Click Here for Printable Version

The Santa Claus rally didn’t happen this year, which is very unusual, the main culprit is easy to identify, Donald Trump.

Since his inauguration he has been the investors friend but not this Christmas.

His criticism of the Federal Reserve Bank interest rate increases, the shut-down of the US Government over funding for a border wall, threatening to sack both his Treasury Secretary and the Fed Chairman on top of his ongoing trade war with China was enough to scare off traditional investors and leave the field open to the trading robots.

We highlighted last month how congested the end of year calendar was for the markets and when the desk based traders left for the holidays the computers took over.

With volumes light, the computers were able to push the indices through mathematical support levels which in turn triggered more selling.

Only when a Trump aide categorically denied that the Fed Chairman Jerome Powell was not about to be sacked, did the computers stop selling.

These events are painful, butare just part and parcel of investing in the stock markets today.

The Federal Reserve Bank of America sets the tone for the whole global economy, the “fiat money” system (paper money with no assets to back it) we all live in relies on trust and confidence, as such the role of Fed Chair is sacrosanct.

It is a sign of Trump’s political naivety that he should make such a comment, sacking the US Secretary of Defence does not have immediate consequences whereas sacking the Fed Chairman has the potential to create a recession out of nowhere.

Hopefully, Trump is getting some sage advice in private from Wall Street and is listening.

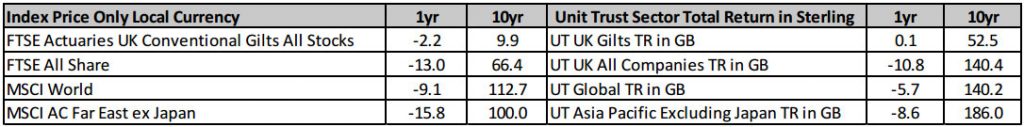

2019 Investment % Returns (Source: Financial Express)

Markets had been relatively weak since May but the returns to UK investors were masked by currency movements, as Brexit inspired sterling weakness enhanced overseas returns.

The headline figures look dramatic, but as the above table shows, when we take the actual returns achieved by UK based unit trusts in pounds and with the benefit of dividends the numbers are not quite so bad, the 10 year numbers remain impressive. It also shows the benefit of diversification.

Global Economy

At the end of the day, as Bill Clinton famously said “it’s the economy stupid”, share prices will always swing around based on the prevailing news flow, that is just a fact of investing life, swings of 15% to 20% sound bad but are untradeable.

By the time you have decided to sell, actually sold, decided to buy back and finally reinvest, in all probability you will be buying at prices higher than you sold at!

So we have to invest and not trade/speculate. What we are investing in is the ability of companies to make a profit and reward us for doing so by giving us regular dividends.

What we have to make a judgement on is how good the environment for company profits actually is, not at present but 12 to 18 months in the future.

We have said before, normally the danger time for company profits is the first year of a new US Presidency.

A boom is usually generated just as voting takes place and then as the new / same President takes office the Fed gets the bad news out of the way early and precipitates a recession to choke off rampant inflation.

We also know that recession induced stock market falls historically have lasted about 12 months and never beyond 18 months.

They are temporary events. For investors relying on their portfolios to fund retirement, cashing-in too early can have profound consequences for their future lifestyle.

So what is the market currently telling us?

Is this pullback just normal noise or does it suggest that there is a recession about to get underway?

It is important to note that the stock market has a recurring “bad habit” of predicting recessions, rarely with any great accuracy.

