Click Here for Printable Version

Global Central Banks have based the retention of their current stimulative monetary policies on the basis that the global supply issues will be temporary. They still hope that as the pandemic passes and vaccination rates rise in the Far East, the ships, trucks and workers, sooner rather than later, will be back where they were before Covid-19 brought the global economy to an abrupt halt.

But the inflationary dislocations do keep coming.

Across the US, Europe and the UK, truck drivers have become scarce, as has natural gas, semiconductors, cars, carbon dioxide and abattoir workers etc.

Globalisation meant extended supply lines at low cost, these weren’t overstretched, but they were finely balanced and susceptible to disruption. The pandemic and now the uneven global recovery has upended the whole supply chain for a wide range of industries.

At the same time, the move away from fossil fuels has added a further disruption, just at the wrong time.

All of this is inflationary.

Economics dictates that if demand exceeds supply then prices must rise. This has been dramatically seen in natural gas prices. The world has massive reserves of natural gas, it is just that exploration has been cut back, LNG ships are in the wrong place and China is overpaying for supplies.

The key question for markets is how long these dislocations will last and at what cost to the recovery?

The answer is that no-one really knows, this is a picture that could resolve itself very quickly or just as easily persist into 2022.

In the UK the petrol buying crisis has shown that panic, fear and greed are not the sole preserve of the global stock markets!

UK Labour Market

There has been much media attention on labour shortages globally as the post-pandemic recovery takes place.

The UK, of the major economies, would appear to be in the worst position as visa restrictions might limit the potential supply of overseas labour.

There seem to be many industries, mainly low paid ones, that are struggling to recruit staff. The reality is that post the 2008/09 Credit Crunch the UK economy became very reliant on temporary, agency workers and self-employed contractors.

Whole industries failed to invest in staffing and took the cheaper option of cutting costs by outsourcing. This wasn’t just with agency workers and utilising the “gig” economy, but by moving manufacturing overseas to the Far East and Eastern Europe.

The UK did this to greater extent than any other major western economy.

Businesses thus reduced costs and gained flexibility, labour became a variable rather than a fixed cost. However, the departure from the EU Customs Union and the pandemic are now exposing the risks associated with this cost reduction strategy.

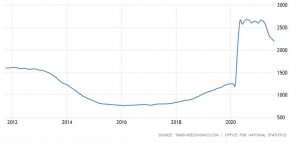

UK Number of Workers Unemployed

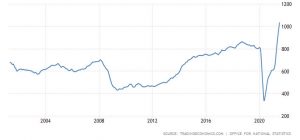

UK Job Vacancies

According to the ONS there are over 2m people unemployed in the UK, yet there are around 1m jobs available. The expectation is that the unemployment number will rise as the furlough schemes wind down.

So the UK doesn’t appear to have a shortage of potential workers. But as the petrol tanker driver crisis shows, many of these jobs require particular skills/qualifications that the unemployed don’t have or can’t get e.g. the shortage of HGV drivers, as the Driving Test Centre were closed.

Moreover, as we saw in last month’s newsletter the changes to tax code IR35 hit agency workers (many from Europe) in particular.

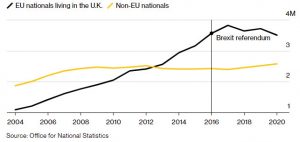

Given the increase in National Insurance it is hard to see that the IR35 changes will be reversed anytime soon. But as the following chart from the ONS shows, the reduction in EU nationals is small in percentage terms and furthermore has been made up by others from overseas.

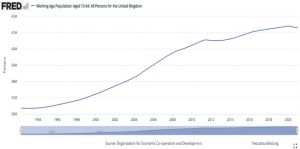

Also the total available workers in the UK (the Working Age Population) has dipped fractionally but by not enough to explain all of the labour issues.

Overseas Nationals

Working Age Population

So the numbers suggest the UK does not appear to be facing a labour shortage, it is however suffering a skills shortage.

This falls into two camps, a lack of qualifications/experience or a physically difficult/unpleasant task that few want to do. The tanker drivers fall into the first role; meat packers, crop pickers etc. fall into the second.

The laws of economics i.e. raise wages, should resolve the first.

The second might be more difficult to fill, even with higher wages. The suspicion is that despite all of the government’s rhetoric, these latter jobs may still require overseas workers.

Generally though, businesses will have to adapt and those that have relied on low wages or the “gig” economy may now realise that the rules of the game have changed and business models will have to be redrawn. Companies faced with unreliable supply lines or agency labour shortages might well choose to take back control and bring those activities in-house.

Power and Energy

The global economic recovery has boosted demand for electricity, just the world seeks to reduce carbon emissions.

Furthermore, the pandemic shut down oil and gas exploration and companies such as BP and Shell invested instead in wind and solar energy.

However, the problem with oil and gas is that unless new wells are constantly drilled, then the amount tapped from existing ones, naturally runs down. Investment in new wells became “unfashionable” in favour of green projects.

If we then add in the Biden administration being anti-Shale oil and gas, plus the Chinese banning coal for domestic cooking in favour of gas and also initially shutting down coal power stations, then the present energy shortage becomes understandable.

The fear for equity markets is that the energy markets are reverting to the 1970s, however we are presently a long way from that. The price rise of natural gas is primarily due to Europe and China getting into a bidding war for supplies ahead of the winter.

Analysts believe there is enough gas in European storage for a “normal” winter, but not for a cold one. The UK meanwhile should not suffer a supply shortage, thanks to the North Sea and Qatari LNG, but it is subject to the higher prices that have arisen from the global buying spree.

China is facing power cuts and unfortunately is now reverting back to coal power stations for electricity supply.

It easy to promise a move to green energy, getting there is more problematic.

Markets

We are in a period of seasonal weakness for equity markets and it is clear inflation is here.

Rising commodity prices, component and labour shortages are becoming more common each day.

Analysis does suggest that these supply issues should be temporary and resolve themselves as the global economy gradually reopens.

The key for the markets though is company profit growth.

We should be entering a period of above average growth and as the US September quarter-end results season gets underway markets will get a clearer picture of just how good this will be.

This is important as with higher inflation and interest rates, markets will be reliant on profit growth to make progress. There is some nervousness that the present energy and labour crises might spill over into corporate profit margins.

We are thus entering a difficult period for markets, if the current dislocations are not quickly resolved and look to be becoming more permanent then prices will have to adjust.

Valuations are high, but justified by the growth potential, if this has to be downgraded then so will prices.

However, we do need to remember that we are still early in a multi-year growth cycle, there is just too much unspent cash around, not just in consumer’s wallets but in bank balance

sheets and government spending programmes as well.

Markets, particularly, technology stocks have been going up in a straight line and periodic corrections do allow buyers to put cash to work.

There are currently plenty of reasons for the equity markets to correct, the key for this month though will be the US earnings, just how good will they be?

October 2021

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.