Click Here for Printable Version

The global markets moved on from the pandemic in February. Early signs that the vaccines were actually performing better than expected led to traders calling an end to the pandemic, at least from the market’s perspective.

This means they are now starting to analyse what the implications of the monetary and fiscal response to the economic lockdowns will be.

In a word it’s inflation.

We have written before about the three variables that dictate the direction of markets, these are: the direction and rate of change in company profits; the direction and rate of change in interest rates and finally, the direction and rate of change in inflation. It is a circular pattern as each one depends upon the other.

So far we have had the perfect pattern, the direction is up for profits and down for interest rates and inflation.

In February, as the vaccination drive raised the probability that the pandemic would finally pass, we have seen “expectations” for inflation move up. This is reasonable as both Keynesian and Monetarist economic theories tells us that after a significant increase in money printing and government spending then inflation will be the inevitable consequence.

However, both economic theories were written well before the internet age and the commercialisation of China.

Nevertheless, if markets are being efficient, they have to at least price in the possibility that inflation is on its way.

What does this mean? Ultimately higher interest rates and thus lower corporate profits. In the short term the bond market is where we would see these interest rates rise first and that is what happened in February.

Interest Rates and Inflation

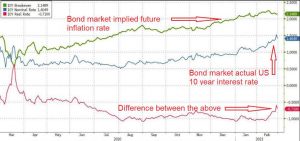

Real Yield of US 10 year bonds (source: Federal Reserve Bank of St Louis)

US Treasury Bond yields are important, they set the benchmark for commercial loan and mortgage interest rates in the US and also indirectly the UK.

The UK economy was always closer at a macro level to the US than Europe and that is even more the case now.

Historically, i.e. since data was first collected c.1899, bond yields have been on average 0.5% above the rate of inflation. Over the past 10 years there have been two recent periods when central banks have allowed, in their words, bond yields to “run hot” and yields were lower than inflation. These were post the Credit Crunch in 2009 onwards and now. If we take the above shaded area and highlight it in the chart below, we can see that the green line shows that the forecast level of inflation in the USA has risen from 0.5% last March (as the pandemic hit) to 2.1% now .

It took a few months as the purple line shows, but the gap got too large and as the vaccines seem to work, bonds had to fall in value to close the gap. There is still further to go. So far the Federal Reserve Bank is making it very clear that they simply don’t know if the virus will mutate again. Also they don’t know what the true level of unemployment will be as and when the pandemic employment protection measures finish.

They are thus prepared to wait and see and if necessary “run the US economy hot”. That is not necessarily the case in the UK but Gilt yields will always follow US Treasuries.

What we can say is that investors are now worried about inflation and that will impact on the equity markets and ultimately, through higher loan interest rates, on the real economy as well.

Valuation of Equities and Higher Bond Yields

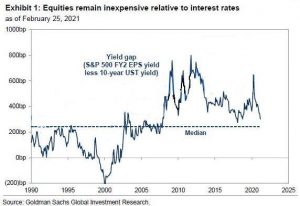

We can directly value equities to bonds by comparing the index Equity Earnings Yield (profit per share as a % of the share price, which is different to the dividend yield) to a bond yield, normally the US 10 year Treasury.

The forecast P/E Ratio for the S&P500 is 22 times earnings, this converts to an Earnings Yield of 4.6%. Using the above number for the actual Bond Yield of 1.5% then as this chart from Goldman Sachs shows the difference at 3.1% is still above the long run average ratio and thus marks equities as being cheap relative to bonds.

Interestingly, if yields did rise to 2.1% i.e. the above Implied Inflation Rate, a difference of 2.5% to equities, this would still make equities historically good value compared to bonds.

Fundamentally, there is room for bonds to fall without harming equity valuations.

It is the ending of QE that would be the big issue.

Rishi Sunak Budget 2021

This the first post pandemic (hopefully) and Brexit Budget and it was important for the Chancellor to send a message to markets that the UK finances are under some sort of control and secondly announce policy decisions that might help the UK mitigate the initial bad impact of leaving the EU and lay the foundations for possible future benefits.

What the markets got was the usual fudge.

There will be a freezing of income tax allowances and a delayed rise in Corporation Tax, offset to some extent by a “super-deduction” aimed at increasing investment.

So the message was to keep supporting those lockdown hit industries for a longer period but also increase the tax burden as much he dared in order to get some extra cash in.

The general rise in bond yields will impact on the cost of funding the national mortgage but this cost is still way below historic norms.

There was though little of the post Brexit “bonfire of regulations” and policy changes.

We suspect that the UK does not want to declare its hand whilst financial services trade talks are still ongoing. There was some relaxation though in Stock Exchange listing rules, which are designed to attract tech flotations and private equity companies.

There were also lots of little pots of money for regional investment and targeted true fiscal stimulus. The main impact was though the continuation of the furlough and other lock-down benefits as well as the Stamp Duty holiday.

The latter keeps the crucial housing market bubbling and the former keeps hard cash in the hands of consumers.

The biggest economic negative for the UK is outside the Chancellor’s hands. The UK/EU trade deal and vaccine success means that the pound is strong against the euro and the dollar.

Remember, house prices and the currency are the two main determinants of future UK economic success. Strong sterling is not good.

Markets

We are now entering a potentially difficult period for global bond and equity markets.

The pandemic appears to be passing as the mass vaccinations take place. There remains a risk that the virus mutates, however, the vaccine developers have shown that new shots, that used to take around 4 years to develop, can now go from concept to approval in 9 months, boosters may take much less.

This means that the markets can accurately price-in the economic implications if significant new mutations do occur.

The virus was the immediate short term issue, markets have now moved on to fretting about inflation.

This is major risk to the new investment cycle. If inflation picks up beyond say 2.5% in the US then QE ends and the markets lose their lifeblood. What is tricky is that Central Banks are flying blind, the phrase they use is how much “scarring” has been done to an economy?

Is high street retail dead; is work from home the new normal; what is true level of unemployment? The reality is that there are many forecasts, but they are all supposition rather than true analysis.

It will take time for an accurate picture to emerge and in the meantime the markets are in guessing mode, in that respect the fall in bond prices and thus rise in yields/interest rates is logical.

We must expect volatility as this price discovery process takes place. Remember in markets it is often better to travel than to arrive!

February 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.