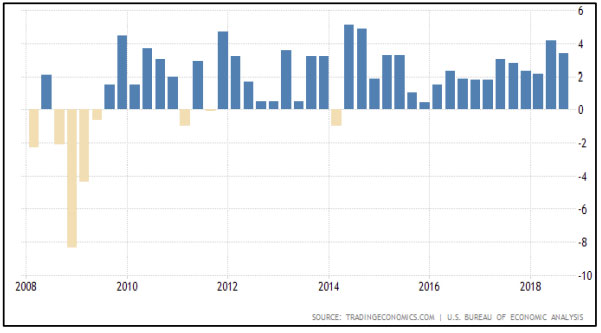

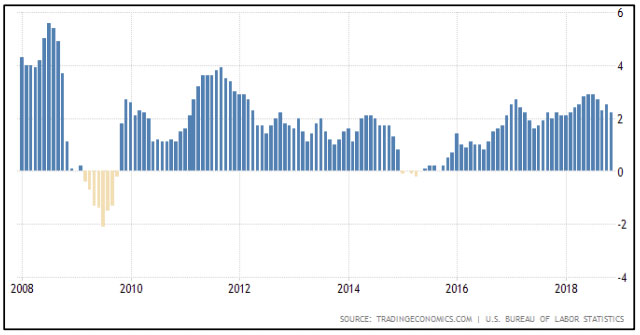

The two key statistics for the economy are GDP growth and Inflation. As these charts show neither is racing away nor collapsing.

US GDP Growth

US Inflation

However, there have been recent reports from some companies suggesting that the US economy is slowing, one example is the US parcel carrier FedEx.

Earlier in 2018 they had upgraded their profit expectations for 2019, but in December they spooked the market by cutting forecasts by over 8%.

They blamed a slowdown in Europe and the UK, but also said the trade war between China and the USA was impacting volumes.

This suggests that the global economy is slowing sharply. The market has therefore taken FedEx to be the “canary in the coalmine”.

Especially as companies such as Apple and Caterpillar have also cut forecasts as costs rise and China sales fall (again due to Trump trade tariffs).

Company profit forecasts should be racing away at this point in the cycle, the fact that they are being downgraded is not good news.

However, it is clear that the main reason behind these downgrades is the trade war.

It is quickly reversible. Another factor is the actions of the Central Banks.

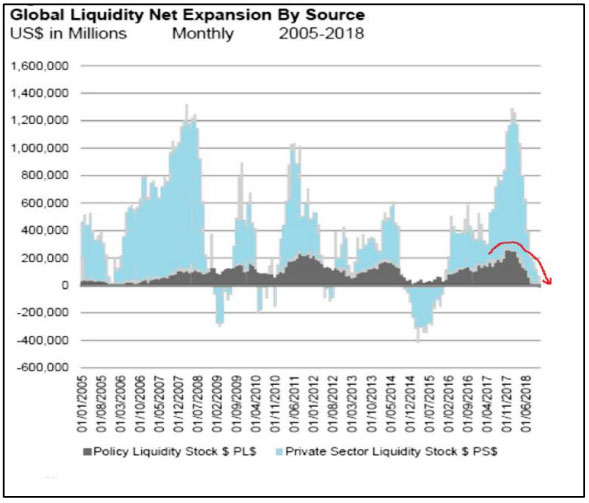

Global Liquidity Squeeze (Source: Zerohedge)

The global economy relies on bank lending to “oil the wheels”. With interest rates so low banks are very reliant on Central Banks providing liquidity.

From this chart the blue bars represent bank lending and the grey bars Central Bank Quantitative Easing.

As the money pot has been withdrawn so has bank lending.

Basic monetarist economic theory tells us that if the supply of money goes down so does economic activity, that is exactly what we are seeing now.

It now seems the global economy was not yet strong enough to cope with a reduction in liquidity.

The Fed has raised rates and is not just ending QE but it has embarked on QT (Quantitative Tightening) this doubles the impact of the interest rate increases.

In a nutshell it appears that the Fed and the Peoples Bank of China might have tightened too much too soon.

But again this can be easily reversed.

So it would appear that we have two factors at play here: the China/US trade war and Central Banks tightening economic policy possibly too much too soon.

They are in fact connected. If talks between China and Trump are successful then the Fed can afford to hold steady, however, if the talks deteriorate and new even harsher tariffs from the US are implemented then the Fed will have to consider easing monetary policy.

This at present is unlikely to be an interest rate cut but an ending of Quantitative Tightening. So either way the markets are a hostage to President Trump’s actions.

