Click Here for Printable Version

2020 passes with the world still turned upside down by Covid-19. Populations around the UK and Europe are locked down and unable to spend, whole industries have been driven to bankruptcy and sadly we seen increased global mortality.

However, markets that had crashed by roughly a third in March are rising strongly with some hitting new all-time highs.

To the casual observer this may appear absurd and is confirmation that the global markets are irrational and just a lottery.

This would, however, do the markets a disservice, ultimately markets look at three key variables: the trend and direction of interest rates (which is down), the trend and direction of inflation (which is down), and the trend and direction of corporate earnings 12 months into the future which they forecast will be up.

Also as we have learnt since the financial crisis of 2008 that it is the size of central bank’s balance sheets and what they are doing with them that dictates short term market direction.

So whilst the pandemic news is bad and not improving, as long as the Federal Reserve Bank of America, the Bank of England, Bank of Japan and the European Central Bank keep printing money then this cash has to go somewhere and as such stock markets will go up.

So far Covid-19 has forced the Central Banks to print money on a gigantic scale and thus had a positive impact on markets.

Clearly, money printing on this scale cannot last forever and that is why the vaccines are so important.

It doesn’t matter to markets that the roll out is fast or slow, it is the fact that they are here that gives confidence, that at some point, this pandemic will pass and the world will return to a new and very different normal.

What will be very important about this new normal is that in most recessions wealth is eroded i.e. through loss of income/jobs and falls in property prices/pension funds, this time it is different.

Your government has shut your job down and has compensated you for it. Some will be significantly worse off from this crisis but many will emerge with their wealth significantly enhanced and with pent-up spending power.

The markets are essentially saying that they have moved on from the pandemic and are focusing instead on where and how this wall of potential consumer cash will be spent.

There are risks of course, the virus could mutate to an extent that the current vaccines do not work or indeed the vaccines have serious side effects.

Thus, the short term will be about the battle between the virus and vaccines and this will dominate the news. But as investors and for the financial world only, we have to shut out the noise of the media and concentrate on what is important for markets.

That is the vast amount of cash being pumped into markets by the central banks is pulling interest rates down and thus equity valuations up. It has been made very clear that this cash will keep on flowing for the immediate future.

If we then throw in fiscal stimulus, a strongly recovering China and a potential virus end date (at some point) then it becomes very clear why some markets are hitting new highs.

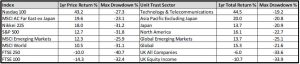

2020 Investment % Returns (Source: FE Analytics)

On the face of it some returns for 2020 have been very healthy, but we have to bear in mind the huge volatility experienced during the year.

As the Maximum Drawdown numbers above show most markets fell by around a third in 2020 as the pandemic first took hold and before the Central Banks stepped in to announce new massive Quantitative Easing measures.

Some markets did better than others, as we have highlighted in prior newsletters those markets with a high tech exposure did particularly well i.e. the likes of Apple, Amazon etc. in the US and Alibaba, Tencent in China.

The UK and Europe does not have any large technology companies in their indices and thus lagged.

Banks, Oil and Mining did particularly badly, hence so did the FTSE100. If we look at the earnings numbers we can see why.

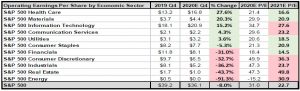

Industry Sectors (Source: Dow Jones S&P)

Just as in war time steel and armaments manufacturers do very well, the same has been true with the pandemic. Clearly Healthcare globally has seen increased demand and thus profits, but so have technology, internet cloud and home delivery companies, all of which are in the Information and Communication Services sectors .

These have seen earnings rise very nicely, as the market as a whole experienced recession-like profit declines.

The Materials sector includes Gold miners which saw safe-haven buying. The problem for these sectors now is that they are now very expensive.

Those with long memories will remember 2000 when there was a severe hangover from the Y2K (computers allegedly couldn’t cope with the 2000 date code) inspired tech party.

