November saw the election of the most important person in the world, not Barrack Obama but Ji Xinping. Ji is the new President of the People’s Republic of China and for investors is far more important than the President of the USA. The global economy needs growth and China’s on-going industrial revolution is the epicentre of global growth.

What happens there impacts on stock and bond markets everywhere. This once in a decade handover (officially for five years but always “re-elected” for another term) followed months of political infighting within the Communist Party. The other election in the USA saw the pollsters proved wrong with Obama winning a significant majority. Obama not only won the support of African and Hispanic Americans but crucially women under 38. The Republicans are becoming increasing marginalised from many sectors of American society and have clearly not been helped by the Tea Party faction wanting to move them further to the right. This is important in American politics as winning the “poplar vote” gives a majority party the moral high ground. This could prove to be very important in the current negotiations on the “US Fiscal Cliff”

US Fiscal Cliff

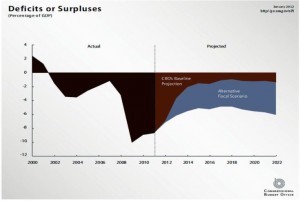

This is a phrase that has come out of nowhere but has the potential to scare markets. Just as in the UK the USA is spending more than it receives in tax revenue. This is known as a budget deficit or as we would know it, an overdraft. Like any individual, governments have a banker that is lending them the money, but it is not a single bank it is the markets or more specifically the Treasury Bond market. As long as the market believes that there is a plan to pay off the overdraft and bring the National debt (the USA’s mortgage) down then it will happily keep on lending by buying Treasury Bonds.

The US agreed a plan between the President and Congress (2011 Budget Control Act) but with hindsight this programme was too severe and if fully implemented would push the fragile but recovering US economy back into recession, especially as Tax Cuts are due to expire at the same time. But unlike the UK they do have options and there are talks underway to step back from austerity.

These negotiations are fraught with politics. The Republicans smarting from their drubbing in the election want to force Obama into a climb-down on Medicare; the Democrats want to tax the wealthy. Obama has the Senate on his side but the Republicans hold the House of Representatives and can block any proposal. Our guess is that Obama will play hardball and push it to the last minute.

Not great for markets in the short term, but a deal will be done, as it always is. In the meantime negative news flow and political wrangling could upset markets. As at November 30, Obama is supporting an undeclared amount of spending cuts, $1.6 trillion in higher taxes over ten years, and cuts of $400 billion from Medicare and other benefit programs over a decade. Furthermore, Obama wants to include “an extension of the 2 percentage point payroll tax cut” and spend “at least $50 billion” in 2013 “to boost the economy.” The question is where to raise these taxes from and what impact this will have on US consumer spending.

UK Pre Budget Statement

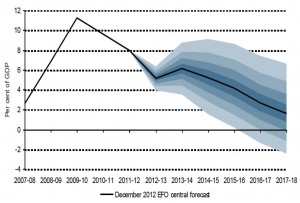

To summarise the UK’s financial mess is easy, a stagnant economy that needs stimulation by government either through tax cuts or infrastructure spending but the same Government can’t afford to do that as it is too much in debt, and to make matters worse is already spending far more money than it brings in. To solve it is very hard.

Meanwhile the National Debt (the mortgage) still keeps getting bigger and is forecast to continue to do so. The OBR’s latest stab at a forecast (superceding all their previously wrong ones) estimates Net Debt will peak at 80% of National GDP in 2016/17.

If HM Government seeks to increase revenue by raising taxes this will slow the economy down further, thus making the situation worse. Cut spending, not even Margaret Thatcher managed to do that. Raise taxes too much, then government reaches a tipping point when a higher rate becomes counterproductive, as perception that a high rate is unfair leads law abiding tax payers to find alternative solutions.

Add in a coalition partner that wants to tax the rich for social reasons rather than cash flow ones and it is perhaps unsurprising the UK is in the mess that it is in. George Osborne has tried in this speech to raise more money from wealthier (not necessarily wealthy) taxpayers, appoint more tax inspectors to chase down corporate and personal non-payers and put a few pennies back into household budgets by increasing the tax free allowance and scrapping the fuel duty rise. Overall it won’t be enough; this is another “kick the can down the road” exercise in doing something but not much. What is needed is radical reform, but, if the Tories are minded for such an exercise their Coalition partners are certainly not. As before, Cameron and Osborne are waiting patiently for the US, China and the Emerging economies to begin booming again and hope that the UK can capture just of bit of their “magic fairy dust”, this would then get our moribund economy growing enough to cut taxes in time for the next election.

Markets

For 16 out of the last 20 years December has been a positive month for share prices. Much will depend on the US Fiscal Cliff talks and how much public arguing there is before the inevitable deal is done. US consumer spending will be important as well, after 3 years of being thrifty will the raft of new electronic gadgets such as Amazon Kindle Fire, Google Nexus and the iPad mini tempt the US public to start spending again? We are also starting to get positive economic statistics from the Far East with Purchasing Managers Indices in both China and India pointing to an expansion of manufacturing activity, good news. In the meantime we still wait for a Spanish bailout request and we are still overdue another Greek crisis, seems like a while since the last one? The Santa Claus rally may be slightly later in the month this time due to Options/Futures markets having a much later Expiry Day but all things being equal hopefully we should have a good end to what has been a very positive year, despite all of the bad news we seem to have had this year!

November 2012

Click Here for Printable Version