After January’s stock market traumas, February saw a strong recovery in stock markets. The FTSE 100 rose by 3.8% and the beaten up Far East by nearly 7%. Ostensibly the main catalyst for this was the sharp recovery in the crude oil from very low levels.

As always, whilst this was the primary reason quoted by the investment media it was part of a cocktail of factors that lead the short term speculators to close out their negative bets and switch to the long side.

Remember the markets are fretting that a recession is imminent, led by a collapse of the oil exploration and production industry and a fall in Chinese consumer demand.

The evidence we got during February was that corporate profits outside the Oil and Mining corporations were robust and whilst Chinese manufacturing output may be contracting the services side was growing nicely.

If we then add in Saudi Arabia and Russia at least talking to one another then the traders decided that prices, at least for now, had fallen far enough and banked their profits.

These traders like to use price targets to define their risk and one way they do this is to analyse share price patterns.

It was therefore no surprise that the point they chose to take their bets off the table was the bottom end of the current S&P 500 trend.

As the chart below shows this price point combined with the slightly better news flow consequently February ended up a positive month for shares.

The Trend is Your Friend

Using complex mathematical algorithms and superfast telecommunications these traders allegedly jump in front of genuine client orders and can create sharp market movements such as those we saw in August last year and again in January this year.

This can be painful but as long term investors we should disregard these moves, the key, as ever, is the profitability of the many hundreds of multinational companies that ultimately make up a client portfolio.

Whilst these traders can influence the price of markets on a day to day basis they cannot change the underlying company profitability and thus the value of the companies we are actually investing in.

What makes it even more expensive is that there is minimal growth to support the current lofty valuation. Nothing in the latest set of results has changed this fact.

Forecasts are for a strong recovery in profits in 2016 but that is predicated on a recovery in the oil price which is by no means certain.

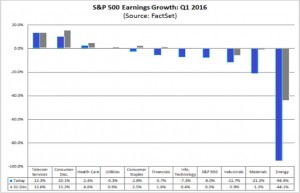

Indeed, as this chart from FactSet shows, forecasts for profits in the first quarter of 2016 are already being downgraded.

The Blue bars show the current estimates, the Grey bars are from the end of December. Despite the recovery in the crude price oil, company profit forecasts are still under pressure.

Brexit

After such a long gestation period the Brexit Referendum date has now been set and David Cameron has come back from Brussels with some concessions from the EU.

Clearly, we will not take a political position on a possible Brexit but we must have an economic view as an exit may have an impact on the valuation of sterling, gilts, credit ratings, tariffs etc.

Since the announcement we have seen various pieces of independent investment research from a wide range of brokers, fund managers and economists.

The consensus view, almost without exception, is that it is better to be in the EU than out, but crucially, an OUT vote would not be disastrous either.

Looking at voting intentions, there are, it is believed, about 15% of the electorate who are classified as undecided voters, which is quite high.

Analysis of historic voting patterns over time suggests that when there is not an overwhelming case the undecided voter tends to either not vote or go with the status quo.

This seems to be reflected in the bookies odds which remain at about 65%-70% probability of an IN vote.

This has barely changed despite the “Boris factor”. So for now the markets remain relatively sanguine about a Brexit.

Trump

“The Donald for President” campaign started as an interesting sideshow in the race to become the Republican Presidential candidate.

However, after a number of state caucuses (where voters indicate who their favourite candidate would be), Donald Trump appears to have a commanding lead.

The battles between the Tea Party and “old school” Republicans, which have effectively shut down the Government of the USA for over two years now, seem to have not been well received by the US electorate.

Trump has performed well on TV and has told the voters exactly what they want to hear.

Could he get the nomination, it certainly looks like it and if so could he beat Hilary Clinton? We have to now assume it is a real possibility.

So what are his policies? At the moment he has not declared any bar a few soundbites, so the markets, as yet, cannot make any judgement as to whether he will be a good or bad President.

As Obama has found out, a President without the support of both Houses of Congress has very limited power. The Trump story is likely to have a lot more twists and turns to it yet.

Gold

Gold is hard to value, it pays neither interest nor dividend it is a trading asset.

The super-rich and many countries use the dollar and US Treasuries as their safe haven.

If the dollar starts to fall and inflation starts to erode the value of US Treasury Bonds then they switch to Gold. The fact that Gold is going up when the Dollar is relatively strong and there is no US inflation suggests that this may just be a speculative move?

But someone may know something that the market doesn’t and as such the Gold price needs watching.

Markets

Markets have recovered nicely and the long term trend has held firm. But we cannot relax; valuations remain too high for the current level of growth.

Markets can look through this fact for some time but this issue ultimately has to be resolved.

Profits need to recover (specifically oil company profits) or prices have to fall.

The correlation between Brent Crude and the global stock markets is at an all-time high. This is unlikely to change for now.

The number of geopolitical issues facing the market gets longer each day, the Middle East, the Ukraine, the refugee crisis, Brexit, Greece, Spain, Merkel, North Korea and Trump will all dominate the news flow.

Economically, given that governments have no cash to spend, banks can’t or aren’t allowed to lend and QE is now having only limited impact the current fashion to return economic growth to “normal” is negative interest rates i.e. charging Banks to have money on deposit with the Central Bank.

Of the majors Japan has led the way and Europe may be next? Such moves will be received positively by markets but it will be a short term fix. They need to get profits up and quickly.

February 2016

Click Here for Printable Version