Many investors are looking at the Biden administration to boost the “old economy” and get these post-recession earnings numbers growing again and thus the market’s valuation down. This has been termed the “Biden Reflation Trade”. How this pans out will dictate how individual funds will perform this year.

In 2020 unless they had technology or healthcare, funds went nowhere. Will it be the reverse in 2021?

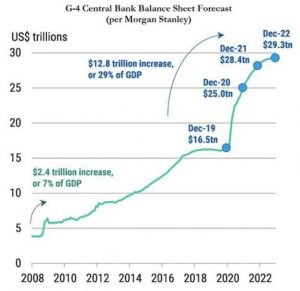

The Market’s Lifeblood: Central Bank spending

This chart shows the enormous boost that the big 4 Central Banks from the USA, UK, Japan and Europe have given to the global economy in an attempt to counterbalance the negative impact of the lock-downs.

This chart from Morgan Stanley and based on amounts already announced, will add up to a staggering equivalent of 29% of global GDP. An amount not seen since the post WW2 Marshall Aid plan.

This outweighs the 7% seen in the Credit Crunch of 2008/09. That period didn’t turn out to be inflationary as the banks received the cash and hoarded it on their balance sheets. This time, money is going directly into the economy.

We have no doubt this will give us problems in the future, but not just yet. Marshall Aid was blamed for 1970s inflation some 25 years later! Central banks have gone “all-in” and will not reverse course unless they really have to.

Nevertheless, when Charlie Munger, the partner of the world’s greatest investor Warren Buffet says :

“We’re in very uncharted waters, nobody has gotten by with the kind of money printing we’re doing now for a very extended period without some trouble and I think we’re very near the edge of playing with fire.”

If we assume the vaccines work then the biggest single risk to the markets and the new investment cycle is inflation.

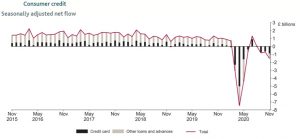

The UK Consumer. Savings ratio and Credit Card debt (Source: Bank of England)

Where might inflation come from? If we take the UK as an example, since the first lockdown house prices have risen by 7%. This is no doubt been helped by the stamp duty holiday but there has also been a change in consumer behavior.

Many office based workers and companies have discovered that with modern technology they can work just as, or indeed more, effectively from home at a significantly lower cost to their business.

This genie is now out of the bottle and will be very hard to put back in. Why sit on a crowded commuter train or the Tube for hours every day either getting infected or infecting someone else when you can work from home?

Especially when the value of a small, highly valued South East property can be exchanged for something bigger and better in the Shires.

Not only have property owners seen the value of their assets rise significantly, (the opposite to the usual 20% falls experienced in a normal recession ) but their bank balances are looking a lot healthier as well.

Clearly, we have to caveat this as some sections of society have been hit very hard, have lost jobs and qualify for very little income support. But for those in work and likely to stay so, as the first chart from the Bank of England shows, the cash in their bank accounts has gone up dramatically from an average of £5billion to a peak of £30billion during the first lockdown.

Not only that, but they have paid down their credit cards as well. What this figure will be at the end of this new lock down is hard to guess but we could easily have over £20-£30 billion of pentup consumer spending, just in the UK!

The UK/EU Trade Deal

The UK leaving the European Union had an emotional impact way beyond its economic one. Hard economic analysis indicated that whilst Project Fear had the amount of goods and services as percentage of UK GDP at 15%, the Office of National Statistics had it at 12% with warnings relating to the “Rotterdam effect” and distortions caused by the export of Germany’s own Gold bullion from the Bank of England to the Bundesbank.

Eurostat meanwhile had it 8%. So if we say the true figure is about 10% and 20% might have been lost due to a No Deal that would be a 2% hit to GDP.

Not good but not that disastrous either. As expected, the usual very last minute deal was agreed and whilst trade in goods with Europe will be tariff-free there will be disruption due to new paperwork etc.

