Click Here for Printable Version

We are still waiting for a US/China trade deal, this has the potential to be the defining market event of 2019.

As we write meetings are imminent which means Trump might not be able to help himself and will try to “turn the screw” at the last minute. This may work in the US real estate market but who knows how the Chinese will react?

In the UK the long-feared political crisis seems to be approaching, the Local Election results were bad for both the Conservatives and for Labour and could force Theresa May and Jeremy Corbyn into a compromise Brexit deal around a Customs Union, it must be noted that Theresa May’s deal already includes a form of Customs Union.

The problem is,even if the party leaders could agree a compromise would it win support from their respective parties?

The most important event of the month was the US corporate results season.

We don’t invest in politics or Presidents we invest in real companies and their value goes up when their profits go up. The previous season unexpectedly reported a fall in profits and there were real fears that the April season would disappoint as well.

The reality so far is that there has been modest growth and reassuring comments from Chief Executives,hence share prices have bounced nicely.

One aspect of the season that was notable was the continued struggle of the automotive companies to cope with the climate change targets,are they moving too little too late?

Climate Change

Much is currently being written in the media about climate change, academics meanwhile debate if the climate is changing due to carbon emissions or whether the current warming is just part of the natural rhythm of planet Earth.

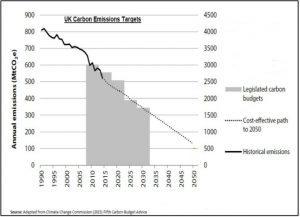

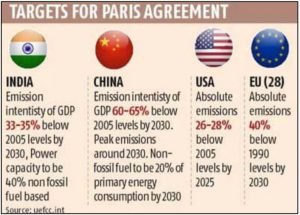

Rightly or wrongly, Governments have though taken the former view on board and agreed to reduce future carbon emissions,as the above charts and tables show.

This is already having a significant impact on business and has the possibility of killing whole industries as well as creating new ones. It is easy for a government to offer platitudes and make promises, but making that future a reality will require a lot of work. But,as a report from the University of Technology Sydney highlights, the future demand for the metal ingredients in batteries must therefore rise significantly.

Notably, lithium is needed for batteries used in vehicles and energy storage,as well ascobalt, manganese, and nickel.

Electric vehicle motors rely on rare earths, as do the generators inside some wind turbines. Solar panels take up a significant share of the world’s supply of tellurium, and gallium, along with silver and indium.

Most renewable technologies also require large quantities of copper and aluminium.

This report calculates the expected demand for 14 critical metals if the global economy were to achieve limiting global warming to the Paris Agreement target of 1.5c.

To do this would require 100 percent renewable energy and no petrol or diesel vehicles by 2050.

A very tall order and one that most protesters don’t seem to realise is already underway.

In this scenario, the demand for lithium and rare earths for electric vehicles alone will exceed current production rates by 2022.

Cobalt and nickel demand will also be higher than current production by2030.

It gets worse. By mid-century, even in the most optimistic scenarios, the battery sector’s cobalt appetite is projected to exceed known planetary reserves, whilst lithium demand will have used up at least 86 percent of known reserves.

The key word here is “known”,mining prospecting will have to increase, but also metal demand will have to spawn a whole new and massive recycling industry.

The shortages are already being felt, Audi has had to delay the launch of its new E-tron model as BMW and Mercedes have allegedly “hijacked”battery supplies from LG Chem.

It is easy to protest about climate change,it is very difficult to put the demanded solutions into practice, there are already seismic movements underway in many industries,especially the automotive.

US Earnings Season

Markets heaved a collective sigh of relief as company after company beat pessimistic expectations for profits in the first quarter.

As the below table shows, after growing nicely during 2018, the aggregate profit of America’s 500 most valuable companies dropped sharply in the final quarter.

With presently just over 70% of results in the aggregate has not only grown (in a quarter hit by very bad US weather) it has also beaten the same period last year. Given that some bond market indicators are suggesting a recession is imminent this was very encouraging.

But for the outlook we do come back to Trump and the Federal Reserve Bank. We must remember the markets have rallied as the US Central Bank halted its policy of tightening monetary conditions.

There was probably not enough in this set of numbers for the Fed to start tightening again, but it wouldn’t take much more. The Fed traditionally doesn’t move during a Presidential Election, so the markets will be hoping that for now the data is just “warm” enough to keep profits going up and the Fed sitting on its hands i.e. the classic Goldilocks scenario.

Modern Monetary Theory

One of the consequences of the current Parliamentary chaos is that we may have another General Election.

Also over in the USA the Presidential election process is just beginning.

The problem the Labour Party and the US Democratic Party both have is that it is perceived their stated policies rely on increased government spending at a time when debt levels are very high and private individual’s disposable income is static.

How are they going to pay for it all without raising taxes for middle income earners?

In the USA, Democrats have found a solution in economics and it will be safe to assume that Labour will hit on the same idea in the UK.

This is Modern Monetary Theory or MMT.

In essence, MMT allows a government to borrow as much as it likes, (or even print money),as long as it is spent in the “right way”.

Classical economics states that printing money ultimately leads to 1920s Germany style hyperinflation, as seen in modern times by Zimbabwe, Argentina and presently Venezuela. But MMT advocates claim if the extra money is spent in the “right way” then it won’t be inflationary.

A good analogy would be that if an individual borrows money from a bank that he normally couldn’t afford and spends it all on holidays and fast cars then he and the bank will ultimately have a problem.

If however, he invests the money and achieves a return greater than the interest/capital cost then it is actually a sensible and desirable thing to do(the “right way”).

The question is,can politicians be trusted to invest wisely and not buy votes by spending on the political equivalent of trinkets i.e. using MMT as the “Magic Money Tree”.

Markets

May normally marks the beginning of the end for the markets positive seasonality. We must assume that barring a few last minute shenanigans Trump and China will agree a trade deal which will have a positive impact on both economies.

Trump may then turn his attention to the global economy’s major problem, Europe.

By the end of the month the European Parliamentary elections will have taken place,with it is believed a big swing to the right, possibly helped (if the UK local elections are any sort of a guide) by a sizeable contingent from Nigel Farage’s Brexit Party, which was not in May and Juncker’s script.

We might get a Brexit deal between May and Corbyn but will it pass Parliament? Both leaders now need Brexit out of the way,but their respective parties might not let them achieve it.

The odds of a second referendum do seem to be increasing.

For the markets though it’s still all about the China/USA trade talks, expectations remain high and the markets are hopeful a resolution will be agreed soon. The danger is that a potential deal is delayed either through intransigence on the part of the negotiators or by Trump himself.

By doing this he risks delaying the good news until the markets enter the summer doldrums, in which case traders could use any bounce to take profits.

For now though, company profits are back rising and that is the best news for the markets, though a trade deal and an end to the Brexit nonsense would help as well!

May2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.