China/US trade war

The Chinese had hoped that Trump would be placed under pressure at the Mid-Term Elections and the Mueller investigation might have led to a possible Impeachment, so far neither of these events seem to have weakened Trump’s negotiating position.

But there has been some progress.

The meeting between Trump and Xi at the G20 has given cause for some optimism.

Trump has delayed new tariffs whilst China has lifted sanctions on US Soya Beans and opened up the Chinese market for US rice. The 90 day agreement between Xi and Trump runs until the end of February and talks seem to be underway at present.

Both sides now know that it would be economically sensible to reach a deal.

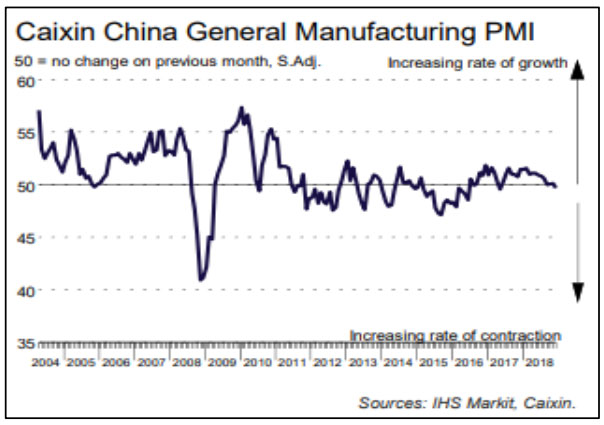

China is slowing, a move below 50 on the Purchasing Managers Index indicates contraction in the underlying economy.

However, it is not falling off a cliff like it did in 2008/09.

So whilst the markets may feel that China might be forced to sign a trade deal they may see it differently.

So far the Chinese Central Bank has injected liquidity into the

Chinese banking market by “tweaking rules” and has not flooded the market, as yet.

This means they have room for manoeuvre should the talks not go well.

But then again so has the Fed.

What is new is that the US stock market has started to worry about the impact the trade war is having on company profits and that does change the dynamic of the talks.

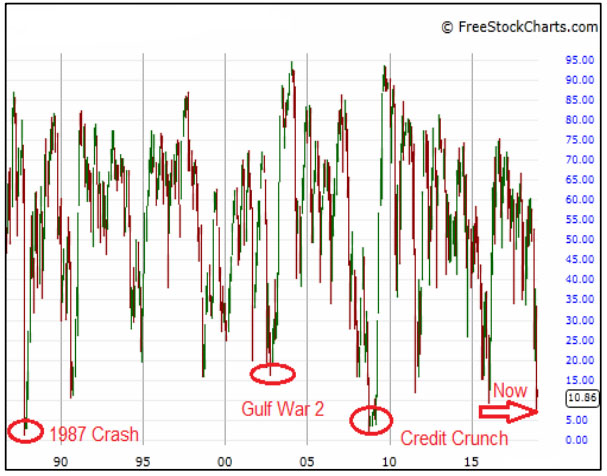

% of US stocks above their long term average

The problem with using profit forecasts to value shares at present is that the forecasts can’t be accurate, if Trump signs a China deal then they are very cheap, if he doesn’t and the Fed keeps raising they could be very expensive!

So we have to use alternative methods in order to judge whether markets

are cheap or expensive.

This chart shows the number of S&P 500 companies that are above the 200 day moving average of their share price.

This average is widely used to define whether a share is in an uptrend or not, why 200 days well that’s roughly a working year.

What this chart shows is that this China Trade War correction, whilst in magnitude is nothing like the crashes of 1987 and 2008, leaves share prices are at an extreme position.

Historically, when share prices reach this extreme position it’s generally a good time to buy

Brexit, Project Fear and a War of Attrition

Unfortunately, the soap opera of Brexit keeps on running, nothing has changed, indeed it now seems to have turned into a war of attrition.

Theresa May seems to be looking to either run the clock down and perhaps try and get last minute EU concessions that will be enough to get the DUP on board and get the deal through Parliament; or bore MPs into capitulating and backing her deal.

