2013 was a good year for equity investors and, for once, a bad year for bond holders. The FTSE was up by 14% but Gilt prices fell by 7%. But we must not get carried away. The average long term return from equities including dividends is 9.5%, but we know that on average we get five or so good years followed by a bad one and a half years.

Given that, in the bad years, equities can fall by a third, the good years mathematically have to be better than average and this is just what we have had, nothing special, just normal investment business. What was also unusual about 2013 was the wide variation of returns from global equity markets, with both the US and Japan up by 26% but the Emerging Markets were down by 6%. These returns reflect the distortion of QE, 2014 should be the year, hopefully, when QE finally comes to an end.

The Last Cycle

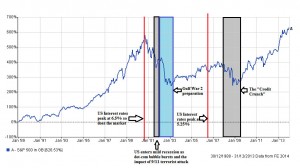

Where we are in the cycle dictates where we should be investing. The above chart covers the last 25 years of the S&P 500 and gives us some clues as to what to look for in the future. The key facts are as follows: The Red Line. A significant rise (but not the first) in interest rates will bring the equity cycle to an end. Grey Box, Recession. Equity prices fall before the recession starts, shares are valued not on current profits but on estimates of next years, the market will anticipate a recession before it starts.

Blue Box, War. Equity prices hate war/conflict, particularly if it is anticipated and hasn’t happened yet. The long run up to Gulf War 2 distorted the cycle. So we have to ask ourselves where the next Red Line will be, remember this is not necessarily the first interest rate increase but the peak of the interest rate cycle, i.e. the rate at which it triggers a recession, and we also have to watch out for the “wild card” of war.

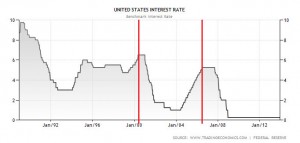

US Interest Rates

would receive interest of just 1.7% p.a. for the next 10 years.

With QE being tapered this rate has since risen to 2.9% currently, thus causing capital values to fall. However, Ben Bernanke has promised to keep the Fed Funds Rate at current levels to beyond 2014, and 2015 is a Presidential Election year. So in essence we are not near a Red Line, yet.

Global Growth

Simply multiplying this final number by 4 and comparing to the annual rate tells us who is accelerating and who is stuck in neutral. The leaders are highlighted in blue i.e. USA, China, UK, South Korea, Indonesia. The losers are Europe and the emerging economies of Brazil, Russia and India. The question is, with QE ending will the US drop back? Also will Chinese market reforms help or hinder their growth?

Gilts and Bonds

For cautious investors Gilts have been the bedrock of portfolios, especially during the traumas of the Credit Crunch. As the Coalition finally got its act together (or possibly waited until the optimum time to stimulate a housing boom for the next election) and introduced the Funding for Lending Scheme and the Help to Buy Scheme, optimism about UK growth has increased.

In London at least, growth is back on track. The odds of QE in the UK ending and interest rates rising have therefore increased, to the detriment

of gilt prices. Whether UK rates rise in 2014 will depend on the inflation statistics. Whilst the high street is full of discounts, utility bills, and train fares are rising and will be reflected in the RPI calculation. As we have seen, Gilt prices have already started to fall in 2013 and with the 10 year Gilt yielding 3.2% prices are discounting the end of UK QE. However, the current level of growth is undoubtedly fragile and with the ending of the Funding for Lending Scheme and rumours of the large stock of newly built houses outside the South East not selling, QE might just end up being around for some time. Much will depend on growth elsewhere in the world. The coalition has finally kick-started a recovery but whether it remains and blossoms will depend on what happens in the US, Europe and China.

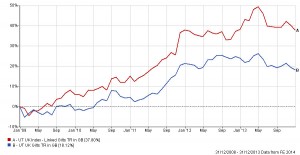

Gilts and Index Linked Gilts

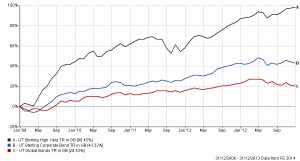

Corporate, International and High Yield Bonds

The bond sector covers a wide range of assets including overseas government debt and corporate bonds. Generally speaking both Corporate and International Sovereign Bonds produced a poor total return in 2013 for the first time since 2009. Riskier, High Yield Bonds, which tend to follow equity markets, attracted support as investors chased income.

The immediate future depends upon US growth and interest rates, if the market believes that the current level of growth is sustainable then bond yields will rise in expectation of a quick end of the taper and the Fed Fund Rate to rise earlier than expected. Any slowdown in growth and International Bonds will rapidly return to favour. The bond market is at a tricky point and in 2014 could see it move in either direction.

