Click Here for Printable Version

October duly lived up to its volatile reputation, across the globe equity and some bond markets pulled back.

Many equity markets have now see a classic 15% correction from their recent high, however, this is just part of the regular noise of markets.

Stock markets have been unusually calm, October simply marks a return to “normal service”. Why has the tone changed?

Fundamentally, markets have been benefitting from a goldilocks-like combination of accommodative central banks and rising corporate earnings. As inflation picks up, the central banks are starting to turn off the “easy money tap” which leaves the markets reliant on just corporate earnings for support.

The problem the market had in October is that the US results season has been good, but the markets expected that growth forecasts for 2019 would be increased, they haven’t, in fact fractions have been shaved off.

For the stock markets this means they have to re-price, they do this by cutting prices to a level where investors step in and buy.

This can be a complex and messy process, it has been likened to picking up a bouncing rugby football. This process is not helped by the widespread use of trading robots using complex algorithms to try and predict the next short term move.

But crucially corporate earnings haven’t collapsed, they just aren’t being upgraded in the way the markets wanted.

Where are we in the Cycle?

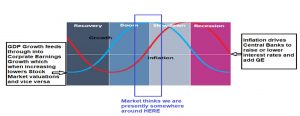

Judging where we are on the investment cycle is very difficult, if we use historical precedence then we should expect the cycle to turn during the first year of the next US Presidency, which starts in February 2021.

We then have to discount this back into the stock markets which price-in events 12 to 18 months in advance (as shares are valued based on next year’s company profits not this year).

This therefore brings us to our “danger period” of late 2019 as a possible cycle turning point. Some though are starting to suggest that company earnings could actually decline next year.

This is where we have to be careful, as the old adage reminds us “the stock market has predicted ten out of the last two recessions”.

It is certainly possible we could move into recession next year but as ever is it probable?

Trump has generally been good for markets, however, his trade wars and anti-immigration stance are starting to impact on US company profits.

The trade restrictions are increasing raw material and component costs (Ford recently stated that US steel is now very expensive) whereas immigration controls are creating labour shortages in some areas such as construction.

Both are inflationary, hence the Federal Reserve Bank has to keep raising rates which supports the dollar, thus making imports more expensive and also dampens consumer demand.

If this continues and the spiral of “cost-push inflation” persists then yes it is possible the US could tip into recession.

But, it is equally, if not more possible that Trump does a deal with China and also does whatever he can to get re-elected.

This is why short term market predictions are impossible to make. The market thinks we are entering the above “Slowdown Period” which is where growth starts to level off as inflation and interest rates gradually rise.

What does this mean in practice? It means two things, the market will cut valuations and secondly, dividends become more important than ever.

Typically, dividends make up 30% of total equity returns, in these Slowdown Periods they can make up around 50% of returns.

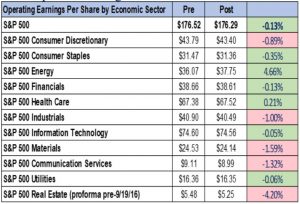

With around 70% of reports in we have seen a miniscule 0.13% reduction in expected profits. It’s just that the markets wanted to be upgrading these numbers, hence the disappointment.

But these figures still represent a very healthy 14% projected increase over the present level.

This places the key valuation measure, the Price to Earnings Ratio, at a very reasonable 15.5 times. What this means is, if Trump signs a deal with China and/or the dollar startsto weaken then the equity markets will have strong support.

The pessimists out there believe these numbers will deteriorate, but that assumes no China trade deal nor the Fed reacting to an economic slowdown.

The Brexit Soap Opera

The UK’s divorce from the EU is a three stage process, firstly to agree what are our ongoing financial responsibilities (not a one-off bill, as is wrongly misrepresented by the media), secondly, the actual legal divorce (enshrined in International Law) and then the trade deal.

We have stated all along that the trade deal is effectively already agreed. Donald Tusk has reportedly offered Norway or Canada with added tweaks for the UK.

Norway depends on the UK remaining in the Single Market with associated costs and with the UK having to comply with some EU rules, Canada meanwhile is a straight free trade deal.

It seems now, with hindsight, that Theresa May and the Civil Service have all along preferred the Norway option either on philosophical grounds or as the only practical deal that would get through both the Commons and House of Lords.

The DUP it seems wouldn’t support Canada, and the calculation therefore is whether there are enough Non-Conservative MPs, especially Labour rebels, to outweigh the Brexiteers and support a vote on a very soft Brexit that leads to a Norway style trade deal.

It might be doable. The crucial factor is, that if passed, it then becomes International Law and might well be irreversible, it just depends on an “end date clause”.

For the UK economy in the short term this would be good news, the pound should strengthen but perversely this would be bad news for the FTSE100, because as the pound goes up the Footsie goes down.

We have to be aware though that this might just precipitate the feared political crisis.

Markets

November is likely to be an even more complex that normal trading month. Typically, the first part is a hangover from the October storms with the second part tending to be more positive as Thanksgiving arrives.

Key events will be the US mid-term elections and the potential for a China/USA trade deal. Trump and Xi are due to meet at the G20 meeting in Argentina at the end of the month.

Currently, expectations are low, but markets have been moving on the tone of Trump’s regular tweets.

This is potentially a binary event for markets and could dictate whether Santa comes early or late to the markets this year.

After such a strong and long run in share prices there are many out there “seeking glory” by trying to call a market top.

Our view is that this is a lottery and if a client has their assets and investments structured correctly irrelevant, the present “market noise” does not change the long term positive outlook.

The probability is, given all the issues in the world at present such as the US elections, Brexit, the Italian Budget, China trade deal, Saudi Arabia coupled with the disappointment over future US earnings there are enough reasons for markets to continue to be shaky, at least until Thanksgiving and the G20.

But we mustn’t rule out the possibility of positive developments between the US and China.

In these types of markets real investors tend to sit on their hands and let the computerised trading robots swing prices around until the murky picture becomes a bit clearer.

November 2018

Click Here for Printable Version