that 65% of US companies beat forecasts with the rest split equally between matching expectations or were below. The Oil sector had the biggest misses (this sector is notoriously difficult to forecast). The mighty Apple did though fail to meet forecasts as sales of iPhones were only up 25% on the quarter! So once again whilst economies may be struggling the companies that we invest in are doing rather well.

There is a caveat though; these numbers represent the second quarter ending in June so the most recent European crisis has only had a minimal impact. It is the current quarter that may lead to companies seeing sales under pressure from the UK and Europe double-dip. That is why saying the right things is so important for markets, they need to believe that earnings won’t slow down as Central Bank action is ramped up and actually begins to work!

Valuation

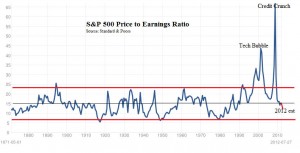

For an index the weighted average of all the constituents’ earnings per share is calculated and then the index divided by the market eps gives us the market’s PE. If a company is cheaper than the market but growing at a faster rate, then more often than not it outperforms the index.

The above chart shows that post the current US earnings season the PE has moved into the “cheap” bottom end of the 140 year range. Furthermore it remains below one of the stock market’s great “rule of thumb”. That is to say if the PE number is either the same or below the growth rate number, then a company should be bought. The PE of the S&P 500 is 13 and the annualised growth rate is 16%, so way below the rule of thumb and thus cheap.

This company only recently floated on the US stock market yet makes no money at all and the little that it does has turned out to be less than predicted. As a flotation it has been a spectacular flop. As a website it has however been a spectacular success. Facebook has staggering 955million regular users, the majority of which are in the very valuable youth/young adult demographic. The big question is how can it make money from this massive and captive market? At the moment no-one knows and the fear is that no-one inside Facebook knows either! But as ever in the markets we have been here before, the same questions were asked about Google, can Facebook repeat Google’s success? This should be a fascinating stock to watch over the next few years.

The Presidential Election

For UK investors the Presidential Election campaign had received very little attention until the Republican candidate Willard Mitt Romney saw fit to criticise the British attitude to the Olympics. He has now been placed in the same box as George W Bush in terms of UK public opinion. But, he could be President of the current economic superpower for the next 8 years and thus gauging exactly what he stands for would be critical to the future direction of bonds and equities. He is from a political family, very wealthy and was Head of the prestigious US management consultancy firm Bain & Co and set up their Venture Capital operations which is where his enormous wealth came from. He organised the Salt Lake City Winter Olympics (hence his presence on London now) and turned it round from an impending collapse. He is a businessman first, politician second, which is probably why he is a bit “gaff” prone and might struggle against Obama’s smooth delivery style.

He is currently on a global foreign policy tour which has not gone well, wrong things were said not just in London but crucially in Israel as well. In a war-weary America right wing foreign policy may not go down well at this time? His home agenda though is about jobs and job creation which is much more market friendly. As a Wall St grandee he will also be bank friendly, but again that may not win him many votes either. So in essence what we have is a clever businessman that does not come across well and perhaps at the moment has not surrounded himself with the best advisors. In Obama he has a formidable competitor but one who is struggling to get America booming again, unemployment down and house prices up. It is Romney’s policies on those issues that will dictate whether or not he gets to sit in the Oval Office.

Markets

Unfortunately and not unexpectedly there is nothing new to add to our prior views on short term market direction. The positives are that earnings are still headed in the right direction; share valuations therefore remain cheap; China is the key to global growth and the news flow from Beijing is increasingly accommodative. Chinese interest rates are being lowered, lending restrictions lifted and markets reformed. On the negative side the US economy is plodding along when it should be racing away, and Europe, despite for the first time some positive noises appearing, is no step closer to reform and thus resolution. So nothing much has changed except the fear of an earnings slowdown has been soothed by the latest results season.

The immediate future is though finely balanced, central bankers everywhere need to do more to stimulate their domestic economies. QE has not been a great success it has helped the banking system but with the banks hoarding the cheap government cash it is not feeding its way into either the economy or so far inflation. Talk is now of non-standard measures. What these might be is of course unclear, though as Ben Bernanke’s academic specialism was the 1930s Depression it might be some sort of direct stimulus. As ever, there is never anything new in investment.

August is a poor month for economic news and decision making with most governments on holiday. For equity markets though, July shows the current trend is intact and that we shouldn’t get “bumped off” the trend by news headlines that sound dramatic but have little impact on company profits. Those profits appear fine for now but we do need Central Banks to start stimulating and soon, otherwise the cycle may turn earlier than it should. But with a Presidential election in the US, new leader in China and at last European politicians facing up to reality markets should get what they want, but might have to wait until September.

July 2012

Click Here for Printable Version