October is normally the month for strong winds and weak markets, but not this year.

The “flash crash” of August tempted the long term institutional investors out of their slumber as they looked through the present economic difficulties to a resumption of growth in 2016. The FTSE100 rose by 4.9% which year to date leaves it down by 3%.

We highlighted last month that the current company results season would be very important for the stock markets, and so it proved. Old economy businesses from mining, oil, chemicals and shipping all struggled.

In the UK the steel industry cutbacks highlight the impact that the commodity collapse is having on manufacturing companies.

The banks held steady, but the good news came from the new economy as the big technology companies reported good growth in profits and more importantly cash generation. The “cloud” is the new tech growth area as Amazon, Microsoft,

Google (soon to be renamed Alphabet) all beat estimates.

In the old world though, Danish shipping leader AP Moller (Maersk) is tying up one of its new massive container ships as global trade slumps. The global economy remains behind where it should be at this point in the cycle.

Harley Davidson

Bank Lending

Another of our “themes” is that the global economy remains sluggish because the banks have not recovered to their pre 2008 lending levels. QE has kept the banks alive but they remain risk averse and will only lend on “dead certs”. A recent ECB survey did however show that EU banks are finally starting to relax their loan standards for businesses.

This is very positive and is a sign of growing confidence in Europe’s economic prospects. The poll shows that the European Central Bank’s €1.1tn quantitative easing package is helping to open up the closed credit markets, lowering a serious barrier to Europe’s recovery.

A lack of lending has been one of the most pressing problems for the euro area.

Companies and households across the euro zone demanded more loans in the third quarter of 2015 compared with the previous three months.

“QE had a net easing impact on credit standards and particularly credit terms and conditions. The easing impact was greatest for loans to enterprises,” the ECB said.

If the banks don’t start lending again then the final option is what former Fed Chairman Ben Bernanke called “helicopter money”.

That is bypassing the banks and lending directly to the business and personal sectors. In a way that is what “Help to Buy” and “Funding for Lending” is here in the UK.

Overall bank lending has improved in both the UK and US but is still below 2008 levels. Part of this is due to regulation restricting how much banks can lend, as well as taxation and fines.

From Barclays, Royal Bank of Scotland to Deutsche Bank, UBS and now Standard Chartered banks are still struggling to find the best business model for the post Credit Crunch world.

Much depends upon politics, voters increasingly vote with their wallets, at some stage the politicians will realise that economies cannot return to normal until the banks do so.

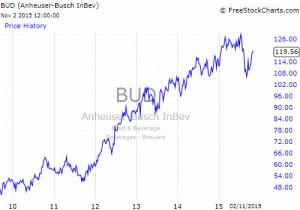

AB Inbev/SAB Miller

One of the consequences of QE is that corporate bond yields are artificially low and for many investors more attractive than sovereign debt. For those businesses that generate lots of cash, such as a brewer, tapping these bond markets for funding rather than the “finicky” banks creates opportunities.

Global dominance came with the merger with Anheuser Busch the owner of Budweiser.

Now they wish to acquire the number two global brewer SAB Miller. The deal is worth $104 billion and requires the issue of a staggering $55 billion of new bonds.

The combined company, providing it gets regulatory approval, will dominate the global beer trade. There will have to be some disposals, particularly in the US/Canada, but the fragmentation of the global beer industry means that this

deal should be done.

When a deal of this size happens we often get “me too” transactions, Dell and EMC is another example, issuing $40billion in new bonds, Pfizer and Allergan also.

Cheap bond money, a lack of organic growth and shareholder pressure keep the corporate merry go round spinning. The real question is for how long can the corporate bond market cope with all these new issues?

Saudi Arabia

The image of Saudi Arabia is of a wealthy country, the reality is after it has forced the oil price down, its budget deficit this year will be $107billion (UK $8.6 billion).

For now this is affordable, but it does appear that the Saudi (and the other Gulf States) are selling financial assets, mainly bonds, to fund the shortfall. However, something has to give, either oil prices rise or spending is cut. It is the consequences of cutting spending that are perhaps the most concerning.

No one is quite sure of the stability of the political structure in Saudi Arabia, especially as there is a new King.

Add in the geopolitics of a resurgent Iran teaming up with Putin’s Russia, just as the political will from the USA towards the Middle East seems to waning. For example, there is no US aircraft carrier in the Gulf for the first time in many years.

The Saudi’s have also invaded Yemen to fight Iranian supported Houthi rebels. This is important as interest rates can only stay low if inflation does as well. Oil is big part of the inflation conundrum; Saudi Arabia is the key to oil remaining low, a “Black Swan” event from here would change the investment picture significantly.

Markets

The recovery of the markets since the sharp moves of August has left many market commentators dumbfounded, but as we have said before the sheer diversity of investment opinions at the moment is at extreme levels.

Bonds remain hugely expensive and on an earnings basis Old World equities are expensive whereas the New World is getting cheaper by the day.

Bull markets can be hard to break, the flash crash of August could have caused the trends to fail but as we highlighted in the August newsletter they just held and that prompted investors to reload and keep on buying.

It was touch and go for a while but so far the buyers have won the day. However, just because the markets have recovered doesn’t mean that the risks have gone away. The results season for many companies was poor, on an annualised basis S&P 500 earnings are now down by 7%, this means that the key P/E Ratio has moved north of 20 and into expensive territory. The market is relying on hope; hope that improving GDP growth in 2016 will lead to a recovery in corporate profits. November and December are normally the best months of the year for share prices.

There are lots of issues facing the markets, perhaps more so than at any time over the past few years, as long as investors believe that 2016’s corporate earnings will be up on 2015 then they will keep on buying. November sees Thanksgiving and the now global Black Friday shopping phenomenon, markets will be hoping that the consumer feels like spending.

October 2015

Click Here for Printable Version