Click Here for Printable Version

The global equity and bond markets have fallen sharply since the Russian invasion of Ukraine, they believed that this would stoke, already high, post-Covid inflation and the Central Banks would have to act.

The markets were proved right, interest rates have gone from virtually zero to over 5% in both USA and in the UK. History tells us, as does economic theory, that such moves in interest rates always end in a recession. Will it be the same this time? It is too early to tell, but the signs are not good.

Property on both sides of the Atlantic is falling in value and business defaults are increasing, big name collapses are starting, Silicon Valley Bank and Yellow in the US, Wilko’s over here, there will probably be more.

The cost of interest for many businesses is now a heavy burden and it will only take a relatively small decline in sales or a customer non-payment for a business to fail.

Based on historical precedent, the next couple of months could see the recession start in earnest (Germany is already formally in recession).

However, this is actually good news for investments. Markets operate around 18 months into the future, they have been forecasting this recession since the first tanks rolled into Ukraine and now, should it arrive, markets will switch to pricing in future interest rate cuts, falling inflation and recovering corporate profits i.e. all the key market drivers turning positive at the same time.

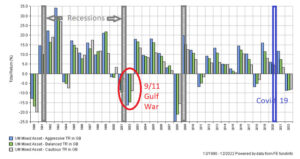

Markets Fall ahead of Recessions

This chart shows the quarterly return form three Mixed Asset unit trust sector averages, Cautious, Balanced and Aggressive since 1990.

What this shows is that historically they have always experienced negative returns just ahead of a recession.

It also shows that they spring back to positive returns as and when it actually arrives. This is the time-shift from the above paragraph.

Only once has the pattern not worked and that was in the early 2000s. Here there was a classic recession post Y2K and just when the spring back was occurring the unfortunate events of the 9/11 attack and subsequent build to the Gulf War held markets back.

So now the pattern is yet again indicating recession and soon. If a recession does arrive then the US Federal Reserve Bank (Fed) can relax its aggressive monetary stance and investment returns should get back to their usual inter-recession growth cycle levels.

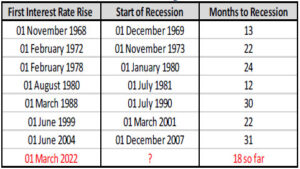

Time between Rates Increasing and Recession

Source: Rosenburg

Global economies are not very reactive to changes in monetary policy, it takes time for the increased interest costs to impact a business and for subsequent redundancies to lead to mortgage and loan defaults.

We are though in the zone where conditions should show signs of deterioration.

Comments from the recent Dallas Fed Survey include: “High interest rates are hitting industrial production like never before…”.

“For the first time in a long time we are seeing customers reduce or cancel orders due to softer end user demand..”.

We have seen broader markets weaken with the exception of Automotive…”. This is all suggestive of a slowdown in manufacturing, based upon falling consumer demand.

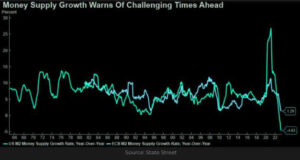

Money Supply and Corporate Lending

In the Thatcher and Reagan years the financial news was dominated by the Money Supply statistics, better known as the M numbers.

Markets watched closely just how much money was being pumped into an economy primarily by the Central Banks. The then new economic doctrine was that too much money supply equals inflation and thus to bring inflation down first you have to bring the money supply down.

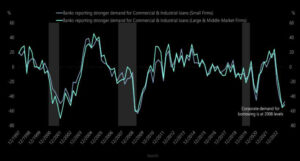

The first chart shows M2 from the Fed and the ECB, whilst the second shows Corporate Loan Demand.

If companies aren’t demanding credit then they are not investing and that isn’t a good sign for an economy. The magnitude of the numbers doesn’t matter, it is the pattern that counts. The current rate of change of Money Supply/Corporate Lending across the US and Europe is nearly “off the scale”.

It is below/equal to the Credit Crunch of 2008/09. Furthermore, loan demand has never been at this level without being in a recession.

If economics is right, then a recession does now seem to be a high probability. That for the markets is actually good news. The Central Banks would be forced to cut interest rates, especially given that for the US 2024 is an election year. Remember, interest rates go down, bond and stock markets go up.

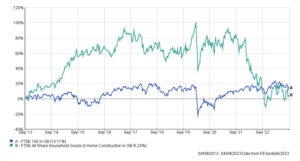

UK Housebuilders

In the UK housebuilding shares, such as Persimmon, Barratts, Crest Nicholson and others have fallen by c50% in value in 18 months. Effectively, as this chart shows, giving back all of the past 10 years of outperformance compared to the FTSE 100. There is no mystery here, high mortgage rates have killed demand for new houses.

Housebuilding shares have the lowest valuation in the UK stock market and are valued close to the market value of their land banks.

This is not unusual and was the same in 2008/09. House sales are down as are selling prices, but mainly at the high end. Rightmove suggests it is primarily 4 bed and over, in the South East where the pressure is most intense.

When markets do start a new Bull phase, it will here that we will see it first.

Markets

Markets and survey-led indicators such as the PMIs have been pointing towards an imminent recession for some time, but so far there has been no hard data to support this thesis. Historic analysis does though suggest it is too early to know for sure, either way.

If a recession is coming, it should now be very close. Inflation continues to fall and is now running, on a monthly basis, at normal in the USA and close to normal in the UK.

If economic conditions do deteriorate, then central banks will be under pressure to cut interest rates and at a pace much faster than is currently priced-in by the markets. The current view, in both the bond and equity markets is that there will be no recession and interest rates will remain higher for longer. This view is at odds with what economics, the surveys, the money supply and also the corporate lending figures are suggesting.

Much now depends on the hard data, the inflation numbers must stay low, whilst other economic news must be generally negative. If this is the case, the balance of probabilities will continue to point to a near-term turning point.

September 2023

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.