“October is often the most difficult month for markets” and so it proved to be.

Investors had become used to share prices rising in a steady fashion and forgot that big percentage swings are normal and to be expected. Markets were already fretting about the end of US QE and then a combination of falling oil prices and poor economic news from Germany brought the “deflationists” out of the woodwork.

But markets move not on news but on the physical trading of shares and bonds; for a lower price to be struck a trade needs to take place. What we also saw in October was some very unusual patterns of trading which appears to have exacerbated this volatility. Computerised share trading, lack of liquidity in the high yield bond market and peculiarities in the structure of hedge funds made the initial sell off sharper and deeper than normal.

However, the good news is that the long term investors took advantage of this dip and bought. The rebound was as sharp as the fall; the mind-set is “buy-the-dip” which means the Bull Market is intact.

Germany

We know that Europe has been struggling for some time; we almost expect bad news from Spain, Italy and France. We also know that southern Europe is bailed out by the robust countries of the north, Germany, Holland, Denmark and the Europe’s emerging economy of Poland. So any news that suggests that Germany is struggling is not at all welcome.

Indeed, recent Purchasing Managers Index data has shown a contradictory uptick in activity. We should also remember that Angela Merkel stated that sanctions on Russia, for their actions in the Ukraine, would hurt the German economy and it would seem she was correct.

For example, Ford has seen sales collapse in Russia and has put its Russian assembly plant on short time working which has impacted on its German component operations.

So is it deflation or the impact of sanctions which could be lifted at any time?

Oil Price

The deflationists also point to the collapsing oil price. This, they say, suggests that global demand is falling due to slowing growth and therefore the global economy, post QE, will end up looking like Japan, long term no/low growth.

The oil price has indeed fallen but there may be another explanation? Saudi Arabia is forcing the price of oil down; this seems to be in order to put political pressure on Iran and Russia.

“To pressure Iran to limit its nuclear program, and to change Russia’s position on Syria, Riyadh will sell oil below the average spot price at $50 to $60 per barrel in the Asian markets and North America, says Rashid Abanmy, President of the Riyadh-based Saudi Arabia Oil Policies and Strategic Expectations Centre.

The marked decrease in the price of oil in the last three months, to $92 from $115 per barrel, was caused by Saudi Arabia, according to Abanmy.”

Both countries depend heavily on oil exports for revenue, and a lower oil price means less money coming in. The break even oil price for Iran is estimated to be $140 and for Russia over $100 so with Brent Crude at around $84 the financial squeeze is severe. It would seem that the Saudi’s are trying to pressurise Putin, perhaps in return for the US dealing with the Islamic State?

The knock-on effect is that gasoline prices (in the US at least) are falling at the pumps, at circa $3 per US gallon prices have fallen by 10% in a month and are now at their lowest for over 4 years.

This is very important, as Thanksgiving is approaching and the Black Friday shopping day; this is the day after Thanksgiving which is the busiest shopping day of the year for Americans. Having more money to spend could be just the boost the US economy needs? The consumer both in the US and UK remains in hibernation, with mortgage worries and no pay increases they lack confidence. This will change, it is just a question of when, and falling gasoline prices might just be the trigger they need?

London Housing Market

We have written before how the London residential market is being hugely distorted by the impact of overseas cash investors. Foxtons, one of the leading estate agents in London recently reported that the London market was cooling. They state that…

“Although the longer-term outlook for London property markets remains positive, the market is expected to continue to be constrained for some time due to political and economic uncertainty within the UK and Europe, tighter mortgage lending markets, and mismatches between the price expectations of buyers and sellers.” This is the first mention of politics and with the General Election due next year and both EU membership and immigration high up on the political agenda, overseas buyers may choose to invest elsewhere or at best wait and see what happens.

The London property market was not replicated across the rest of the country. The Bank of England’s problem of how to cool the London property market without hurting the rest of the UK may have gone away for now. Importantly, this means the timing of the first UK Base rate rise may have been pushed out again.

Harley Davidson

Remember, a Harley Davidson motorcycle is a pure discretionary purchase and whilst it is expensive, is not so costly that only the super-rich can afford it.

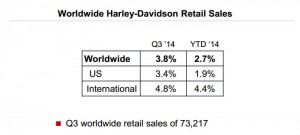

This slide taken directly from the results presentation shows that sales continue to progress nicely. Over 73,000 new Harleys were bought during the quarter; European sales were up 1.7%, which was mainly the UK, Far East by 13% and Latin America by 7%. So we have a pattern of strong

growth in the New World, steady growth in the US and UK, flat in Europe.

Once again a reflection of global GDP; this suggests that the New World is the place to be.

Hedge Funds and High Frequency Traders

Part of the volatility in October was due to the impact of computers in the markets. Unemotional and working through complex algorithms these trading systems can greatly increase market volatility just at the wrong time and cause “flash crashes”.

These are unnerving because participants don’t know whether it is a flash or a proper crash and without the human interaction that the old trading floors allowed, makes short term trading a very tricky business. Also the banks are no longer allowed to trade for their own accounts so another layer of safety has been removed from the markets. Most long term investors accept that this is just the price you have to pay to get the best returns, but for Hedge Funds utilising paired trades with automatic stop losses this could be disastrous.

Rumours are that some big Hedge Funds got caught out in the October volatility and may have to shut up shop!

Markets

November marks the beginning of what is normally the best period for share prices, Thanksgiving in the US, which is at the end of the month, traditionally starts the Christmas share price rally.

But this will be the first November for 5 years without some form of US QE. Markets are hoping that the QE baton is about to be passed to Europe, the odds of this happening are however slim.

The Europeans are pragmatic and maybe we should expect other measures to stimulate European growth instead? As the weather starts to get colder we will need to watch what Vladimir Putin is planning.

He may yet annex Eastern Ukraine and threaten to cut the gas off if Europe responds with sanctions? In the short term this remains a risk to markets. The falling oil price may make Putin think twice. As ever, much will depend on US economic stats, the markets want to see signs that the consumer is starting to spend again, this is a common problem not just in the US but UK, Japan, China and especially Europe.

The big investors showed their confidence in the growth story by “buying-the-dip”. This confidence needs to be supported by economic reality. With falling gasoline prices as the US holiday season approaches, the odds that this that this may actually happen look reasonably good.

October 2014

Click Here for Printable Version