Click Here for Printable Version

“So goes January so goes the rest of the year”

the old adage seems to have worked in February as the post US election trends continued. Trump’s early days as President has been controversial, but he has remained quiet on the issues that the markets care about such as deregulation and tax cuts.

Nevertheless, Donald Trump has reignited business optimism and promised a return to traditional means of stimulating the US economy and signaled a move away from relying on the Central Bank.

Markets have responded to this optimism, as they are valued on future profits prices have adjusted to reflect the heavy expectation that corporate earnings will be significantly higher next year than they are now.

However, all this relies on Trump delivering and also that events elsewhere in the world do not dilute his growth strategy.

It is very early days into his controversial Presidency and nothing economically, as yet, has happened.

The probability that he will deliver on at least his deregulation and tax cuts agenda is high, especially given the pro-business orientation of his cabinet and the Republican control of both Houses of Congress. However, there is the danger he will become distracted with other issues and the markets start to lose patience with him.

Bookies have odds for Trump being impeached at 3 to 1.

But it is Trump’s policies that the markets like, not necessarily the man.

Donald Trump v Ronald Reagan

In November 1980, Ronald Reagan was elected President replacing Jimmy Carter. Americans decided that the country driven by economic decline and international embarrassment needed a change.

Trump’s economic proposals of cutting taxes, increasing military and infrastructure spending are similar to Reagan’s.

But there are very different circumstances, in 1980 rampant inflation and low growth had led to a severe recession.

When Reagan was elected, the 10-year Treasury yield was 12.7% due to equally high levels of inflation.

When Trump was elected, the same Treasury rate was about 1.9%, it is now 2.4%.

The Credit Crunch of 2008 has effectively meant stagnation not recession but there has been a similar decline in US industry.

Jobs have been created but on low wages and in Starbucks and Amazon not at Caterpillar and GM.

Interestingly, Trump’s stimulus plan of $500 billion plus per year is substantially bigger inflation-adjusted than Reagan’s.

So Reagan and Trump have similar plans, are both controversial characters, have some similarity in the employment situation but start from very different economic circumstances.

Can we use the Reagan period as a “roadmap” for Trump?

Source: Altaira Capital Partners

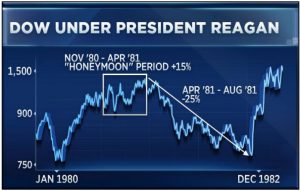

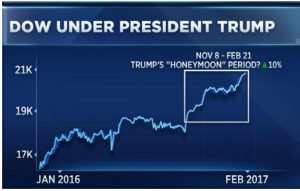

These charts from highly respected Technical Analyst Ralph Acampora highlight that the Dow had a 15% run from the Election Day 1980 until April 1981.

Then, as Reagan struggled to get Congress to implement his policies, the market pulled back, before setting off on a multi-year bull run.

Intriguingly, since Trump’s victory the Dow is up about 10% and on this basis could have further to go. However, could the same thing happen to Trump, might he also struggle to get his plans passed by Congress?

Budget Debt

Trump is inheriting a budget deficit of $10 trillion over the next 10 years and this is before any of his tax cuts or infrastructure/defence spending.

In 2015 Obama agreed a debt ceiling holiday with Congress; this expires on the 15th of March and reverts to a ceiling of $20 trillion.

On current estimates the US Treasury will have $200 billion of “overdraft” left and is currently spending (before any extra Trump stimulus) about $75 billion a month.

So by summer there will be no money left and the US Government will again face a shut-down.

Obama always struggled with a Republican House, in theory; Trump should have “his” party on his side.

But he wasn’t the Congressmen’s choice. This will be his first major hurdle to cross and could be a significant one for the market as well.

Gold

Remember, Gold is not an investment it can’t be valued, it pays no dividend or coupon, it is a gamble.

Traditionally, it was used as a hedge against inflation more recently it tends to move in the opposite direction to the dollar.

So for the price to be picking up when the dollar is being relatively strong is unusual.

This may be due to the Chinese imposition of tighter exchange controls or Indians placing cash rupees into anonymous gold rather than bank accounts as Modi wants.

Also we are seeing a number of risk events happening in March, the above US Budget showdown is one, elections across Europe are another. All might see traders seeking safety in gold?

European Elections

The markets so far seem sanguine about the forthcoming Dutch and French elections.

They feel that Brexit and Trump were Anglo-Saxon issues and the political system in Europe will make it diffuclt for Wilders and/or Le Pen to form a government.

Whilst it would appear that victory is not probable it is also possible. The negative ramifications for either winning lie in an exit from the euro and the EU.

As Greece has shown there is no procedure in place for leaving the single currency and the consequences on the banking system must not be underestimated.

It could cause another credit crunch and widespread bank collapses across Europe.

This is a very high stakes game. As we write Wilders in Holland has the best odds of a victory but is unlikely to be able to form a government, so would be powerless to change anything in Holland.

In France the demise of right winger Fillon and the subsequent rise of more socialist Macron in the opinon polls makes the French Election more unpredictable.

Like her father, Le Pen is unlikely to win the second round, hence the markets seem calm.

Markets

Markets normally don’t pay much attention to politics particularly in Europe as the status quo is so embedded in mainstream European political culture.

Even now markets are not pricing in either a Wilders or Le Pen victory.

Rational analysis suggests the markets are correct, but the same analysis didn’t work for Brexit and Trump.

In the UK, March/April will probably see the triggering of Article 50 and we cannot rule out a snap General Election or Theresa May calling Nicola Sturgeon’s bluff for a second Scottish Vote.

So the markets are facing a number of short term political headwinds.

But any sign that Trump is delivering on his promises will underline the positive long term outlook for equities.

Valuations are coming down and growth is accelerating and even though US interest rates are likely to rise on March 15th they remain very low by historic standards.

Institutions are overweight bonds and underweight equities; over the medium term this will have to change thus raising the possibility of a Reagan/Thatcher style boom.

But, we must remember before that boom there was significant economic pain.

We remain concerned that rising US interest rates are squeezing the US consumer before they get any Trump benefit.

In essence therefore the medium and long term outlook for equities is likely to get very much better.

In the short term though, there are some enormous political hurdles to overcome in the US, Europe and the UK.

February 2017

Click Here for Printable Version