Parliament as a whole is biased towards a no/soft Brexit and it now, according to the European Court, has the ability to withdraw Article 50 and cancel the whole process.

Whether they would be prepared to do this without a second referendum is very hard to say.

Likewise, there is considerable debate as to whether the Government could just run the clock down to March 29th and leave by default.

Parliament may or may not have the power to block this, if not, given the lack of Brexiteers it could vote itself the power to do so.

At a guess, if Brussels offers some last minute compromises to satisfy the DUP over the Irish Border question then there is still the possibility this deal could get through.

The markets seemed to have ceased to care, with China and Trump the main focus of attention, the danger to UK shares is if Article 50 is withdrawn the pound will rise significantly, at a stroke that would cut profits for most of the FTSE100.

Most fund managers before the vote were of the view that a Brexit, in whatever form, wouldn’t be good for the UK but then again it wouldn’t be that bad either and that is still the case.

The hard economic analysis regarding Brexit remains unchanged and does not support Project Fear.

The Corbyn risk remains a significant one. He has finally come clean and stated that he is personally pro-Brexit.

He has to be, you can’t be in the EU and nationalise utilities and railways, but why state this now? Corbyn is a shrewd political operator and has not called a No Confidence Vote, yet.

That is probably because he has judged that he can’t win it, perhaps his thinking is to wait for the Conservatives to implode and then push for a General Election?

To win a General Election he needs the Brexit voting working classes, he didn’t get these votes in the last election, hence the change in stance.

Investment Strategy for 2019

Bonds: In the first half of 2018 it looked as if inflation was accelerating and returning to “normal” levels.

The Fed lead the way and increased interest rates, it now seems too quickly.

But what is very unclear is how much of current slowdown is due to interest rates and how much is the Trump Trade War?

Markets like to overanalyse and fret on issues that rapidly go away. If

a deal is done then “normal service” will resume, if not, Bonds will be seen as a safe haven. In the UK, Gilts have the added complexity of the Brexit/Corbyn situation.

A Labour Government would have to borrow lots of hard cash, that will force interest rates up and Gilts down.

UK Equities: The FTSE 100 is driven not by the UK economy but the global one, it will generally follow the US indices. It has lagged due to the industrial mix of the largest holdings, Oil, Banking, Mining an Pharmaceuticals dominate.

The pound drives short term moves, any Brexit inspired weakness does lead to a boost of buying.

We need therefore to watch for a strong pound.

For the UK it’s not Brexit its politics, any hint that Corbyn has an opportunity to get into number 10, will frighten UK markets.

Global Equities: The outlook is dependent on the actions of the US President. It is becoming clear that corporate profits around the world are finally being impacted by the trade war.

Just like 9/11 and the Gulf Wars this is a distortion to the normal economic trend.

There is an increasing risk that if the trade talks fail or carry on too long then by accident the global economy could tip into a short recession.

However, if a trade deal is done then this has potential to reignite the global economy and with share prices at an extreme technical position the bounce could be very powerful.

Summary:

December proved to be painful for global equity markets, concerns of an economic slowdown and thus a decline in corporate profits were exacerbated by naïve comments about the US Federal Reserve Chairman by Donald Trump.

This has brought global shares to a position where they are at a very reasonable valuation.

The doomsters will say that this valuation is illusionary as the global economy is about to dip into recession and thus earnings will collapse and valuations rise.

But this view is predicated on no agreement between the US and China.

What is clear is that both sides should be more motivated than ever to get the deal done.

Markets will now be hostage to every tweet, comment or announcement from either side.

Investment managers are sitting on the side-lines and awaiting developments leaving the markets open to the trading robots.

This has and will lead to short sharp moves in prices. Shrewd investors, structure their assets correctly and feed money in on these dips, the not so shrewd buy at the top and sell at the bottom. 2019 will be the year of Trump, what he does and what happens to him will dictate the day to day movement in share prices. Hopefully though, he will stop commenting on the Fed!

December 2018

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.