“So goes January so goes the rest of the year”… this old stock market adage has an element of truth in it. Cash is allocated by global pension and wealth funds based on their views for the year and the investment process begins in January, volume rises and gives us a clue as to where the hot money is being placed for the year ahead.

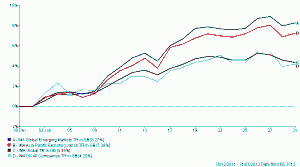

January has seen equities rise between 4% for the Old World and 8% for New World whilst Gilts have fallen by 0.2% and Global/Corporate Bonds up by 1.5%. Markets such as the US are now back to their 2011 highs, it’s as though European debt crisis has never happened. As we know there are no truly accurate predictors in the markets but the performance of equities during January does give us grounds for optimism.

January Unit Trust Sector Performance

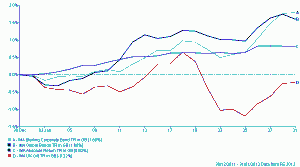

LTRO

It is perhaps no coincidence that the new ECB head Mario Draghi is ex-Goldman Sachs and this is the sort of financial engineering that made them (in)famous. Reports from the markets suggest that the ECB is forcing European banks to take the money. The next LTRO is due end of February and rumours abound that a staggering e1trillion will be borrowed from the ECB, this is not printing money and perversely the majority of the cash borrowed ends up back on deposit with the ECB! It is however all about market confidence, if you hold a 3 year euro denominated sovereign bond as part of your capital don’t worry if no-one wants to buy it as you could always pawn it at the ECB pawn shop at super cheap rates.

This takes the pressure off bond prices and reduces the risk of default as Italy and Spain etc. can issue as much 3 year debt as they like, the buyers will be there. Clever, but yet again just kicks the can a bit further down the road.

The Cycle

We have written at length about the five year cycle that favours equities, the current one started in March 2009 so we have in our mind 2014 as a possible turning point. It may be earlier this time as we have the Presidential Election starting which sees the new/old President in office early 2013. Markets aren’t scientific but sometimes just tend to work out; Ben Bernanke of the US Federal Reserve Bank announced at the last interest rate meeting that US Interest rates will stay low until 2014, exactly in-line with the cycle.

US Results Season

One of the key supports for the markets is the ten year low in share valuations globally. These valuations can only hold good if the underlying companies continue to report healthy levels of growth. The occasional poor economic statistic adds an element of self-doubt in investors’ minds and they seek reassurance from those multinational companies that report quarterly results. Another results season has just passed with of the major’s only Google disappointing. Google is an unusual business making money out of internet site traffic but also increasingly software such as Android for mobile phones and tablet computers which makes their profits hard for the market to predict. However elsewhere from Banks to Car manufacturers all reported robust profits and more importantly good order books as well. Once again star of the show was Apple, in the company’s first post-Steve Jobs announcement, profits were up 118%. Apple’s valuation is now $400billion, but it also has $98bn in cash on its balance sheet, enough to buy Italy, or more accurately pay off the Italian government debt!

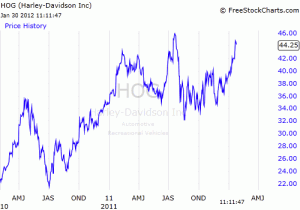

Harley Davidson

Iran

Markets so far appear unconcerned about Iran. Israel has said an attack isn’t imminent, the EU has offered a “no sanctions for talks” deal which looks like it may have some chance of success. However a President who is facing an election with success over Osama Bin Laden, a pull out in Iraq, regime change in Libya and impending withdrawal in Afghanistan might be rolling the dice one last time. The prize of Iran would end a long running sore starting with the Iranian embassy siege and Jimmy Carter’s (a fellow Democratic President) embarrassment. The US now has three aircraft carrier battle groups in the Straits of Hormuz; normally at best they have one. That’s significantly more US fighter planes than in the whole of the RAF and exceeds the Iranian air force by at least 2 to 1 probably a lot more. Throw in Saudi and UAE fighters (who have the most to lose from a closure of the Straits) and Iran is facing big odds. Let’s hope they back down.

Markets

Good US earnings and the LTRO have helped support markets. This is at a time when China is effectively shut down for the New Year celebrations, so we are encouraged but wary. Greece is in a death spiral and rumours are that Portugal will shortly follow. We are also reliant as always on the last piece of news, markets believe that the US is back on course, any sign that it isn’t will be reflected in lower prices. Similarly for Bonds if inflation rears its ugly head the same thing will happen.

But markets always have to worry about something, it is in their nature. When they don’t have anything to worry about that is the time to get out! The supporting factors we talked about last month remain in place and it would seem the hot money believes in them too. So far so good, but it is only one month, another twelve to go yet.

January 2012

Click Here for Printable Version