Click Here for Printable Version

We know that the easiest way to beat the wealth-sapping impact of inflation is to invest in the global bond and equity markets.

But as we have often said there is a price to pay.

These markets do not give us an “easy ride” and at times test investor’s nerves, but it is all part and parcel of growing wealth. In normal times we should expect prices to swing around by circa 15% and every 7 to 10 years or so a recession comes along and that can hit equity prices by about 30%.

Painful, but thankfully always temporary. Usually it is about 12 months or so before share prices start growing again. Indeed, historically, the best returns are always in the first couple of years after a recession.

Those that panic out and sell, not only crystallise losses, (rather than just seeing the paper value fall), but also they rarely reinvest in time to benefit from the bounce.

Sensible investors protect themselves from these difficult periods by holding the correct level of cash reserves.

Why is all this important now?

The coronavirus looks as if it has spread globally from China and is close to becoming a pandemic. Last month this was possible but not probable, now the reverse is true.

We are thus faced with another series of big “Ifs”. If it spreads further within the USA will the Americans follow the Chinese and shut down large parts of their economy?

If it does and they do, then a global recession becomes certain. But if it is short and sharp and if the Central Banks react, will the markets look through to the recovery and price accordingly?

Lots of “ifs” and as yet no clear answers, so markets are flying blind and have repriced by c10% very quickly indeed. Where we go from here depends primarily on the rate of growth of infections in the USA, that will dictate the immediate market direction.

Traders might gamble either way investors should not. What fascinates us is that this is all occurring close to the point where we would normally expect a recession to occur.

If the global economy does tip into recession does that coincidently end the current investment cycle virtually right on cue and thus start a new one? This is important as the single best place to invest is always at the bottom i.e. the beginning of a cycle.

Markets

This chart represents a “Balanced” portfolio but using unit trust sector averages rather than actual client portfolios. We have used it before and updated it for the recent market movement.

From the chart we can see that, so far, the present market move just counts as “Normal market Volatility”.

The Black Line is a moving average and acts as a short hand for the trend. If we operated in a news vacuum then it would appear there is nothing to be concerned about. Such charts allow us to place current events into a long term context but cannot be predictive. What it does make clear is that there are two scenarios that are currently in play for the global equity markets.

Scenario No. 1

The virus spreads globally, however, the extent does not warrant the lock-down of business activity that we saw in China.

Some industries such as airlines and tourism will be severely impacted but generally it is business as usual with some disruption that causes a very minor slowdown in economic activity.

Corporate earnings growth will slow and in some economies there might be a very mild recession.

This to some extent would be counterbalanced by Central Bank action and China returning to growth again.

That would all point towards a “Normal Volatility” event, which typically last one to two calendar quarters.

Scenario No. 2

The virus spreads and deepens and forms a true Pandemic. Governments globally follow the Chinese example and shut down their economies. This precipitates a supply shock which causes widespread financial consequences to companies.

These consequences could lead to staff being laid off and bankruptcies accelerating. Bad debts rise at the banks risking a “credit event”.

Sounds dramatic but actually just a normal recession.

Again the impact would be mitigated by Central Bank action and China recovering. This should be reflected in the markets through a “High Volatility” event.

We must note that such recessions that are caused by shocks rather than interest rate increases tend to be shorter than normal i.e. no longer than 12 months.

Which of these scenarios is the more probable? That is very difficult to judge, we live in a modern world of constant risk assessment and we have a media that always presents the most dramatic and worst case. Investment professionals have not seen a virus epidemic of this extent before and thus there is no precedent to follow, it is therefore a very difficult call to make.

We have to remember it is not the virus that is creating the economic risk but the containment measures.

We could also easily have a pandemic but governments allow businesses to keep on trading.

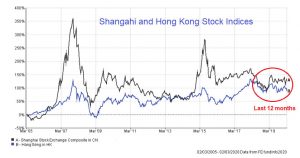

Chinese Market Experience

China and Hong Kong were clearly hit by the coronavirus first and so far the hardest and seem to be through the worst.

China manufacturing PMI has collapsed to 35 which indicates full recession.

Other methods of monitoring Chinese economic activity such as electricity usage and pollution levels all indicate a severe curtailment of economic activity. But this has not been reflected in the Shanghai and Hong Kong stock indices.

It could be argued that Shanghai might be subject to government influence, however, Hong Kong is not.

In the year to date Shanghai Composite is down in local currency (as we write) by 2.6% and Hong Kong by 6.7%. South Korea the next hardest hit economy, with car production currently suspended, is down by 8.9%. All suggestive of a Normal Volatility event?

Markets

Investment time horizons should be quoted in years and even decades rather than days.

Recessions and periods of high market volatility are painful but just part of investing to beat inflation and grow wealth and spending power.

We have long argued that a recession is overdue and clients should have higher than normal cash reserves. Is this “Black Swan” event the one that ends this cycle? Is a whole new investment cycle therefore imminent?

We won’t know until it has actually occurred!

Current equity price action suggests that markets are looking for this crisis to pass quickly, if it doesn’t, then profit expectations, will have to be further downgraded and shares will have to reprice.

Given the virus incubation period we will know more in the next two weeks or so. In China the epidemic peaked 24 days in.

The US Federal Reserve and some Far Eastern Central Banks have already cut interest rates and we have yet to see the full economic stimulus response from China. Hong Kong is already handing out free money £1000 per person!

Markets are now in a period of great uncertainty which is generally not good, we will hopefully get some clarity on the extent of the epidemic over the next few weeks. China seems to be showing that the coronavirus is a temporary phenomenon and as ever in the selfish world of global investing, this will pass. February 2020

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.