The equity markets remain in the doldrums, as we enter May it will be a full year where the FTSE100 has effectively gone nowhere. It is though understandable, as the support of QE is withdrawn we need profits and the economy to accelerate, this is happening but at a glacial pace. So far the markets have been patient, but underneath the apparent calm there have been some sharp sell-offs in the high profile, new-economy names such as Amazon, Google, Facebook and Netflix.

Traders have got bored and as the cycle is maturing have moved to the side-lines for now. As investors though we can afford to wait, we have valuation on our side. Fundamentally, nothing has changed from last May to now, valuations have got a bit cheaper but the markets believe for now in the Goldilocks scenario (which we talked about in a recent Market View) “not too hot, not too cold” and if anything remain slightly pessimistic about the outlook for the global economy.

Our view remains that this is a risky stance as it assumes “that it is different this time” which of course it never is. One recent development though has been the return of the mega takeover or merger.

Corporate Takeovers

We have had a number of mega deals in the technology world such as Facebook buying Whatsapp but we have been missing good old fashioned takeovers.

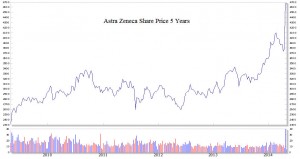

This is where a company receives an unsolicited takeover or merger offer sometimes from one or even two competing companies. We have just had two come along, GE of America and Siemens of Germany are bidding for French electric engineer Alstom (which includes parts of the old UK company GEC). Pfizer another American company has made a bid for Anglo Swedish drugs firm AstraZeneca.

The circumstance behind each proposed deal is different but the drivers are the same. The bidding companies are flush with cash, shareholders are pressurising them to do something with this cash or pay it back as special dividends.

GE, Siemens and Pfizer are thus trying take out competitors at what they see as reasonable valuations. What does this mean for the markets? It confirms that valuations are cheap, it confirms that Chief Executives are finally emerging from their post Credit Crunch “bunker mentalities” and once one company sets the ball rolling then a competitive process takes place and we get more and more deals. This is good news for now, but we must point out this only happens towards the end of the cycle. So as we have said for a while, whilst we are not there yet, the turning point of the cycle is slowly and inevitably coming.

High Frequency Trading

Market investors and traders have for years been complaining about the growing impact of computerised high frequency trading. High profile US author Michael Lewis has just a published a book about this very subject and this has stimulated the US legal authorities into action. What exactly is High Frequency Trading?

The name covers a range of trading strategies but the concerning one is known as “front running” and is outlawed in most markets. This is where a client places a buy order and rather than filling this order, as he should, from his existing stock of shares the broker’s computer goes into the market and buys the matching amount and then sells it immediately to the client at a higher price. The broker has taken no risk, held the shares for a nanosecond and made a guaranteed risk free profit. But his “duty” was to get the best possible price for the client.

A further complication is the practice amongst some brokers of “Dark Pools” where clients of that broker can match orders that are too big for the market amongst themselves, fine in theory but in practice the broker’s computers now have information by which they can manipulate market prices

and make low risk profits to their advantage. Supporters of such practices point to dealing commissions now being very low and market spreads (the difference between buying and selling prices) also being very low. But as investors rather than traders what concerns us is that a share price is a fluid entity and every day there is a “price discovery process” that finds a fair level for each share.

These practices are impacting on this process. Share prices used to reflect what someone was prepared to pay, with the advent of derivatives the practicing of “shorting” i.e. selling shares you haven’t got in the hope that the price goes down so you buy them back at a lower price, greatly increased volatility.

Now computerised trading on a massive scale is adding further to this volatility. We know that over the short to medium term share prices are effectively random and unpredictable; it is only over the long term that value wins out. Since Michael Lewis’s book was published the markets have pulled back, Goldman Sachs has closed its Dark Pool and the FBI and SEC are investigating.

It may mean that spreads will widen for day traders, but if this reduces volatility and reduces the risk of “flash crashes” (when the computers go haywire), it is potentially a good thing.

Emerging Market Valuation

Mexico is growing rapidly through deregulation yet is valued the same as IBM. Malaysia, the same as Facebook, South Africa with all its gold miners is worth the same as GE.

Clearly there are risks, especially political ones, as Russia is at the moment reminding us, but as investors we have to ask “is it in the price?”

Readers of last month’s Market View will hopefully have picked up that you tend to make more money when you buy cheap markets than when you buy expensive ones. It pays to be a contrarian rather than simply buying last’s year’s best performer.

Markets

Since peaking on the 22nd May 2013 the FTSE 100 is unchanged. This is despite the greatly improving UK economy, as rising property prices drive down unemployment and increase wages.

What this shows yet again is the “disconnect” between the UK stock market and the UK economy. We do though need to watch Gilts and Corporate Bond prices; these have held up well as the markets take the view that interest rates are lower for longer.

But, we are entering a period of political instability; the rise of UKIP threatens to dilute the Conservatives traditional vote, just as Labour is moving to a very market unfriendly leftist stance.

Throw in Scottish independence, which if voted for would lead to a dominant and possibly unassailable English Conservative majority; we can thus see that uncertainty for the UK economy is increasing and as we know markets don’t like uncertainty. As we enter May we will undoubtedly get the usual “sell in May, go away, don’t come back ‘til St Ledger day” headlines, this is clearly not practical for long term investors and does count statistically as just “noise”. With the big technology names falling some will argue that May has come early this year. Ukraine will dominate the headlines, but whilst markets don’t like wars economically it is not that significant.

What will focus the market’s attention is deflation across Europe. The ECB needs to do something and the markets would like some form of QE (just as the US QE tap is being turned off), whether this is practically and politically possible in Europe, or more accurately Germany, only time will tell. “Super” Mario Draghi needs to act, just a question of how and when. This could be big news for the markets. Meanwhile the equity markets sit and wait for the global economy to accelerate, so far, patiently.

April 2014

Click Here for Printable Version