The fears of August evaporated in September as Russia persuaded Syria to put its chemical weapons under international control, and Ben Bernanke surprised markets by not introducing a taper to the Quantative Easing programme, despite being widely expected to do so. Maybe he had got wind of the budget impasse in the US and the potential drag this could have on the recovering US economy?

The key housing markets of the USA and UK continue to recover and brokers are beginning to upgrade growth expectations for both economies. This is the first stage of a process that should see company profits accelerate thus making share valuations even cheaper. There are risks though, Italy appears to be heading back into political chaos and the next stage of the US budget crisis is upon us.

But the biggest news of September, and not widely reported, was the fund-raising by Verizon to acquire Vodafone’s stake in its US mobile phone subsidiary.

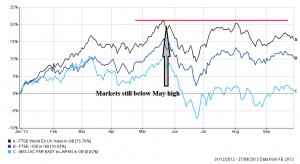

Year to date Equity Markets

This sideways movement or consolidation is actually a respectable performance. China is beginning to accelerate again, we always said this wouldn’t happen before the final quarter, Abenomics in Japan may be working and the UK and Europe are seeing growth accelerate, if the taper is being delayed then the background for the final quarter of 2013 could be positive, barring the usual political “banana skins”.

Verizon

Verizon was one of the original “Baby Bells” formed by the break-up of “Ma Bell”, AT&T in 1984. Formerly known as Bell Atlantic, Verizon entered the US mobile phone market in 1999 via a joint venture with Vodafone.

This initial strategic caution has long been a source of irritation for Verizon and has subsequently wanted to buy out its British partner. After long negotiations the staggering price of $124 billion was agreed. What is significant is how the deal will be funded. With many commentators saying that bonds are overvalued and that the taper will force bond yields up and therefore prices to fall, Verizon managed to raise $49billion dollars in a matter of hours and demand was so high they could have raised $100 billion.

For a market that is supposed to be “dead” this was an amazing achievement.

As a cycle progresses we normally get big mergers and takeovers as companies use their excess cash to buy market share. This process is just starting, e.g. Microsoft has bought Nokia. The investment bankers seeing the incredible amount of spare cash available in the markets, and thus the fees they could earn, will be encouraging their corporate clients to do deals and not to miss out on this potential gold rush.

This is part of the natural cycle of markets, but as the cash is gradually spent the buyers will demand higher yields and so the interest rate cycle will begin its inevitable rise upwards.

To us as investors, this will suggest that we are close to entering the final stages of the current investment cycle.

Baltic Dry Index

During the Credit Crunch of 2008/09, one of the most widely watched indices was the Baltic Dry Index. This is a real world index rather than a sentiment driven financial one. It reflects the rates charged by ship owners to carry freight around the world.

Too many ships and not enough cargo, the rate drops, as economic activity picks up holds get filled and the ship owners rapidly increase their prices.

This coincided with China slowing itself down as food and housing inflation accelerated.

Recently the new Chinese leadership has started to reform parts of the economy and reduced some lending restrictions. This has been reflected in various indicators of manufacturing activity (the Purchasing Managers Index or PMI) moving back above 50.

Above 50 shows that Chinese manufacturing is growing, below, it is contracting.

We always have to be circumspect with statistics from the Far East as this is still a one party state and such governments like to tell the population what they want to hear. Nevertheless, the Baltic Dry Index is based on hard facts and this is saying global growth is picking up

Housing

We have talked at length in previous newsletters about how important housing is to both the UK and US economies.

So much of consumer’s wealth is tied up in their properties that rising prices are essential for them to feel richer and have the confidence to go out and spend. After the Credit Crunch the banks stopped lending, they made it immensely difficult for even those with an impeccable credit record to get a mortgage.

The whole point of QE was to lower long term interest rates which penalises the banks and should in theory force them to lend, but it didn’t. The Treasury and Bank of England tried various measures including “Funding for Lending” which has helped. Those banks with weak capital bases, Lloyds, Santander and RBS, lent more under the FLR scheme but actually withdrew an equivalent amount of existing loans from the market thus creating virtually no increase; to their credit HSBC and Barclays have lent more.

With time for this Parliament rapidly running out, the Coalition was forced into action, effectively lending directly to house buyers enough money to fund most of the deposit needed to buy a house. This was initially only for new houses, but has now been extended to the existing housing stock. This is after 5 years of QE and support for the banks, and seems to have done the trick as growth is finally picking up. Some brokers are predicting growth of 3% plus in 2014, a significant level of growth for the UK. This is good news, though unfortunately it won’t be long until the inflation doomsters come out of the woodwork.

Markets

October is normally a difficult month, we get the US third quarter results and traders are looking to pull prices back to acquire cheap stock in preparation for the traditional Christmas rally. The delay to the taper helps sentiment but it is merely a delay and this has been quickly priced in.

The key event as we write is the impasse between the two Houses of Congress over the US Budget. This same impasse in January led to the Sequester. So far the US economy has been robust enough to cope with the “Fiscal Cliff”. Currently, there is no budget agreement and the US government is technically shut down with non-critical employees sent home without pay.

If, no agreement is reached by the 17th then the US Government runs out of cash. The “Tea Party faction” within the Republicans is trying to force Obama to delay his health care reforms but Obama is refusing to move.

The impact on the US economy will be to slow it down and may force market interest rates up. The 17th October is the critical date, as by then the US debt ceiling needs to be increased and Treasury Bills are due to be repaid shortly after, without the increase, the US defaults. There is a risk that both parties will push this right to the wire, thus creating huge uncertainty for markets.

As ever economies are being held to ransom by political infighting.

30th September 2013

Click Here for Printable Version