Click Here for Printable Version

Just as the long awaited China/USA trade deal was signed and optimism was unleashed, along came a very serious flu virus to bring markets back to reality.

China was supposed to drive economic growth forward from here but instead this latest virus has led to an effective “lock down” of the whole Chinese economy.

Chinese oil demand has dropped by 20% indicating just what damage this is doing to the global economy. The timing is not good either with the first cases announced during the Chinese New Year holidays. Whether this has the potential to trip the world into recession depends on the rate of growth of new cases.

A continued, prolonged, expansion could lead to bankruptcies and thus bad bank loans rising which would not be good.

We do, however, have a stock market roadmap to follow. We have had outbreaks of flu-like viruses before, with SARS in 2003 perhaps the most comparable.

Nevertheless, the coronavirus is different, it seems to be less deadly, but more contagious, so is likely to be far more economically disruptive.

Commodity markets are already seeing the impact, but for example the lack of Chinese tourists and their associated spending power will hit many retailers even in the UK, it is noticeable that the airlines and luxury goods companies have seen their shares hit the hardest.

What markets want to see is a plateau in the rate of growth of new cases. As soon as this happens they will start to price in the economic rebound.

Coronavirus and Markets

What is fascinating about this chart is the sheer number of epidemics the global economy has experienced since the 1980s.

What is also clear is that there is little, if any, correlation between the timing of these events and stock mark returns.

Credit must be given to modern healthcare as the infamous Spanish Flu of 1918 has not been repeated in the western world.

It is of course always possible that coronavirus does turn out to be far worse than it currently appears, but based on what little we know so far, it isn’t probable.

Stock markets are forward looking mechanisms, they seek to “price” future corporate profit growth.

This growth level was accelerating. It will now be how long this outbreak lasts and in turn what impact it has on profits that will dictate the immediate market direction.

History tells us these events do pass and for the corporate world at least things do return to normal. Often these severe events can act as a stimulus to future economic growth as pent-up demand spurs spending. Markets have pulled back, but then they had experienced a particularly strong run.

The Chinese markets were closed for the New Year holidays, which was subsequently extended. Once they reopened they had some catching up to do and fell by about 10%.

This was actually less than normal volatility. We should expect share prices to swing by about 15% from the mean each year, the fact that they haven’t recently isn’t normal. In global stock markets everything, always “reverts to the mean”.

China and the Global Economy

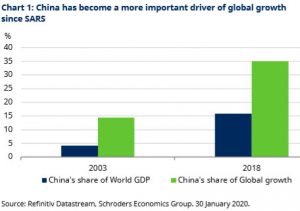

In 2003 the SARS outbreak didn’t have any meaningful economic impact outside China and Hong Kong. But, as this table shows China was then a much smaller percentage of global growth, it is now over a third of growth and 15% of total GDP.

A sharp slowdown in China is therefore not good. If the outbreak continues for a significant length of time, the levels of disruption must have a negative impact on China’s trade partners, especially the rest of Asia, Australia, and Germany.

Irritatingly, global manufacturing had just started to recover but it is now in danger of being derailed, especially if Chinese component supply is disrupted.

Central Banks which had just started to think, post the trade deal, that their job was done are now on full alert.

US Presidential Election

The single biggest factor in the timing of the Investment Cycle is the US Presidential Election.

Incoming Presidents like to get the bad news out of the way early in a term of office and often the US Federal Reserve Bank uses it as an opportunity to choke off inflation and slow the US economy down.

We need to be aware that this point in the Presidential lifecycle can be a high risk one for markets.

Whilst the vote is not until November the election process starts in February as the two US political parties vote to choose their respective candidates.

The markets are assuming that Donald Trump will be the Republican candidate, however, who his Democrat opponent will be is up in the air at present.

The opinion polls have former Vice President Joe Biden in the lead with left-wing Bernie Sanders very close behind, lagging are Elizabeth Warren and Pete Buttigieg.

Biden and Buttigieg are considered by the markets to be business friendly, the others not so.

There are a series of caucuses (local opinion poll votes) which are not binding, but historically have been accurate pointers to whom the Party Conference will confirm as the candidate.

Any sign that Biden/Buttigieg are going backwards and Sanders/Warren forwards in the race may well unsettle markets.

Markets

There is an old stock market adage “so goes January so goes the rest of the year”. Let’s hope not, markets had started the year strongly but then came news of the coronavirus.

The FTSE100, for example, ended the month down by 3.4%. However, we also had the important US company results season.

What we mustn’t lose sight of is that markets are fundamentally driven by corporate profits and with 61% of the S&P 500 having announced their 4th quarter 2019 results, we can now reassess the market’s valuation. Clearly, these numbers were still being impacted by Trump’s trade tariffs and the ensuing US consumer “buyers strike”.

Overall, operating profits showed no growth over the previous quarter, however, when compared to the fourth quarter of 2018, profits were up by nearly 12%, which is very good.

This makes the Price to Earnings Ratio (the key market valuation) 20.5 times, not cheap but not expensive either.

If we can get past the coronavirus quickly and global trade reverts to normal, then markets can continue on upwards.

But as we have seen, China is critical to global growth and if it remains in “lock-down” for a prolonged period of time it may well have negative consequences for the whole global economy.

With oil demand down by 20% it is a clear indication just how important China is.

Markets are watching the infection numbers very closely, they want to see a slowdown in the rate of infection and preferably a plateauing.

This virus, apparently is not as deadly as SARS but easier to transmit, that could make it far more disruptive to the global economy.

Markets are though looking for this crisis to pass quickly, if it doesn’t, then growth expectations, which were looking good, will have to be downgraded and shares will have to reprice.

At the same time markets will be watching the Democrats closely, if Bernie Sanders continues to rise in the polls, markets will start to get nervous.

January 2020

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.