In 2007 the philosopher Nassim Taleb introduced a new animal into the investment menagerie of Bulls, Bears, and Stags etc. with his concept of the “Black Swan”. Probably incorrectly interpreted, an investment Black Swan event is one that has not been foreseen and therefore has not been “priced into” investment valuations. The idea that long serving Middle East dictators could be unseated by the power of the Facebook generation surely qualifies as such a Black Swan event?

The problem for us as investors is that as history shows in France and Russia what happens in the first stages of a revolution rarely ends up as the long term result. The “Velvet” revolutions of Eastern Europe were more about liberation from the Soviet Union. In recent memory Boris Yeltsin holding back the tanks at the new Russian democratic Parliament springs to mind. So what we have is a new Black Swan event but one that can’t as yet be priced into markets.

There are however two non-democratic countries that are very significant to the Global economic world and they are Saudi Arabia, the key supplier of Oil, and China, the key supplier of growth. Any change in leadership particularly in Saudi Arabia (especially towards an anti-west Islamic state) would have major repercussions for markets as crude prices would rise significantly; Saudi Arabia is the swing producer of oil and is currently pumping extra supplies to keep prices stable. What exactly would Obama do to protect American interests in Saudi Arabia and in particular the Saudi monarchy?

China perhaps we can be a bit more sanguine about? Some sort of democracy is inevitable in China it is a question of when. As countries become wealthier state censorship is hard to tolerate. Frustration at a lack of free speech is a common theme in the Arabic internet- inspired uprisings but so is poverty. China is so rich it might try to pay-off the population and subsidise food etc. together with some minor reforms plus the regular change in the Politburo is also fairly imminent. The Arab countries which are in revolt have very high youth unemployment in populations where the majority are less than 30 years old. China doesn’t have the same demographics or an unemployment problem. Demand for change in China will come not from the young poor but from the educated rich, who also have the most to lose. If China does descend into protest then all the major markets will suffer, the London market for example is dominated by Chinese dependent miners and banks such as HSBC and Standard Chartered; Germany’s car makers would also be hit hard. The international investment world is becoming wholly interconnected as Globalisation takes hold.

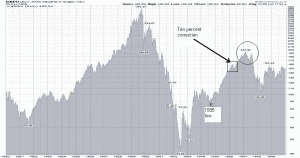

History Repeating Itself?

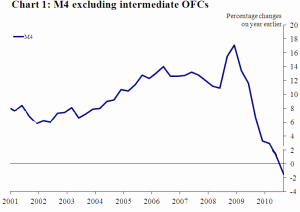

Back in the UK the mess continues. Inflation is soaring yet the economy is stagnant at best, the Government is cutting expenditure and therefore deflating whilst at the same time berating the banks for not lending and yet taxing them more and thus taking away cash for them to lend! The Government is only concentrating on cutting its overdraft it is ignoring the stimulus side of the equation. The only way out of this problem without government stimulus is if the Banks do start to lend again.

Project Merlin is the Coalition’s “magic” solution. Here the banks have promised a pot of gold to British business should they need it, at of course standard (now post credit crunch more expensive) lending terms. That is the problem, it is ok the Government telling the Banks to lend more but the Bank of England is keeping a closer eye on credit quality and many potential borrowers simply will not qualify for these loans. What is difficult for the UK is identifying exactly what the best solution is, the Government cannot afford to stimulate the economy, but also cannot it afford not to? Waiting for the rest of Europe and the USA to start growing again and piggy backing is perhaps the best we can hope for as an economy.

UK Money Supply

Summary

Stock markets do not defy gravity forever but often can give the appearance that they will and complacency sets in. Often a Black Swan flies in over the horizon and markets have to re-price. Only time will tell if the Arabic uprisings will have an impact on the two key non-democratic states of Saudi Arabia and China. There are rumours that anti-monarchy protests are planned in Saudi Arabia for the 11th of March. This creates uncertainty and with uncertainty comes volatility, but this is nothing new and is why we have balanced portfolios with a wide range of assets.

We also have to be mindful that we are not investing for next week or next month but depending on circumstances could be for the next decade or even two. Volatility is a two sided coin it also throws up opportunities to buy the long term growth assets we want at realistic levels.

February 2011