Equities

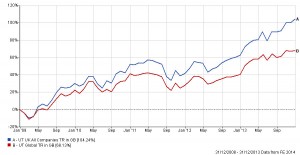

UK Equities and Global Equities

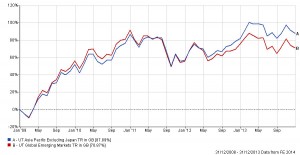

Far East and Emerging Market Equities

Equity markets produced mixed performances. In the UK the Mid Cap Index was the star performer and helped the Unit Trust Sector to produce a total return in excess of the FTSE 100 and World Index. After a strong initial run up to May the markets of the Far East and other Emerging economies were for once left behind after being the top performers from 2009.

There are several reasons for this, firstly China slowed its growth to choke off inflation and this has had a knock on effect on the other emerging economies who supply China with minerals, wood and food. We can see from the above growth table that Russia, Brazil and India have dropped down the rankings.

Secondly, in May, China showed the Chinese banks who was in control and deliberately created a mini credit crunch. The debts levels in the Chinese “shadow banks” and local governments are high but in theory should be manageable. Markets though don’t like uncertainty and the Chinese reforms whilst very welcome and very positive in the long run do cloud the immediate outlook. With other markets doing well investors are taking the easy route for now.

Markets don’t like war and as far as China is concerned the Second World War against Japan is unfinished business and various disputes have become more elevated recently with the extension of a military flying zone. China suffered terrible atrocities and has never forgiven Japan. However, both countries no longer have imperialist ideologies and are focused on making money, so the last thing they want at the moment is armed conflict. China has a huge army and air force but technologically is behind Japan’s mainly US-sourced kit, and war is no longer about who has the biggest army. So whilst sabres will rattle, both sides will face-off for now. But as China gets richer and more powerful we have to be aware that this hatred will be in the background.

Property/Absolute Return

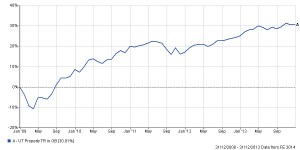

Property has finally started to produce positive returns. London “trophy” properties continue to see cash investment from the super- rich moving money to a perceived safe haven. Industrial and Shopping Centres are showing signs of life as the banks start limited lending again.

Property

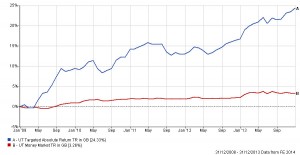

Absolute Return compared to Cash

The small but evolving Absolute Return sector did okay. There are a wide range of strategies used here. Those funds that can “short” the market struggled whilst those that invest in currencies and commodities (Macro Funds) did well. These are all vehicles designed to diversify away risk within a balanced portfolio, the fact that in an excellent year for equities they still produced positive returns is actually good news. This is what they are designed to do, producing steady returns year in year out.

Investment Strategy for 2014

So what are we looking for in 2014, in a word growth? We need economic growth to continue and in some areas accelerate. Without growth then company profits will stagnate and forward valuations will start to look expensive. In the US whilst the taper has started, it is flexible and can be accelerated or halted, especially if the US consumer remains in hibernation.

Ben Bernanke will hand over to Janet Yellen but with an election not too far away the desire to create a recession will be limited. In Europe there is no growth and with new European banking rules starving companies of credit this is unlikely to change without a major strategy change from the

Germans. China is in transformation, the reforms are an unknown entity. Whilst they are to be applauded for long term global economic prosperity in the very short term the execution risk is elevated, especially with the shadow bank’s and local government debt levels being high. The emerging markets depend on China, if Chinese manufacturing picks up, either for exports to the US or for internal consumers, then Brazil and Russia et al will ride on the tail of this growth.

The cycle remains intact for now, there are no signs of an immediate pick up in interest rates but there are risks. The taper may tip the US back into low growth, if so bonds will rally and equities sell off. However, the probability of this happening is low. The biggest short term risk may be the Chinese reform process. Change is good, but might just produce some casualties along the way.

Equity valuations remain cheap, central banks accommodative and yet there is still plenty of pessimism around which perversely is positive

for the stock markets.

So in terms of client portfolios we will be watching to see which way the growth conundrum works out. Any sign of inflation picking up in the US and UK then we will need to protect Cautious investments by switching into shorter dated bond funds or even money market funds. At the Aggressive end, we will need to monitor whether the last six months performance of the Far East and Emerging Market funds is an aberration or the start of a trend. China will be the key here, as will US economic growth.

If the US consumer starts spending then the factories of the Far East and Latin America will have to “crank up” production to supply them. If growth stutters then bonds will rally.

January has initially started well as the hangover from the usual Santa Claus rally has yet to hit. But “proper” trading is only just getting going and traders are desperate to pull prices back. But as the big institutions plan their strategies for 2014 and with bonds producing negative returns for the first time in many years, the temptation to increase exposure to equities will be hard to resist.

This should underpin stock markets in the absence of any new news.

December 2013

Click Here for Printable Version