We would expect that as software companies and lawyers come up with clever fixes these distortions will diminish over time. We have also always said that provided the right policy decision were taken it is possible that leaving the EU could be positive over the long run, it is a very big if.

The timing with the current pandemic does raise the risk that the UK government is looking the wrong way at a critical time. What kind of policy responses are the markets looking for?

The only proven economic theory to work consistently is to have no trade tariffs, low taxation and simple and clear regulation.

What intrigues us about this trade deal is the exclusion of many of the City of London’s activities from the agreement. Possibly at the heart of this lies regulation and taxation.

The EU has rules-based regulation which impacts on all economies equally from Cyprus and Malta to Germany and France. This means these rules can be complex and wide ranging.

Historically, the City was based on principle based regulation. Seems minor but it is very significant.

As we write it seems like the City is prepared to give up many “back-office” functions to mainly Frankfurt and Dublin and thus avoid future restrictions. Thus, the City grandees are looking at the long term of London being a sensibly regulated, low cost and very innovative financial centre.

Their timing or indeed luck might be good as Joe Biden will look to restrict Wall St just as the EU is already planning to add regulation and tax which was previously blocked by the UK.

In the immediate future we expect the old EU investment restrictions on large UK insurance and pension institutions to be lifted in order to help fund the post pandemic/Brexit green investment programme that the UK desperately needs.

How are we going to pay for it all?

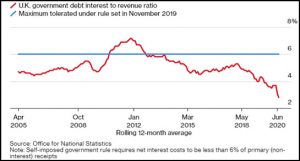

We have shown this chart before and unfortunately it is only updated once a year by the ONS.

Nevertheless, as 30 year Gilt yields are now at 0.7%, despite record new issuance, it won’t

have changed much. What this means in the real world is that whilst the UK’s “mortgage” is significantly bigger, low interest rates means that its monthly repayments have actually gone down.

So Rishi Sunak can keep on borrowing for as long as he likes, for now. But, only as long as inflation remains flat and other countries are doing the same. If the Fed stops QE, all

bets are off, he needs to borrow as much as he can whilst he can! Otherwise taxes will have to rise.

Investment Strategy for 2021

Bonds:

The outlook for bonds depends entirely on inflation. Globally and especially in Europe, yields are below the level of inflation, this is because of central banking buying.

This will only stop if economies race away and inflation expectations rise.

The cross over from the pandemic to normality may prove to be particularly difficult.

UK Equities:

The FTSE100 and FT Mid250 have been left behind, you might think this was due to the trade talks, there may be an element of this, but it is primarily due to the heavy hospitality exposure in the mid-caps and to banks and mining in the FTSE100.

As China recovers, metal prices are booming and the FTSE is starting to catch up.

Sentiment towards the Mid250 has improved significantly post the EU Trade Deal.

Global Equities:

The outlook is now becoming very region specific. The Far East and certain Emerging markets appear to have handled the pandemic better than the West and China in particular is back growing strongly.

As US virus cases continue to rise, we have to wait and see what the new President will do post inauguration.

Will he order a US lockdown, will there be a new stimulus package? With Janet Yellen appointed as Treasury Secretary expectations are high.

Stimulus will see money move from tech to consumer and infrastructure sensitive stocks.

Summary:

In short term we are in a battle between the vaccines and the virus, we need the vaccines to work.

The present rate of roll out means that most expectations are for no recovery in the western economies until the second half of 2021, but this is actually not much different from 6 months ago.

This second wave was effectively already priced in. The vaccines, as we have said many times recently are the key as long as they are working, central banks keep printing money and governments promise fiscal stimulus then this new uptrend can continue.

The last one ended in March 2020 and we are still only 9 months on from that crash. Our roadmap suggests that it historically takes 12 to 18 months before a new cycle starts, so setbacks must

be expected and indeed would be regarded as healthy. But of the historic drivers that we mentioned before, we have ticks against all of them and that is very unusual and positive.

The first year out of a recession is always a difficult and nervous one, 2021 is unlikely to be an exception.

January 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.