Click Here for Printable Version

As investors we are living in two worlds, there is one where the geopolitical risks just keep piling up and up and the other is one of corporate profits and economics. Here earnings are slowing but the markets assume this slowdown will be cured by a hopefully imminent China trade deal.

In the former category, September saw an Iranian sponsored attack on Saudi Arabian oil production, continued protests in Hong Kong, Boris losing in the Supreme Court and the commencement of impeachment proceedings against Donald Trump.

But as far as the markets were concerned none of these things appeared to matter, as the World Index ended the month modestly higher.

Why? Well the economic stats in the US are slowing but show no sign, as yet, of the recession the US Bond markets are close to signalling.

The markets want and need a trade deal and soon, the Democrats might just have made it more likely?

Impeachment

When Donald Trump won there were many that thought there would be so many “skeletons in his closet” that it was only a matter of time before “Deep State” found an excuse to impeach him.

Helped by a whistle-blower the Democrats seem to have finally found a reason to begin proceedings.

The view of most commentators is that there is not enough evidence, at present, for this process to end up with Trump being found guilty. Clearly, it is very early days in this process so a lot can happen.

For the markets the reaction was initially mixed.

Trump will effectively be tied-up until the impeachment process is completed. This makes election boosting tax cuts now very unlikely.

On the other hand, Trump, in theory, should be more keen than ever to get a trade deal done. He can’t now get the economy booming ahead of the Presidential vote unless he can achieve a tariff removing trade deal.

For the Chinese you might think they would be happy with these turn of events, however, mud sticks and Joe Biden, who was the leading Democratic candidate, is going backwards in the polls.

Elizabeth Warren has caught up and in some key states moved ahead to be the leading candidate.

She has linked any possible trade deal to human rights, carbon emissions and labour reform, all issues that the Chinese might not be comfortable with? It might just be better to do a deal with the “devil-you-know”?

The Brexit Soap Opera

So far Boris Johnson’s initial gambit appears to have failed, Jeremy Corbyn has not taken the bait and called for a General Election. He now has no working majority and is vulnerable to a No Confidence vote.

As we write the opposition parties have not called one.

Labour’s non-committal Brexit stance, reinforced atthe Party Conference, now puts them at odds with the Liberals and SNP.

As such the opposition parties might now struggle to create a “National Unity” government? For Boris it seems his current plan is to get, or be seen to be getting a deal with the EU, with the hope that with some Labour support it might pass Parliament.

Most commentators remain of the view that somehow a deal, of some sort, will be done either in October or more likely after a further extension. This is reflected in the recent performance of the pound against the euro.

Whatever happens, a General Election seems inevitable.

What happens next?

No doubt the next few weeks will see even more political nonsense as the poker game joins in Brussels as well as Westminster.

Boris appears to be re-negotiating Theresa May’s Withdrawal Agreement so that the mainland is excluded from the Northern Ireland backstop.

Remember, the backstop is just a failsafe that ensures a hard border between in Ireland does not return if a free trade deal cannot be agreed during the transition period.

If such a deal can be agreed with Brussels, then it will be put to a Parliamentary vote by 19th October.

If Parliament backs the solution, then the UK will exit the EU on the 31st October and enter a transition period of probably 2 years.

During this period, the future relationship including trade, customs arrangements etc. with the EU, will be negotiated.

If a deal can’t be reached, or it can’t pass through Parliament then it will be a question of whether the Benn Act can be enforced and an extension asked for and who is asking for it?

Will it be Boris or a National Unity government? Then it is a further question of whether the EU agrees to yet another extension, in the past they have said there will be no further extension granted without an accompanying election or referendum.

Lots of questions, not many obvious answers!

US Repo Market

One of the most important of the financial markets is the inter-bank deposit and lending one.

In the US this is known as the Repo market. These markets are where banks that are short of cash can borrow for very short periods of time from other banks.

A healthy financial system means that there should be more than enough cash to go around and the Central Bank as the lender of last resort can just sit and watch and monitor.

In September, the US banking system ran out of cash, (just like in 2008 where in the UK it caused the downfall of Northern Rock and others) and it caught the US Federal Reserve Bank by surprise.

Overnight interest rates spiked and the Fed was forced to flood the Repo market with cash.

Just 5 big US banks now control 90% of the overnight market’s excess cash. This development has been described as technical and temporary.

However, with many interest rates negative around the world we are in uncharted territory and market participants do worry about unintended consequences.

Coming at this point in the cycle this is yet another factor to worry about.

German Car Production

The risk of a slowdown in the UK is increasing, but not because of Brexit, it is Germany sliding rapidly into recession that will inevitably drag the UK down with it.

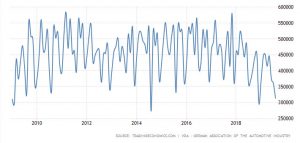

This chart shows the decline in automotive production in Germany, nearly halving since a peak just over a year ago and production is back down to levels seen at the last recession, when a “cash for clunkers” scheme helped boost demand.

The diesel scandal and Trump’s China trade war are partly to blame.

There is talk of some kind of trade in scheme for electric vehicles being prepared.

Some 6% of the total EU workforce depends on the car industry and Britain is its most profitable export market.

Germany needs both a Brexit resolution and a China one as well.

Hong Kong

One geopolitical issue that we do need to monitor are the protests in Hong Kong.

These were originally sparked by the Hong Kong Legislature proposing to introduce a new extradition treaty with mainland China.

This was seen as a threat to Hong Kong’s technical independence from China. The scale of the protests, 2 million people out of a population of 7 million, must be concerning for Beijing.

For the financial markets, Hong Kong as one of the longest established trading, banking and financial markets in the world, any intervention by China especially militarily could cause a capital flight.

This would have wider ramifications for the Far East region and also (via HSBC) for the UK as well.

At the moment this is all a possibility and not a probability, hence the relative stability of local markets. We just need to watch for any deterioration.

Markets

As we enter the normally stormy month of October geopolitical risks remain extensive.

But for the markets they are irrelevant, unless they spill over and impact the profitability of the multi-national companies we invest in. Profits are under pressure, but this can be explained away by the trade war, which should pass, it’s just a question of when.

The impeachment proceedings against Trump may well make a resolution, possibly via an interim arrangement, closer than the market previously thought.

We also need to be aware that Central Banks are easing monetary policy and as interest rates go down generally share prices go up. Hence, it can be every dangerous to be overly obsessed with the myriad of non-economic issues the world is facing at present.

Much will now depend on the imminent third quarter earnings season in the USA, if profits disappoint so might equity markets, if they are better than expected and an interim trade deal can be agreed then the uptrend will continue.

October 2019

Click Here for Printable Version

This information is not intended to be personal financial advice and is for general information only. Past performance is not a reliable indicator of future results.