As 2015 draws to a close it could turn out to be a pivotal year for the global economy. This has been a year of confusion for markets, good economic statistics in the US and UK suggests that company profits should be strong but the reality is very different.

The US is probably about to raise interest rates for the first time since 2008 when Europe, China and Japan are easing monetary policy. This dichotomy is unusual, but as ever, will sort itself out.

As long term investors, periods such as this are irritating but unfortunately normal.

December is normally one of the best months of the year so there is time yet for this to be a positive year for UK Equities. But much depends on the US Federal Reserve Bank meeting and the message it sends for 2016.

Our view remains that future economic growth is dependent not on decisions made by the Central Banks but by individual governments and domestic banks.

The Triumvirate

Growth historically has come from the triumvirate of:-

- Central Banks being accommodative with Monetary Policy, i.e. cutting interest rates and QE

- Governments stimulating through generous Fiscal Policies, e.g. tax cuts, infrastructure spending and deregulation

- The domestic banks “greasing the wheels” by accelerating the supply of money through increased lending

We have only the first of these in place at the present time. The western economies might have “got away with it” if China’s growth had been stable.

For now though it isn’t and they haven’t. Stimulative strategies from governments are few and far between. Even the much lauded e315bn Juncker Plan in Europe, has been slow to get going, mired in the usual Brussels “red tape”.

Governments around the world have neither the cash e.g. the UK; the political mandate i.e. the USA, to provide the fiscal stimulus that is needed.

As governments slowly get their finances in order and the realisation dawns that Central Banks are running out of options this will come.

The banking sector as we have talked about before is slowly getting there, but, cannot make money with interest rates at current nominal levels. Perversely, the banks needed QE to rebuild their balance sheets but can’t make a profit whilst it is in place.

The transition phase, which is where we are at now in the US, will be difficult but necessary if the global economy is to return to “normal”.

A reversal of the heavy regulation may also be needed; punishing the banks for 2008 may be politically advantageous but not if the economy remains weak

Buy 2 Let

Much has been made of the recovery in the UK house market, with London properties in particular showing spectacular levels of growth.

However, in George Osborne’s recent autumn statement he followed on from his previous reduction of tax relief on Buy2Let income with an increase in the cost of buying new properties by adjusting the Stamp Duty rate.

Subsequently, Bank of England Governor Mark Carney highlighted that Buy2Let lending was a risk to financial stability; he said the FPC would decide on whether to tighten affordability criteria “by the end of the year.”

He is concerned that Buy2Let investors have a shorter time horizon than owner occupiers and may exacerbate a falling market.

Since the collapse of 2008/09 there has apparently been a nice recovery. Against that, it is still significantly below the earlier peaks despite the UK population rising significantly over the same period.

So that is good in the respect that the mortgage market still has plenty recovery left in it.

What is bad is that since 2008, as the Bank of England recently reported, buy-to-let mortgage lending has increased by over 40% since 2008.

“Over the same period, the stock of owner-occupier mortgage lending rose by only 2%.”

Hence the Chancellors concern and focus on Buy2Let.

Market Valuation

We make no apologies for revisiting the S&P 500 valuation yet again, it is critical for the immediate outlook for the equity markets.

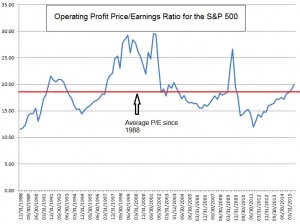

This is particularly the case as the first chart shows that the current historic Price Earnings Ratio for the S&P 500 has moved into expensive territory.

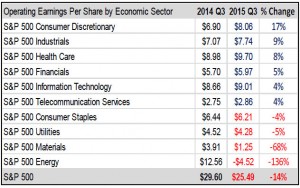

However, if we dig deeper into the actual earnings numbers from the recent reporting season (shown in the corresponding table), we can see the massive collapse in the profitability of the Energy (Oil) sector.

This was far worse than the markets were expecting. Conversely, the other sectors actually did a little better. So the reality is that the underlying market is healthier than it may appear.

A reversal in the earnings numbers of the big oil companies would rapidly move the market’s valuation back to cheap.

OPEC

Given that oil has a big impact on the valuation of the market the recent chaotic OPEC meeting in Vienna does not bode well for an immediate recovery in the price. But we must remember a low oil price keeps inflation and thus interest rates low.

It also puts hard cash into the back pocket of global and especially US consumers. There are currently few signs that this windfall is being spent, yet.

Consumers though, have only a two year financial memory, as wages pick up and outgoings drop and houses rise in value, the temptation to break the “thrift habit” will increase.

Around the world there are few glimpses that the consumer may be awakening from hibernation. China though did see an increase in the rate of growth in retail sales for the first time in several years, at a time when the US and Europe’s rate of growth remained flat. We do need this to pick up and soon.

Markets

As we enter the last month of the year we also approach one of its most significant events, the Fed meeting on the 16th.

Since 2008 interest rates around the world have been slashed to nominal levels. This has only been possible as the inflation numbers have remained persistently low.

In the USA, however, job creation has been good and wages are starting to rise. Historically, this has been an early indicator that inflation might return.

US interest rates don’t normally rise ahead of Christmas but the Fed’s window is limited, as increasing rates during a Presidential election might be interpreted as showing political bias.

This potential move has been flagged for such a long time that it must be priced into the markets by now. The message from the Fed seems to be that further increases will be “low and slow”.

If correct this should suit the market just fine.

We remain concerned about the valuation of the markets as we have a high P/E ratio at a time when company profits are likely to be down by 5.5%. The market is still relying on hope; hope that improving GDP growth in 2016 will lead to a recovery in corporate profits.

There remain lots of issues facing the markets, with oil and China top of the list, but as we said last month, as long as investors believe that 2016’s corporate earnings will be up on 2015 then they will keep on buying.

We do though need this market to remain hopeful, the Santa Claus rally normally starts after the Futures contracts expire on Friday the 18th, let’s hope Janet Yellen doesn’t spoil Christmas.

December 2015

Click Here for Printable Version