As we enter the last month of 2014, investors will look back on a particularly odd year, one that, for most commentators, hasn’t “gone to plan”. But we shouldn’t be surprised, markets rarely do follow predictions.

Short term market movements are impossible to predict; there are simply too many variables across a range of complex and interdependent markets. The world’s brightest brains and most powerful computers cannot accurately predict short term market movements. But as long term investors rather than traders, we know that this is all just noise.

What we are fundamentally investing in when we buy a share (via a fund) is the underlying company, and, more specifically buying into their profits. These profits are distributed as dividends; an unprofitable company cannot pay a dividend. So whatever happens to interest rates, inflation and geopolitical risk is always important to the extent that it may impact on a company’s profits and therefore its ability to pay dividends.

From this we can then calculate the value of its shares. Many forget this basic principle of investing and get wrapped up in the excitement of the

news flow and try to predict future investment returns based on a particular event. Then they are shocked when their random predictions, which are based on opinions rather than facts, are proved to be incorrect.

A current example is the oil price where most were anticipating a rise this year.

OPEC

Oil is dominating the investment news streams at the moment and rightly so. The price is continuing to fall with the recent OPEC meeting being the main catalyst.

The Organization of the Petroleum Exporting Countries was set up in 1960 as an attempt by oilproducing states to assert them in a market dominated by the major multinational oil companies.

It has expanded from its five founding countries to a membership of 12. OPEC member states currently produce about 40 per cent of the world’s crude oil and 18 per cent of its natural gas. But as Russia emerged from Communism and new sources of oil appeared from Mexico, Canada and now with advent of oil shale and fracking the USA, its position has been weakened.

Cutting oil production to raise prices no longer works as it used to, as non OPEC countries simply sell into the rising prices. The problem is that OPEC used to control 80% of the world’s crude oil production, it is now half that.

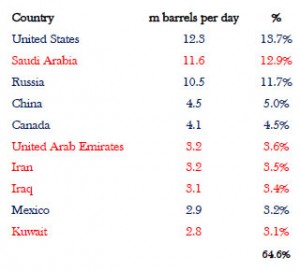

Top 10 Oil Producing Countries

New sources of oil away from the Middle East pushed OPEC producers down the league table; the rise of US production has changed the game.

Can the cartel survive in its current format?

Recent events have raised this question for the first time since OPEC was formed in the 1960s. Much depends on Saudi Arabia. The Saudi’s have a very efficient oil industry and can vary production relatively quickly and easily, the Russians can’t, US/Canadian shale oil once in production can also be easily turned up or down according to demand.

The Saudis for geopolitical reasons have turned up production to squeeze Russia, Iran and ISIL a triple whammy win for them, but also it pressures the US, as new fracking wells become uneconomic as oil falls below the key $60 to $70 price area.

By effectively letting the market dictate the price of oil the OPEC cartel is giving up years of price control, but by doing this it should reduce the flow of new supplies onto the market.

Saudi Arabia as the lowest cost oil producer should ultimately maintain market share but at reduced revenue. This is a business decision for them but one with added benefits as it severely squeezes old enemies such as Russia and Iran whose cost of production is significantly higher than current prices.

Whilst this will impact on US domestic producers and fracking will slow down, there are just too many benefits for the Americans to complain.

It suits them to squeeze Putin and it is a massive potential boost to the US and global consumer as the gasoline price continues to fall, just as QE has ended.

Not such good news if you are an oil company though. The US Oil company sector valuation is down by 20% since October and this includes some of the biggest companies in the world such as Exxon, as an investor it pays to be diversified.

Putin and Russia

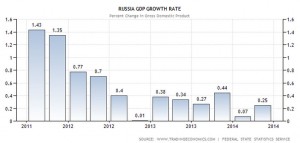

Russia was already slowing down and was barely growing; it must now be in full recession. Whilst economic circumstances are impacting ordinary Russians, Putin’s popularity in Russia appears to remain high.

He seems determined to push on with his geographic ambitions and clearly desires eastern and possibly southern Ukraine. Militarily, for the Russians it could be argued that the opportunity may have passed?

The Ukrainians have had a chance to rearm and get organised with NATO help. Thus, the military option for Putin is now much riskier. So far the winter across Europe has been relatively mild; with falling oil prices you would assume Europe has stocked up on gas, but a cold winter and a threat to cut off the gas perhaps remains Putin’s last throw of the Ukrainian dice for now?

He is unpredictable but it would appear that the West has quietly outmaneuvered Vladimir Putin, at least for now.

Vodafone/Liberty

As the internet has developed we now have the ability to download and watch a film or TV programme either by the phone line, cable, or mobile phone, increasingly the lines between them are being blurred.

In the UK though these services are being provided by separate companies; BT for phone line, Liberty (Virgin) for cable and Vodafone/O2/EE etc. for mobile. In parts of Europe there have been deals that have created multi-channel companies offering customers bundled television, mobile and broadband services.

British mobile business Vodafone may be looking to join them. Vodafone will have a new war chest to spend on acquisitions as soon as it finalises its $130bn deal to sell its stake in its US mobile joint venture to partner Verizon.

It needs to demonstrate to shareholders that it can find new ways of accelerating growth. BT may be following a similar path, as it appears to be looking at moving back into mobile; many years ago it demerged Cellnet/O2 which was later bought by Telefonica of Spain.

Rumours suggest it is interested in EE (Orange/Tmobile). For Vodafone a deal with US cable major Liberty would make a great deal of sense but will have

massive regulatory hurdles to overcome. For consumers the days of integrated internet based devices allowing you to watch what you want when you want are getting closer all the time.

Politics

The Chancellor’s Autumn Statement has reminded us that an election is coming and one that will be particularly tricky for all sides.

The incumbent coalition is breaking up and it seems won’t survive beyond the vote. UKIP is forcing immigration, benefits and EU membership onto the agenda, all issues that mainstream parties have carefully avoided for decades, and with good reason. Both Labour and the Conservatives have moved to the centre of politics, these issues will push them back towards the left and right wings which are political minefields for both Cameron and Milliband.

Cameron has perhaps the most to lose as the Liberals can no longer be relied on as political partners. The classic vote winning weapon of tax cuts will be difficult to achieve as the deficit is still so large.

Benefit cuts are perhaps the logical austerity measure to make, but might just be political suicide. Reducing benefits to fund tax cuts would be a tricky message for any spin doctor. For now a possible serious outcome of the next General Election could be a Labour/Liberal/SNP coalition, which would not be popular with the markets.

Markets

Stock markets are not normally predictable in the short term, but the exception can be December. Once the quarterly futures and options expiry is out of the way, this year on Friday the 19th December, prices tend to drift higher on low volume. There are few company announcements and the politicians have gone home for Christmas. It is only the impact of geopolitical events we need to worry about.

These are of course unpredictable, in the meantime we still need to watch events in the Ukraine carefully. Oil and gas prices are other key indicators for markets that seem to be less worried about economics and more about conflict and politics for now. Question is whether this will be enough to derail the usual Santa Claus rally, hopefully not?

November 2014

Click Here for Printable Version