The stock market recovery that began in February continued into March. At the end of the first quarter of 2016 the FTSE 100 is now virtually unchanged on the year. Star performers were the markets of the Far East/Emerging Markets who are up around 5% year to date.

Such rallies are commonplace, they are just part of the normal rhyme and rhythm of investing in equities, but, there has been something notably different about this bounce. Since the Credit Crunch of 2008/9 such bounces have been led by the FANGs i.e. Facebook, Apple, Netflix and Google, this rally has been led by mining shares such as BHP Billiton and oil stocks such as Exxon.

It would appear that investors were selling technology stocks on the way down and buying beaten up miners and oil stocks on the way up. Is this just a trade or is this something new?

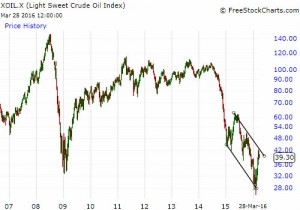

The catalyst for this rally has been the bounce in commodity prices and crude oil in particular, which is up about 50% from its extreme low, but is this “for real”, is it just the computers messing with the market’s psychology again?

Copper and Oil

These charts show that whilst the magnitude of the oil and commodity rally is big in the long term scheme of things this, so far, just qualifies as “noise”.

As we know, markets work on the basis of what might happen next year and not on what is happening now. For the rally to be genuine and sustained we do need a significant belief that either production capacity is being drastically reduced or demand (particularly from China) will climb again in 2017.

Whilst there is no such hard evidence, as yet, there is though the feeling that the oil market in particular will see a better balance between supply and demand. Demand has not collapsed, it continues to grow, especially in the emerging markets, it is just that US shale supply has dramatically increased supply.

But exploration has now been cut and capital investment slashed (without such investment in new wells supply will naturally reduce).

The “nodding donkeys” are being switched off as their farmer owners can’t sell the small number of barrels they produce, and the heavily borrowed shale oil and “frackers” are approaching crunch time.

But does the possibility of a better equilibrium in the oil market justify a bounce of this magnitude or are there other forces at work?

Spring Redetermination

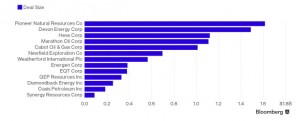

The US shale oil and gas industry is dominated by relatively small companies that are borrowing heavily to fund the development and production of oil and gas fields.

It is these companies that the Saudis have targeted by flooding the market with cheap oil. They can borrow around 65% of the value of the proven reserves in their licensed areas and this value is based on the prevailing price of oil. The banks revalue these assets twice a year in spring and autumn, and adjust the size of their loans accordingly; this is called the “redetermination”.

When the oil price was in the $20s there was a real risk that the majority of these companies would have been wiped out, and the associated bad debts could have caused the still struggling global banking system a very serious problem.

After the recent rise in the oil price this risk has been much reduced. The cynical might suggest that a big rally in the price of oil, just at the “right time”, is perhaps a bit too much of a coincidence?

The bounce in the crude oil price has persuaded investors to put approx. $9billion of fresh capital into these companies. Now some of this new money might be allocated to buying a competitor or even new wells.

However, it is more likely that it will be used to pay down the debt these companies owe to the banks and the high yield bond market.

So again the cynical may suggest that the rise in the crude oil price has been particularly helpful, especially to the banks who have managed to offload their very significant risks to equity investors.

UK Politics

The Conservative Party has a long history of self-destruction and the old saying that a government with a weak opposition will oppose itself seems to be coming true.

The Cameron/Osbourne team may have made a very critical policy error by attempting to reduce disability related benefits.

Far from garnering support ahead of the Brexit vote, they seem to have antagonised an already divided party. For investors this adds to the risks associated with a possible Brexit.

For the first time the bookies odds have moved, albeit slightly and sterling and gilts did come under pressure. Not only does the Chancellor need to find some money from somewhere to replace the projected benefits saving but the team needs to re-establish itself politically.

The Brexit uncertainty remains, the markets assume it will be an easy IN win but that still requires perfect political execution from the Conservative leadership, the market can’t afford for them to make many more mistakes.

Caterpillar v Nike

The new middle classes of the emerging markets want a Mercedes or BMW, use various Apple products and they dress smartly in Burberry and casually in Nike.

This chart shows the relative performance of Nike compared to Caterpillar. What interests us is that after their last set of results Nike shares went down after good profits and yet Caterpillar’s went up on poor profit numbers.

This is known as divergence and is a key sign that the markets might be changing focus.

Markets

As the first quarter of 2016 passes oil has been the key driving force for the markets, share prices followed crude oil down and then back up again.

We are concerned that the rally in oil may not be based on market fundamentals and so is at risk of falling back.

There has, however, been a significant change in the underlying tone of the markets. Investors are now ignoring the FANGs and looking at stocks and markets with very low valuations and huge economic recovery potential.

Again this might be based on sand, but if the new quarter starts as the old one has ended then “fear of missing out” will take over.

Markets have recovered nicely and importantly the long term trend has held firm. The Fed remains supportive of markets as few now expect many more US rate increases this year. Valuations remain rich but for now investors are scenting a profits recovery, let’s hope they are right.

March 2016

Click Here for Printable Version